Table of Contents

ToggleContext

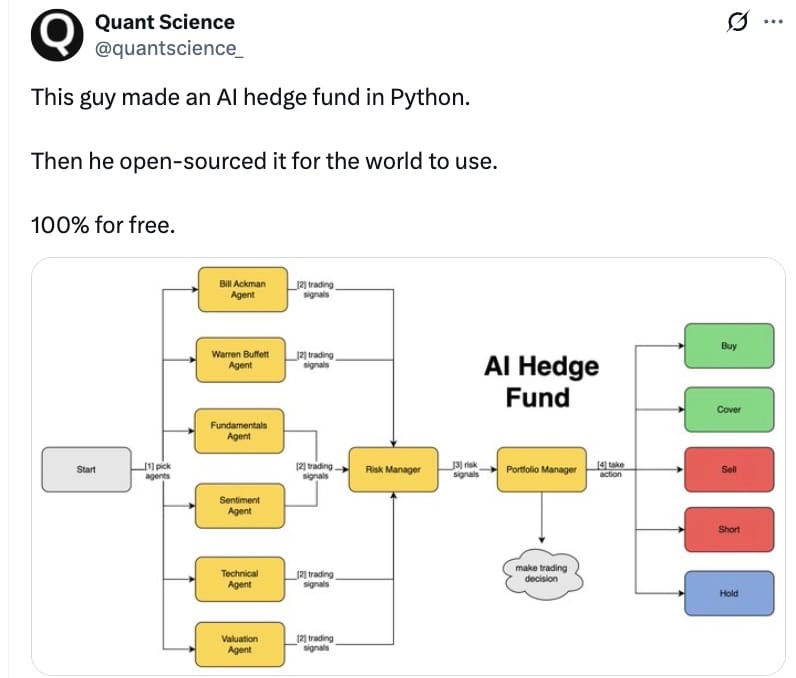

Just imagine, just like your favourite movie character or sports icon, you can now have a favourite fund manager to chat with. It could be someone like Warren Buffett or Bill Ackman. This fund manager character can help you understand your spending habits and discuss your finances.

According to a recent tweet on the X platform (referring to the header image), these AI agents are named after well-known fund managers. One follows a value investing style, while the other adopts an event-driven and short-term approach.

“AI and the Future of WealthTech: Essential Trends You Can’t-Miss”

I want to highlight the recent product launch of Arta Finance. The founder mentioned that they are riding the wave of AI technology. I am quoting Arta Finance because WSJ carried a story saying that an ex-Googler and former CEO of UBS and ING backed this startup. If Arta is embracing AI, are other wealthTech startups using AI in their platform proposition? A credible way to address this question is to examine recent venture capital funding activity. In my previous blog, I noted that of 60 VC funding transactions in the first half of 2024, about four startups focused on AI as a core part of their product offerings.

I analysed the VC transactions from July 2024 to March 2025 using data from a prominent research portal. Initially, I identified over 387 transactions. However, upon further analysis, I discovered that some companies, such as those in auto finance and data analysis for all industries, were in this list. Hence, I excluded them as they were not offering wealth tech as their core proposition.

After applying several relevant filters, I curated the list and narrowed it down to 252 transactions. Please review the caveats and exclusions below for more details on what was excluded. This list of 25 wealthtech / Investmentech startups spans 34 countries.

“Top 3 WealthTech product propositions Shaping the future of wealth management”

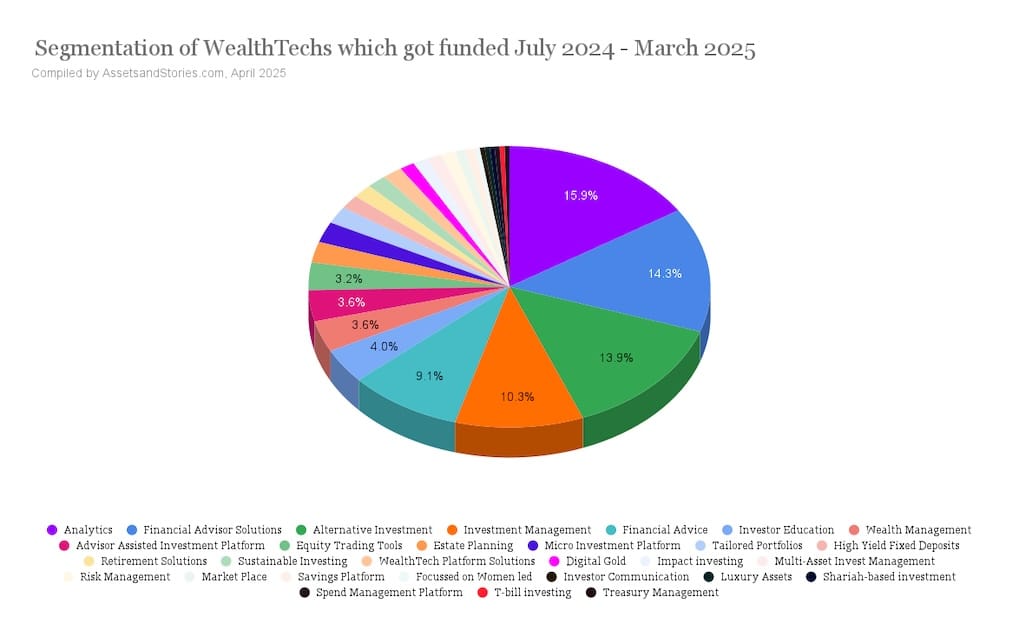

The pie chart below illustrates the breakdown of product propositions. The top three product categories out of 29 are Analytics, Financial Advisor Solutions, and Alternative Investments.

Analytics:

Unlike traditional data aggregation and reporting, these new-age analytics startups utilize data from various perspectives. Their customizable tools allow platforms to tailor the data presentation to meet users’ specific needs.

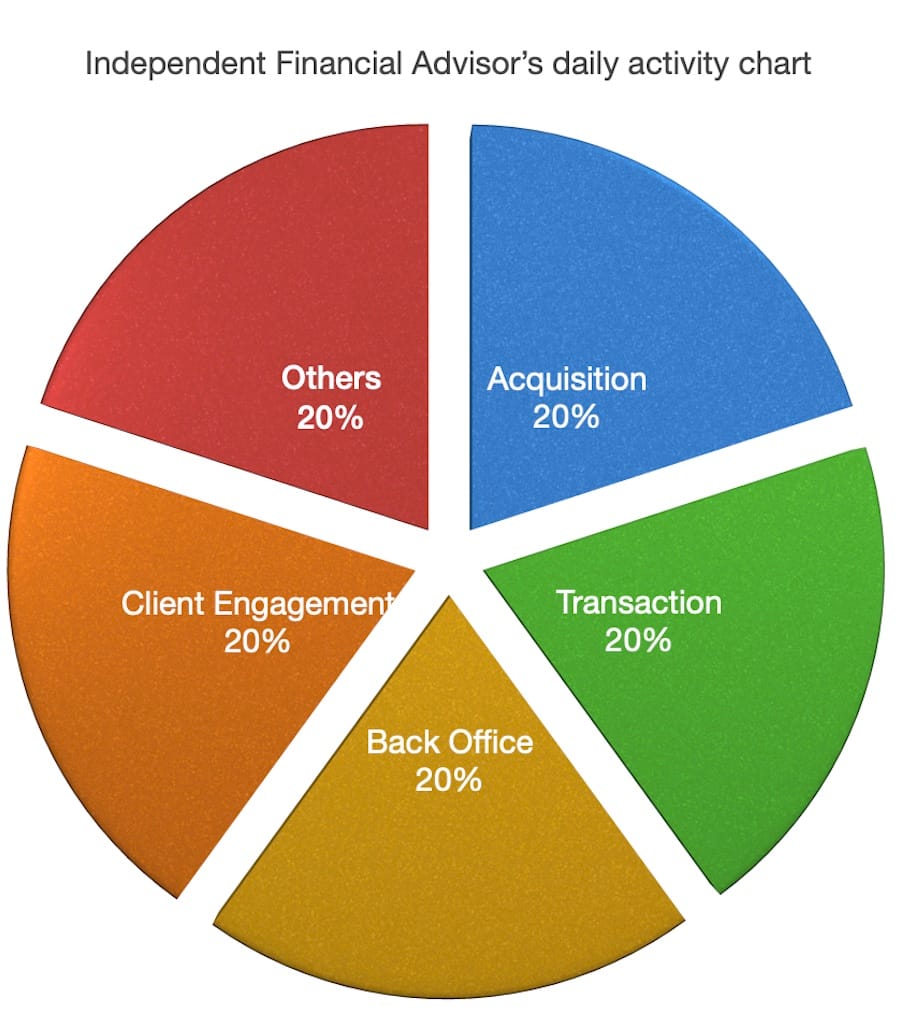

Financial Advisor Solutions / Advisor Tech:

These tools go beyond basic CRM functionalities and portfolio rebalancing. They represent new-age platforms focused on business growth, personalization, and client engagement.

Alternative Assets:

While alternative asset classes have been gaining traction for over a decade, real estate remains dominant.

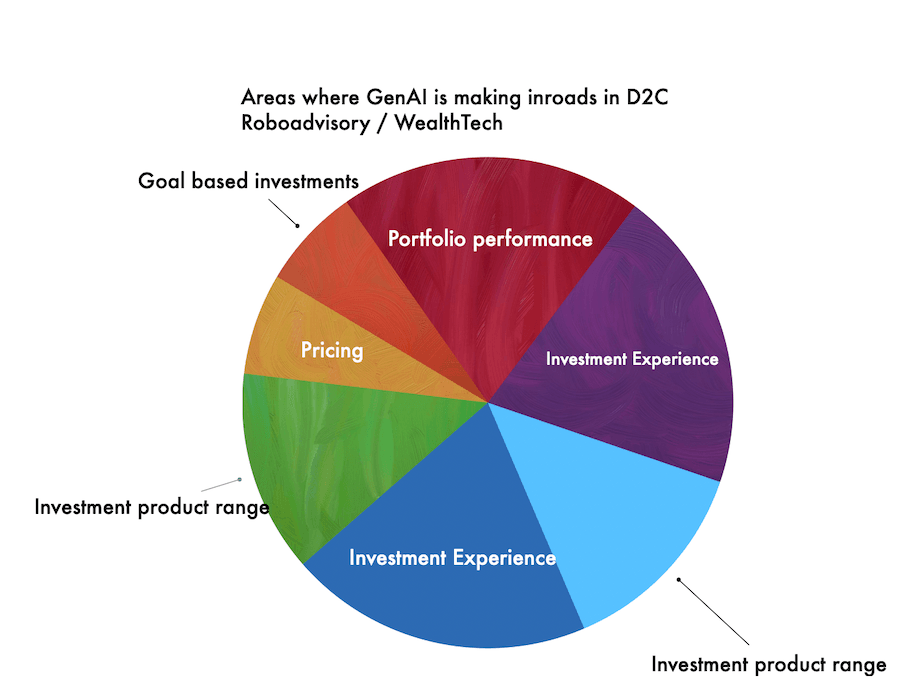

“How are WealthTech startups utilizing AI layers to enhance user experience?”

In my review of these startups, I found that over 20% explicitly mention an AI layer in their product offerings on their websites. However, upon examining other platforms, it became clear that most of them also incorporate an AI layer. For instance, AI in analytics simplifies the user experience by allowing individuals to focus on their preferred data points. Traditional dashboards present an overwhelming amount of information, which can be particularly daunting for retail and affluent investors.

One specific use case I came across is the real-time portfolio risk rebalancing feature. The AI engine processes real-time market feeds and structured and unstructured macroeconomic news and compares them with client holdings. This capability can significantly improve the user experience.

In summary, incorporating AI is a prominent theme in analytics, especially within adviser-tech or financial advisor solutions, where AI is increasingly becoming a central focus.

“Who is the target audience for wealth tech startups recently receiving funding?

There are over 18 categories of target audiences for these startups. Retail, Financial Advisors, and Asset Managers are the top three categories for recently funded wealth tech companies. Affluent individuals and Family Offices have increasingly used products to analyze their portfolios. This trend aligns with reports indicating that Family Offices are independently developing their private market portfolios and moving away from investing in venture capital funds.

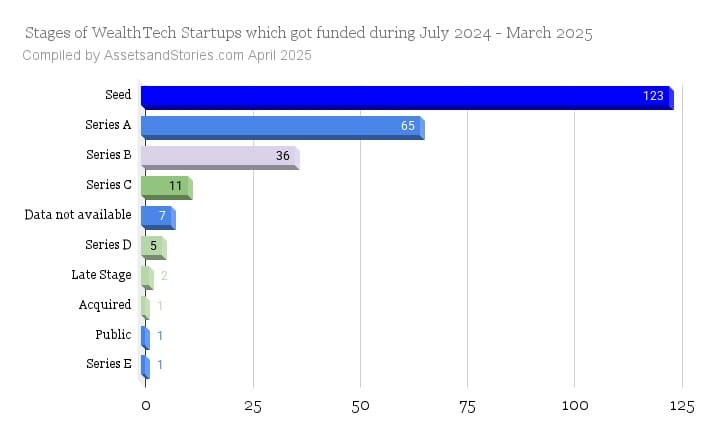

Which stage of wealth tech startups got funded during this period?

During this period, 49% of the 252 transactions involving wealth tech startups were at the seed stage. Seed-stage startups received approximately 5.6% of global venture capital funding in 2024 across all segments. This is indeed an encouraging sign for the WealthTech sector.

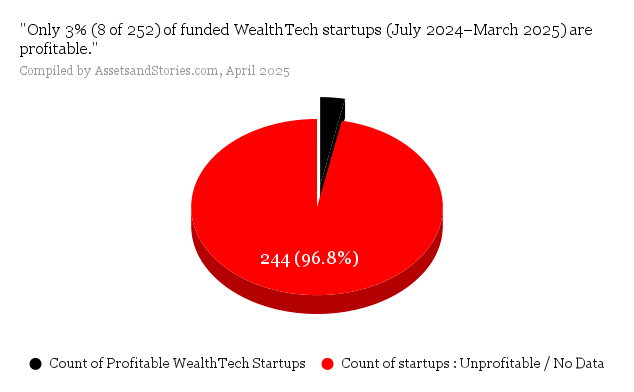

How many WealthTech startups from the recent funding list are profitable?

Of 252 companies, 43 have shared their financials, and 8 are profitable. Additionally, 35 companies have reported negative profits, while the remaining have not disclosed their financial data.

Based on my work experience, the following key factors can increase operational costs:

Customer Acquisition Cost (CAC)

This is particularly high in B2C models, while in B2B, the average cycle time for closing a deal can take up to a year.

Loyalty and Lifetime Value (LTV)

LTV metrics may not be applicable here, as customers often lack loyalty to a wealth tech platform.

Compliance Cost

Given the regulations’ dynamic and evolving nature, startups need to invest time and resources to ensure compliance, which adds to their costs.

Business Model

Wealth platforms must decide whether to rely on revenue from investment product manufacturers or directly from clients. This choice is complex. If the revenue comes from clients, building may take a long time. However, if it comes from asset managers, they are essentially aligning themselves with the traditional wealth management business model.

In addition to these factors, softer variables such as team skills and go-to-market (GTM) strategies are common challenges startups face across all sectors.

In summary, profitability is an elusive metric in WealthTech startups.

WealthTech : is it the future of Personal Finance or just a buzzword?

In my earlier blog, I discussed the relevance of the WealthTech segment. Will investment-tech platforms ultimately be like “Segways” or “e-bikes”?

Some venture capitalists believe that there is no “tech” WealthTech segment ; they see it merely as wealth management. However, these may be just opinions. The key question is: Are investors confident in their personal finances?

According to a survey by Global Atlantic Financial Group, US, 36% of respondents are extremely or very concerned about inflation eroding their pension income. Additionally, 43% express similar concerns regarding the ability of Social Security to provide full benefits for life. The EIOPA’s 2023 Eurobarometer Survey, EU reveals that 58% of Europeans do not feel financially confident about their retirement. In a study conducted by the India Retirement Index and Kantar, 30% of urban Indians worry about running out of funds within just five years.

Supply vs. Demand Mismatch in Financial Advice

United States:

Research and benchmarking firm Hearts & Wallets’ 2023 survey results reveal significant financial advice gaps among American households. These gaps are defined as finance-related tasks that US households find very challenging. Notably, many households in the “wealth accumulation” stage of life need guidance on balancing short- and long-term financial goals. The primary advice gap for retirees with assets between $1 million and $10 million lies in developing a strategy to withdraw income from multiple accounts.

United Kingdom:

The LANGCAT Advice report indicates that only 9% of UK adults pay for financial advice. This creates a considerable gap, especially considering the UK has over 28 million households.

European Union:

The European Commission’s Retail Investment Strategy (RIS) report highlights that European retail investors maintain high savings rates. By the end of 2022, the savings rate for German households exceeded 20%, while that for French households surpassed 17%. However, their investment activities remain limited compared to their US counterparts. More than 60% of European retail investors feel that the advice they receive does not serve their best interests.

If mature markets experience a financial advice gap, one can only imagine the significant gaps in developing countries.

How are recent trends in wealth technology impacting traditional wealth management firms?

Jamie Dimon:

The CEO of JPMorgan is actively using the LLM Suite, which indicates that employees have adopted this tool. It enables advisors to derive insights from the uploaded reports.

Morgan Stanley:

It launched AskResearchGPT in October 2024, and its adoption among employees has been reported in multiple sources. Employees have highlighted the tool’s ability to synthesize unstructured data and provide actionable insights from over 70,000 annual research reports.

BlackRock:

BlackRock’s adoption of AI is well known, with Aladdin and eFront being flagship platforms that showcase their AI capabilities.

Wealthfront:

WealthFront features a dedicated section on its platform promoting its Generative AI portfolio.

Medallion Fund:

Data collection and analysis are attributed to the success of the Medallion Fund from Renaissance Technologies, which utilises sophisticated quantitative strategies. This fund was one of the early adopters of AI.

Observing these trends, it’s clear that AI is significantly impacting traditional wealth advisory firms.

Insights: is this the beginning of WealthTech 3.0?

WealthTech 1.0 (2010 to 2021):

The focus was on providing access to retail investors.

WealthTech 2.0 (2022 to June 2024):

The emphasis shifted to superior technology architecture and platforms for affluent clients.

WealthTech 3.0 (July 2024 onwards)

Introducing an AI agent layer and advanced analytics

Let me break it down further. While WealthTech 1.0 was primarily focused on building platforms to provide access and upgrade transaction capabilities, WealthTech 2.0 introduced superior technology through APIs, creating targeted platforms for affluent audiences and offering private market investment products.

In contrast, WealthTech 3.0 features startups that have emerged in the last six months, where the AI layer is the primary product. These companies leverage analytics and data to serve even the retail audience. Terms like “AI agents” or “lingos” make these innovations appealing to venture capitalists (VCs). As a result, we have observed that seed-stage startups are gaining significant traction among investors.

“WealthTech 3.0: Key Unanswered Questions”

- “Can AI-driven WealthTech 3.0 earn trust from retail and affluent investors?”

- “Will WealthTech 3.0 finally close the global financial advice gap?”

- “Can WealthTech 3.0 crack the profitability code?”

Disclosures, Caveats and Assumptions

1) I am not a Registered Investment Advisor (RIA). Therefore, my opinion on the firms’ names shouldn’t be considered a stock recommendation or caution.

2) I may be biased towards the WealthTech segment as I am the cofounder of InvestMates.io

3) Some startups may be inadvertently omitted.

4) Exclusion list for the above analysis -Crypto, NFT, Blockchain, Crowd sourcing platforms, solely focused on institutional investors, Gifting and Charity, post IPO stage companies.

5) B2B2C platforms / (e.g., advisor white-label tools)- are classified as B2B.