Table of Contents

ToggleHardest Part: Data Gathering

Last December, Nitin Sawant, SEBI Registered Investment Advisor, reached out to me and mentioned that he had applied for an Account Aggregator license. So why should an Investment Advisor (IA) consider entering the Account Aggregator (AA) business? Then we met, and he explained how AA can help to achieve his mission. Since 2006, Nitin has been a practitioner in Financial Planning from a tiny town called Vita ( Sangli district in Maharashtra). From 2013 all his clients paid for his services. Indeed an impressive track record.

Nitin explained that onboarding a client is time-consuming as data compilation is laborious. So how can he reach a larger audience and spend time on Financial Planning rather than months on data compilation? AA solves this data collection point; hence, Nitin wants to switch from his RIA practice to the AA business to solve at a larger scale. He also teamed up with a techie Anand Mahajan, who has two decades of work experience and worked on multiple products and open banking. As a result, Nitin’s firm, OMS Fintech Account Aggregator Private Limited, got the In-principle AA approval from RBI. Now Both Nitin and Anand are working towards getting an operating license.

I had the opportunity to work with Nitin and Anand for a few months. This blog explains how AA+TSP (Technology service provider) + RIA (Registered Investment Advisor) will aid Banks in improving their client experience in wealth management. After AA is fully operational, I think it will be labelled as the “old way” and “new way”. Pre-AA and Post-AA.

Caveats:

a) The AA ecosystem is evolving. I understand from one of the participants from a recent Sahamati event / SamvAAd23 that 80% of Bank Accounts are part of the AA account system, 7% of Demat / stock market, and 4% of Mutual Fund data. Through MFC, fetching Mutual Fund data will be accessible for AAs. On the other hand, Real Assets – Gold and Real Estate will not be part of the AA system.

b) These use cases are relevant if only the client consents.

Use Case No.1: Full View of Client’s portfolio.

Does a Bank Relationship Manager (RM) know the wallet share of her clients?

The answer is a big “no.”

But wait, many MFDs (Mutual Fund Distributors) and RIAs say they fetch this on the “get-go”. If this is true, why do unclaimed assets worth ₹80,000Cr with Banks, Mutual Funds, and Demat?

Something is “not” adding up. Based on my two decades of experience engaging with financial intermediates, I realise that not all distributors / Bank Relationship Managers have access to the full wallet of the client.

Since 2015, I have been tracking the FinTech domain, and after 2018 few wealth techs have started using NSDL e-CAS to fetch the entire client’s portfolio. However, how many clients understand that they are allowing these platforms to read this statement from their Inboxes?

New Way: The Account Aggregator ecosystem helps fetch the clients’ entire portfolio with the client’s “conscious” consent.

This report will help the client and the intermediary (Banks or RIAs) have a meaningful conversation rather than being transactional.

Use Case No.2: Product Suitability and Alignment.

The “old way”: without knowing the client’s net worth or needs, most of the Bank’s RM chase to sell the products to generate revenue to achieve their monthly target. Client experience isn’t good as the product suitability is misaligned.

New Way: A layer of AA+RIA+TSP will help the Bank RM or the IA understand the context and recommend a suitable investment product rather than make it transactional.

Use Case No.3: Is your client DIY or DIYFM

DIY means “Do it yourself”.

DIYFM means “Do it for me”.

When a relationship manager from the Bank approaches her client, does he know that the client prefers to learn and be independent? How much of his client’s portfolio is in Direct Vs. ARN (AMFI registered Number, using a Mutual Fund Distributor)

New Way: AA+RIA+TSP can help extract the report, listing the % of the portfolio in Direct mode and through distributor/advisor mode.

This report helps the Bank RM or an RIA understand the context and adapt the narrative.

Use Case No.4: Does the Bank RM know his client’s behaviour?

In other words, how persistent is his client on the existing investments/portfolio? Does the client continue in his monthly savings / SIP transactions? What’s the average holding period of his investments? Have the past investments skewed towards Debt or Equity Asset class? How frequent are the redemption transactions?

New Way: AA can fetch the entire history of the transaction universe.

TSP can analyse the data points of this transaction dump, and RIA can draw insights from these transactions.

Use Case No.5: Can the Bank RM do a vibe check of all his new clients?

Understanding the context of the client’s world is wildly important. However, this question may not be relevant for well-acquainted clients.

But how does this work for prospects and newly onboarded clients?

New Way: A tool to track the transaction data of the last six to twelve months will help understand the context better.

Use Case No.6: How do the banks qualify all their new prospects or new Bank customers?

Is collecting KYC data points enough to understand the new prospects?

In the past, I have seen a few Independent Financial Advisors (IFAs) collecting quantitative and qualitative data points from prospective clients. Since the IFAs scale is limited, they can afford to take the traditional route of collecting lengthy forms. However, how does onboarding work for large platforms or banks?

New Way: AA+TSP+RIA will immensely help in prospect qualification.

Use Case No.7: How do Banks assess their Relationship Managers (RMs)?

How do Banks assess their Relationship Managers (RMs)? The one who chases few clients or engages with the more extensive set of his entire client list. How do RMs grow up in the corporate client ladder? Based on my work experience, the one who consistently achieves sales targets is noticed in the Head Office. “How?” isn’t essential; however, the only metric is “What”, which gets tracked fiercely.

New Way: AA+TSP dashboard can highlight the metrics of quality of client engagement by Bank RM’s. For instance, it can show how many RM’s have a better wallet share. How many RM’s have better reach in their client book? Is the RM missing out on a potential set of client cohorts, as he may not be comfortable with them?

Use Case No.8: How do banks classify their client segments?

It is obvious as it is based on the book size with their Bank rather than on the client’s actual net worth or potential. Do all the Bank Relationship Managers spend time understanding all their clients?

New Way: New Cohorts can be formed based on the client’s potential and net worth. These cohorts could be a new way of looking at clients’ needs rather than traditional methods.

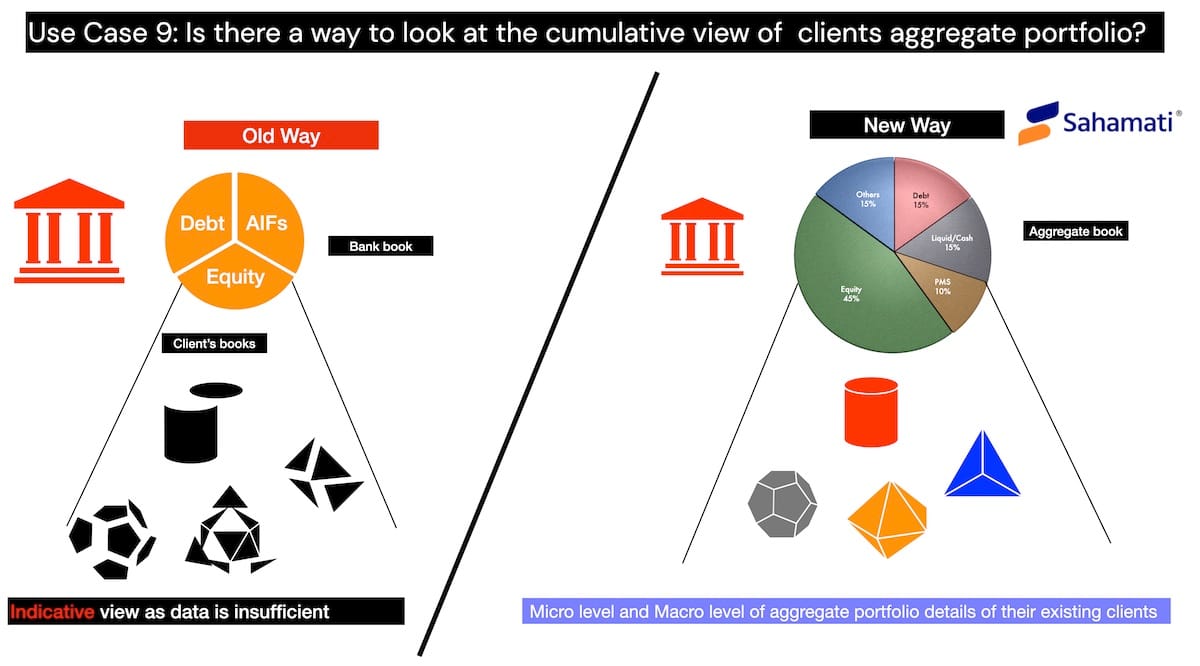

Use Case No.9: Is there a way to look at the cumulative view of the Bank’s client’s aggregate portfolio?

As we all know, the Investment Products Team in the Bank chooses investment products from the entire universe of products available in the market. In other words, this team is a gatekeeper who filters the products to be distributed/advised among the Bank’s clients.

The Product team will have a dashboard with an aggregate view of their client’s portfolio.

Unfortunately, this aggregate view indicates that the Bank will not have full access to their client’s portfolio. A hazy picture indeed.

New way: AA+TSP+RIA tool will have closer to accurate data. Please refer to the header image of this blog post.

Use Case No.10: Does Banks Investment Product Team use new methods to communicate with the clients?

The answer is no. It’s a traditional “Spray and Pray” strategy. The Marketing Team takes the download from the Investment Product team and emails it to all the Bank clients. Invariably the open rate of these emails will be in a single digit.

New way: AA+TSP+RIA tool can help identify new cohorts and curate and personalise content based on their whole portfolio. For example, how many promotional emails from your Bank are relevant to you? Why can’t Banks understand your preferences and choose to send only the relevant content?

If a bank feels these use cases are irrelevant, please check out this recent tweet by Ms Monika Halan.

A clear case as to why Banks need to know more about their clients.

It is appalling that the relationship manager of Ms Monika Halan wasn’t aware of his client when promoting one of the personal finance products.

Hopefully, in the “new way,” post-Account Aggregator world, Bank RMs will have more information about their clients and will be relevant.