Table of Contents

ToggleContext:

The founder and general partner (GP) of Better Capital, India’s most prominent and first pre-seed venture capital (VC) fund, posted a thought-provoking statement on the X platform about the Wealth Tech sector in India.

Many founders and ecosystem stakeholders follow Better Capital, and followers post their comments on the X platform. In my earlier blog, I posed a similar question: Would investment-tech platforms turn out to be like “Segway” or “e-bikes”?. This post’s objective is to analyse the venture capital funding pattern in the WealthTech segment and discover if there are any new trends. It is a continuation of my two previous posts. I clarify that I respect Better Capital’s view, and this post should not be construed as a critique.

Here is a quick recap of my earlier posts.

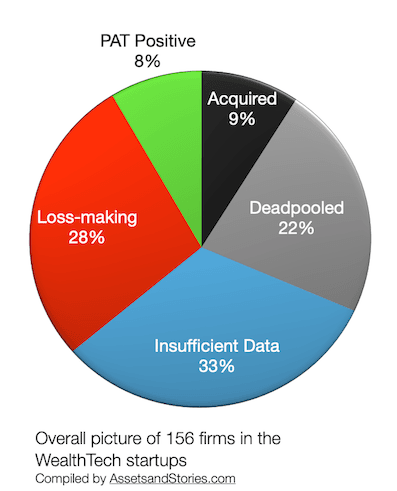

156 Wealthtech firms:

In July 2023, I analysed over 156 Wealthtech firms based in India. This cohort had 132 consumer-facing investment platforms, and only six had delivered profit after tax.

100 leading Investment-Tech firms worldwide:

In March 2024, I posted this after analysing the leading Investment-Tech firms in 26 countries.

What sort of startups should be part of the WealthTech segment?

One key takeaway from the social media’s reaction to Better Capital’s social media post is the scope of WealthTech. The industry has a diverse view of this. I consider these five platforms as WealthTech.

- Consumer-facing Investment-tech platforms, this could be only execution or robo-advisors ( most of them may not be true to the label)

- B2B2C / Advisor led tech platforms.

- B2B SaaS – tools which assist the wealth management industry. These tools could be used in the front, middle or back office.

- Some industry players include the new-age Equity broking (tech-first) platforms.

- New Entrants ( I have referred to a couple of examples in the following section)

Is WealthTech one of the most funded FinTech segments in the first half of 2024?

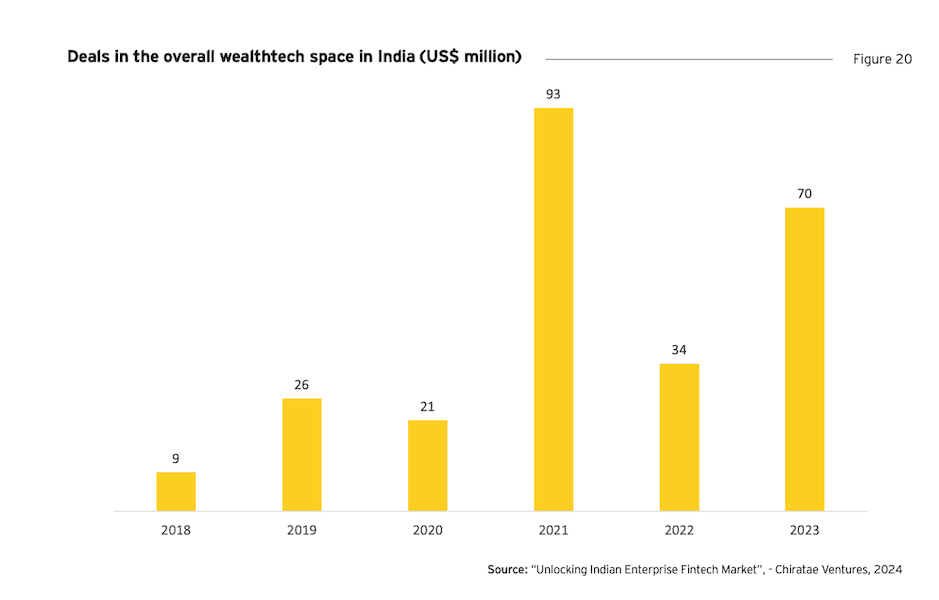

Switching back to the earlier discussion thread, which category of Wealth Tech startups are getting attention from VCs? Are these new platforms focused solely on asset gathering rather than users, or have they figured out how to generate revenue or use innovative GTM (go-to-market strategy)? Let’s look at all these key data points. Let’s begin with the funding pattern. If one were to look at the funding from 2018, WealthTech as a segment has generated interest in the VC community.

WealthTech funding in the first half (H1) of 2024:

I browsed through one of the leading research portals. According to this portal, there were around 60 transactions, and the total funding amount was a staggering $600mn. When I spent time analysing all these 60 transactions, three large transactions skewed the aggregate number.

The top 3 funding transactions were Angel One, NDR InvIT trust and Perfios. For my analysis in this post, I excluded all these three firms. As AngelOne is a listed entity and hence is not a startup, NDR is a logistics firm, and Perfios has more SaaS products in other segments of FinTech than WealthTech. After filtering a few more names, I arrived at 24 startups, and the total funding received raised by these startups was around $141mn. Please refer to the header image of this post.

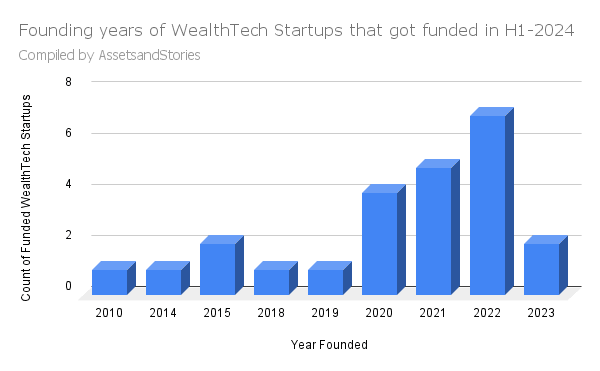

How young are the WealthTech startups that got funded in H1-2024?

Around 58% of startups funded in the first half of 2024 were found in the last four years.

Insight:

The first wave of WealthTech startups began in 2015 and 2016. Startups founded in 2022 / 23 could differ in their proposition and use a superior tech stack and architecture. They could build a product to ride the tailwind of industry structural changes. Hence, let’s label these startups as WealthTech 2.0

What are WealthTech 2.0 startups building?

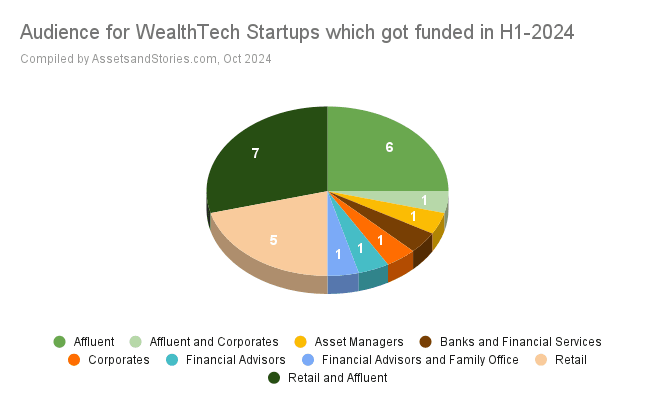

Let’s analyse these startups through the lens of a product manager. Please browse through the pie chart below.

Insight

If you compare these startups with the earlier ones founded in 2015 or 2016, you will find new categories in this cohort. For example, WealthTech 1.0 was predominantly focused on transactions and reporting of mutual funds. WealthTech 2.0’s platforms have included investment products in the Fixed-Income and Private markets.

Who is the target audience for wealthtech startups that were funded in 2024?

Insight

If you were to analyse Wealthtech 1.0, it was invariably retail clients. However, in the new cohort to which we are referring, 60% of this WealthTech 2.0 is targeting the Affluent category. In other words, these startups may increase their revenue.

Referring to one of the comments on the X platform about the post on the WealthTech funding pattern in 2024, a global VC posted that the B2B wealth tech has a massive opportunity. However, my humble submission is that since I worked with several early-stage B2B WealTech, pricing power in India is limited. The founders have to look to build a global product, and only some of them in India have pivoted that path, yet to see a massive breakthrough like Addepar or Vise.

Are there any outlier categories in the WealthTech 2.0 cohort?

a) Creating a marketplace for fixed-income securities, connecting non-banking financial corporations, corporations, and distributors looking to raise debt. Dexif is the first marketplace in India; hence, I label this a new category in the WealthTech platform.

b) AI-based portfolios—As we all know, AI is an abused word in the startup ecosystem. Four firms in this cohort have mentioned AI on their websites. Is this true to the label? InvestorAI—This name is compelling. I would track this company closely and share my thoughts on AI and Investments.

What are other key takeaways from WealthTech 2.0 funding transactions?

a) A few transactions look similar to 2015, so I found no differentiation.

b) It’s glad that early-stage wealth tech startups have raised 60% of funding.

c) The stereotype continues in the VC ecosystem: In my earlier analysis of 156 wealth tech startups, around 47% of the founders were from IIMs, IITs, or Ivy College. In H1-2024, around 40% of wealth tech 2.0 founders were from IIMs and IITs.

Will WealthTech 2.0 show a non-linear growth path?

The premise of this post was on linear vs non-linear growth. In other words, does the WealthTech segment deserve allocation of VC capital?

The Founders of Wealthy and ETMoney deserve applause for how they responded to this Better Capital GP’s comment. This is not because of their straightforward narrative but because of how they built their WealthTech businesses.

My take on this:

Please browse the data points on both the demand and supply sides, including a new variable called “Behavioural Finance” / emotions in the investment.

Demand side:

- There are multiple cohorts of consumers/investors in India. The target market is 100 million. Are these cohorts satisfied with their existing guidance/advice/access to relevant information? Probably not.

- Unlike a consumer e-commerce platform, a user or retail or affluent investor will need more information. The nature of personal finance is complex and not straightforward.

- Does the investor need more choice or novelty in the personal finance segment? In other words, are investors looking for new investment ideas? The answer is obviously yes. Personal finance changes according to age and life stages. Even for affluent investors, risk tolerance varies according to life events. Hence, new and more products give investors more choices.

Supply Side:

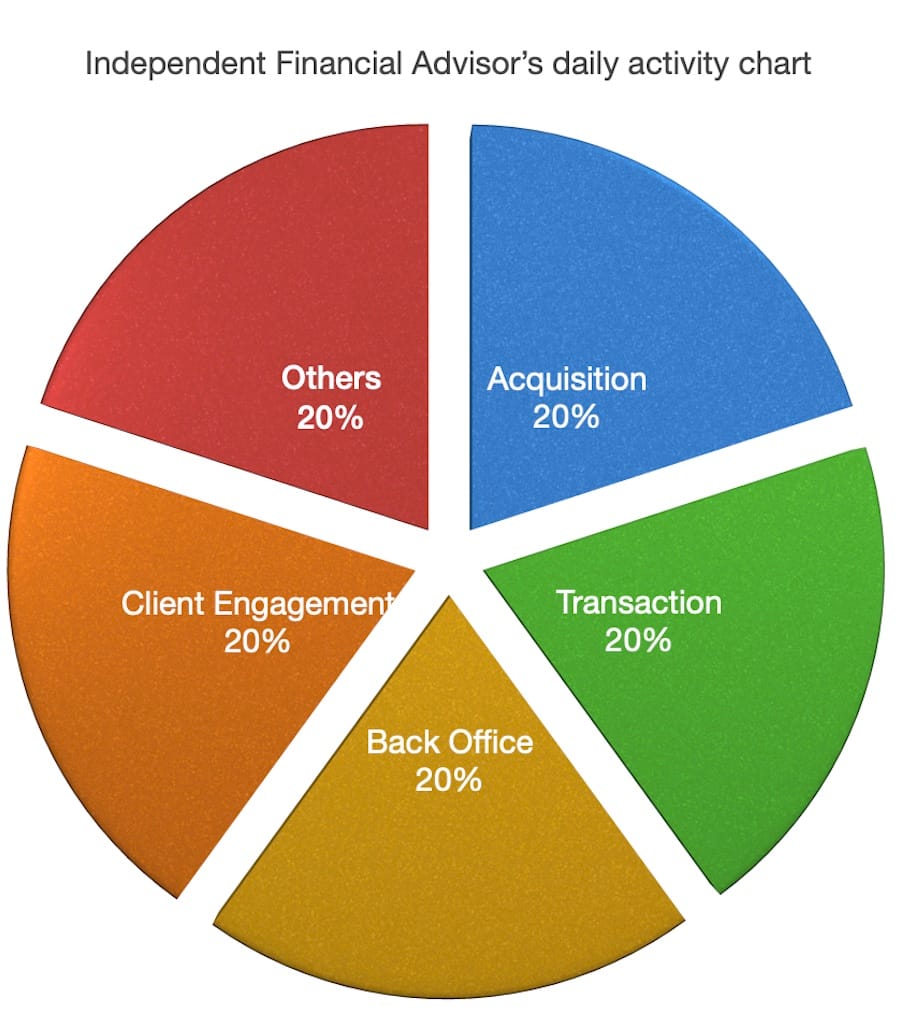

- There are over 1,300 SEBI RIAs (Securities and Exchange Board of India, Registered Investment Advisors) and 120k MFDs (Mutual Fund Distributors)—enough to meet demand? Hence, the supply side is also a key variable in WealthTech.

- SEBI, the regulator, plays a crucial role in controlling the dynamics on the supply side. Based on my experience, SEBI is going through a steep learning curve; in other words, it is catching up with tech and innovation and bringing the jaywalkers to books.

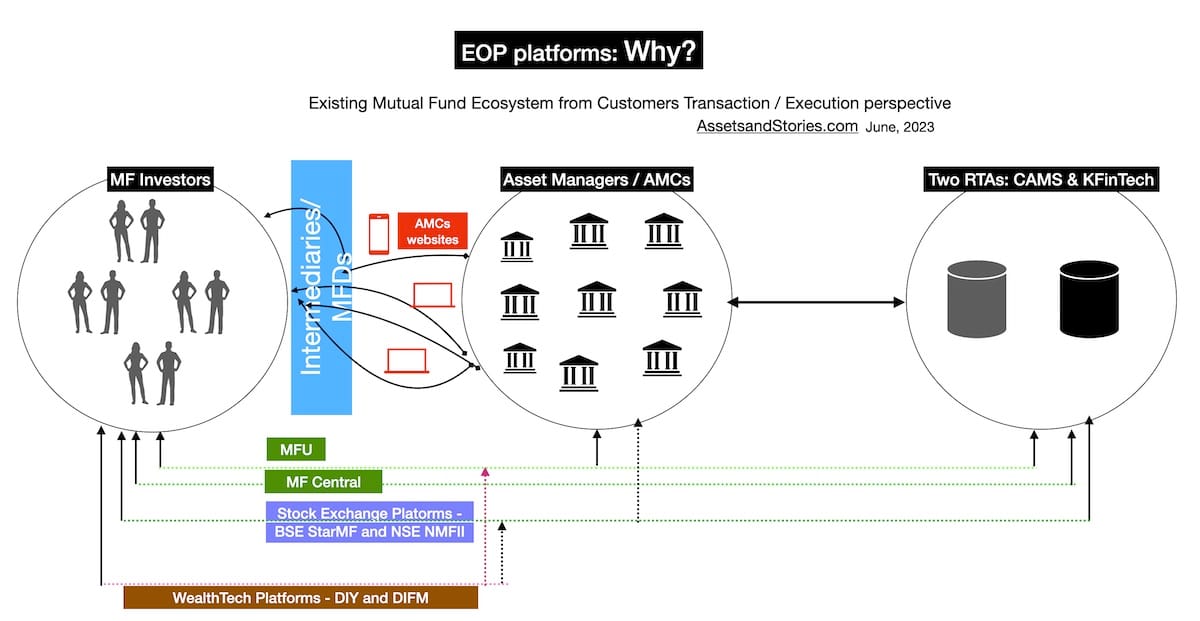

- For instance, in June 2023, I discussed execution-only platforms (EOPs) and why they were introduced, as it is evident that adoption wouldn’t happen. You may see an amendment to the existing EOP, and version 2 may be released in the next few years.

- Similarly, RIAs and RA the regulatory framework for registered investment advisers (RIA) and research analysts (RA) is very stringent; hence, in the new consultation paper a couple of days ago, you may have read that RIAs will be allowed to advise investment products beyond their jurisdiction. If RIAs and RAs are considered “Doctors” and distributors are “chemists”, increasing the number of Doctors or bringing a credible tech layer to empower the chemists is necessary.

- SEBI can also take an alternate route to redesign investment products, making them very easy for retail investors to consume. In other words, it may make it easy for DIY (Direct) investors and hard for distributors. Similar to the UK RDR. Referring to a recent report from the Financial Times on the Retail Distribution Review (RDR) in the UK market. In 2012, investors were given a choice to pay for “advice” or be “DIY” investors. In other words, independent financial advisers (IFAs) were banned from receiving commission payments for selling funds. Fast forward to 2024: One of the outcomes of this regulation is “linear adoption” in passive funds. (please refer to the image below in this post) Will the Indian regulator follow the UK regulator? UK RDR impacted 17 million investors; however, this number could be over 100 million in India. The short answer is that this isn’t an easy decision.

- Account Aggregator (AA)—This was a non-linear category initiative similar to UPI; however, it slowed down due to ecosystem friction points. Can ONDC (Open network digital commerce) and the AA ecosystem come together to make it easy for both retail investors and distributors?

- Can BlackRock launch a platform to offer a proposition to 479 million Jio users? Will incumbent Asset Managers work on improving their Tech and UX? Or Will Asset Managers work to increase the onboarding of new MFDs, as the growth rate was just 2% compared to the financial year 2023-24?

Considering the above eleven variables, should one conclude that “Tech” will not play a role in the WealthTech segment? Would the traditional playbook of garnering AUM (assets under management) be the only way to fulfil the “demand” side’s need? Wouldn’t the regulator alter the supply side to make it palatable for demand?

From the Venture Capital perspective, the house will be divided now. VCs who invested from 2015 to 2017 may have formed an opinion on the WealthTech segment due to anchoring bias, and they will hunt for data points that fit their opinion.

However, another set of VCs may consider the situation from a fresh perspective and invest in a founding team from different professional backgrounds to solve this complex problem.

“There is a considerable gap in the demand and supply of personal finance. However, WealthTech startups couldn’t find methods to monetise or charter a convincing GTM; this doesn’t mean the next wave of WealthTechs will not solve this problem.”

While this post focused on India, I will compile data points on global WealthTech in the next one.

Disclosures, Caveats and Assumptions

a) I am not a SEBI Registered Investment Advisor (RIA). Therefore, my opinion on the firms’ names shouldn’t be considered a stock recommendation or caution.

b) I consult for a few early-stage wealth tech startups that are not part of this list. In other words, this is not a sponsored post.

c) I may have inadvertently missed mentioning a few startups in this blog post.

d) I may be biased towards the WealthTech segment.