Table of Contents

ToggleMutual Funds > Insurance

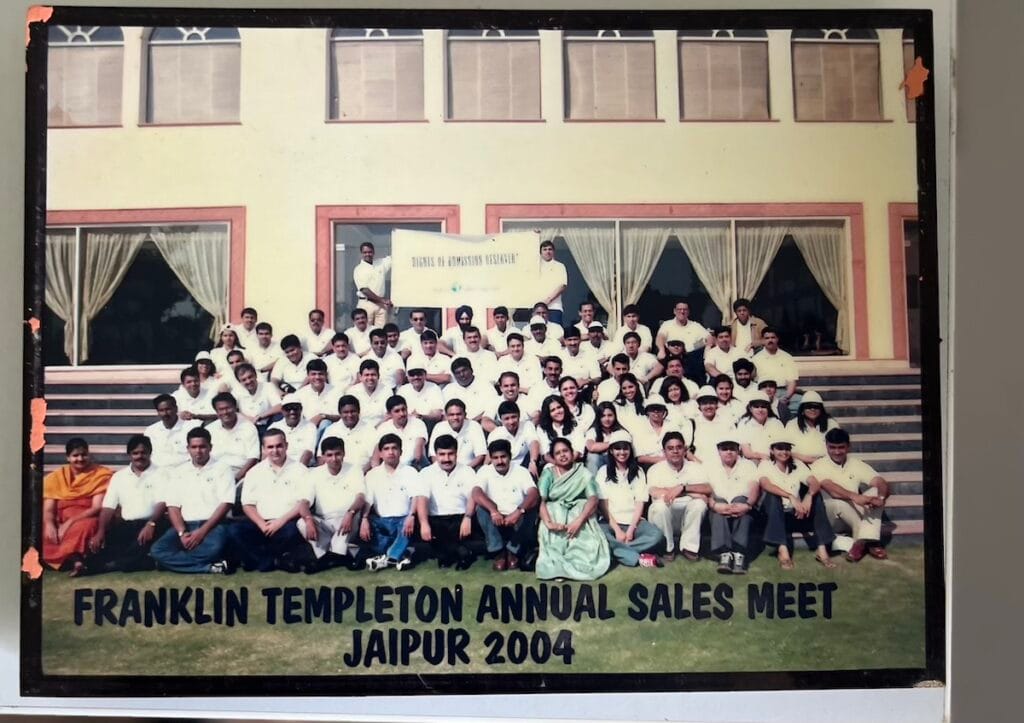

During one of my sales calls in 2002 at HDFC Standard Life with one of the financial consultants, I discovered product leaflets related to mutual funds. One of the product documents was very compelling, and it was Franklin Templeton. The product document, application form, and fact sheet were excellent. So I liked their product material so much that I started savouring every section of the material.

Franklin Templeton

After I read the marketing collateral of mutual funds, I started reading all other Asset managers’ promotion material. Templeton was an outlier then. Its fact sheet and the offer document were very engaging. Moreover, one of the funds of their flagship performed exceeding well. A quick disclaimer: this post’s objective is not to promote Franklin Templeton Mutual Fund schemes, nor am I a registered investment advisor.

Login: MF Industry

After spending over a year at Mysore, I missed my friends in Bangalore. So I firmed up my mind to move to Bangalore. I explored opportunities for a transfer to Bangalore. However, the HDFC SLIC Bangalore branch had a team of Business Development managers with more experience in Financial Services. I had just one year of experience in financial services then. So I started my job hunt in Bangalore, and, fortunately, one of my friends and colleagues referred me to a lead at Franklin Templeton Asset Management, Bangalore branch. They were looking for a staffing resource to develop business from the SME sector. It was a dream come true – taking up a job in Bangalore and working with my favourite Asset Manager.

So I was well prepared for this interview and demonstrated I am a quick learner. I was able to secure this offer in July 2003. It was a delight that I could be part of a large MNC brand in Financial Services. My colleagues at the Bangalore branch cared for me very well and taught me about Mutual Funds. Mr Harish Rao was the Zonal head of the South and East region. He had formed a high-performing team, and till today all his team members have contributed much to MF Industry. Franklin Templeton, Asset Manager, was highly respected among the distributor community during this time. This firm invested in first principles, such as building and educating the distributor community. It had one of the best trainers in the industry. I remember attending Mr Naveen Sukhramani’s training program was a privilege.

Bank Channel

I made quick inroads into the SME segment as Liquid funds were new to many. In 2003, there was clear tax arbitrage for liquid funds vs short-term bank deposits. However, the asset size could have been more substantial as this segment experimented with the mutual fund for parking surplus cash. After three months, I was given an additional responsibility – a few banks to generate new business. I was lucky to get into HDFC Bank. During those days, third-party income/revenue was picking up. In other words, bank relationship managers were asked to generate income promoting Life Insurance and Mutual Funds products. Most of them were new to Mutual funds, and I took the opportunity to share sound bytes of mutual funds with the bank’s new relationship managers. Within a few months, I was able to secure a good market share for Templeton in the Bangalore market.

Did I delete my tech experience?

Looking back, I wonder why I deleted my tech experience during this period. I vividly remember at 3 pm on every business day, the operations team / back office team worked on a pile of papers. Why didn’t I see the opportunity to digitise these? Is there not a tech platform to reduce this paperwork?

These questions did come to my mind once. But unfortunately, I didn’t delve into this subject. Instead, I was actively reading and learning about the Financial Services sector.

If i were to look back on my journey at Templeton Asset Management, i was able to learn Mutual Funds and Channel management very quickly. However, I should have learned more about the back office nuances and investors’ record maintenance systems.