Table of Contents

ToggleContext:

Just imagine, on the way to your workplace, you can ask your favourite “character” from a movie or your sports icon to call and chat. This character can also explain where you are spending more and discuss your personal finances. Since you like your character, your conversation is engaging, and the character talks in the tone and language you like.

Yes, this is not fictional. character.ai has launched two-way conversations, wherein you can have a two-wave voice conversation. You may wonder how many will prefer to converse with their favourite characters. In a recent post by A16z, CharacterAI is at the top of the list of the most engaging consumer AI apps.

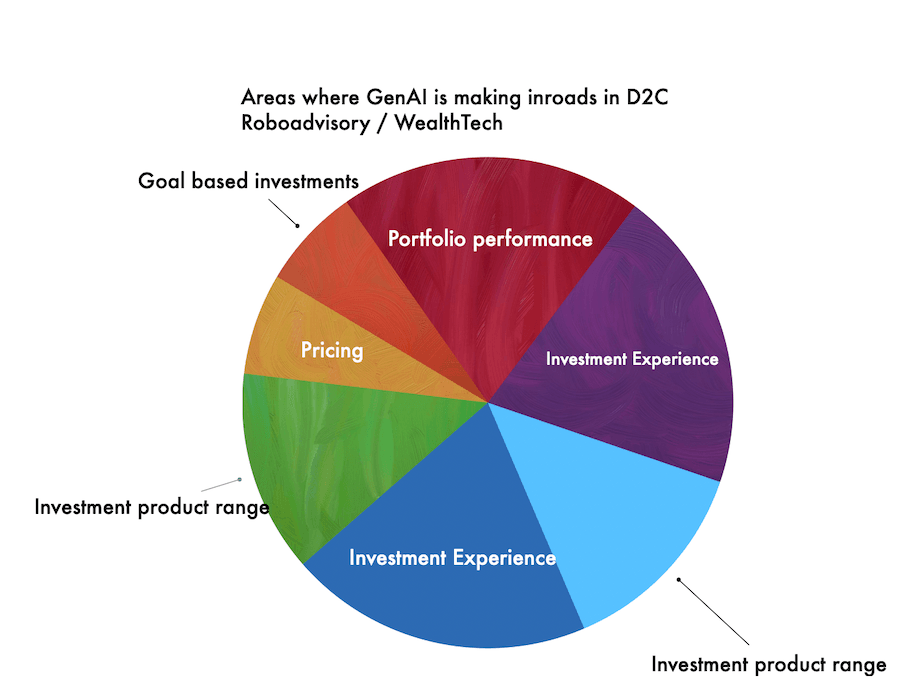

I wondered how many GenAI startups are pivoting into Personal Finance. In other words, how would the experience be if GenAI were applied to retail investors’ investment tech platforms or robo-advisors?

Are there any interactive personal finance co-pilots available for retail investors?

Yes, there are co-pilots like WeFIRE and Fina.

Can these GenAIco pilots take the investors’ experience to the next level? Will these change the business landscape of investment advisory business?

To answer this question, I revisited the existing product proposition offered by Rob-advisors and InvestmentTech platforms.

What do robo-advisors or Investment-Tech offer to retail investors?

There are specific cohorts of retail investors who prefer robo-advisors and investment tech platforms

In my earlier posts, I compiled a list of 100 leading InvestmentTech platforms and identified about 18 product hooks. Product hooks are the features which attract retail investors to use these platforms.

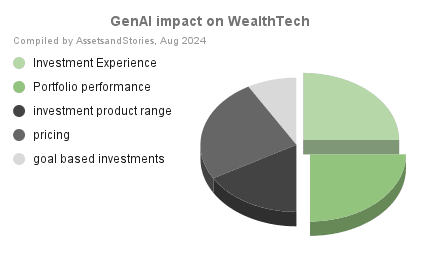

Out of these 18 product hooks, let’s look at the Top 6 product proposition/value proposition of robo-advisors

Product Hook No.1: Can GenAI enhance the Investment Experience of retail investors?

Betterment, one of the largest robo-advisors, draws prospective retail investors by saying, “Simply take advantage of a robo-advisor–like us–to make help investing easy.”

Co-pilots can help the “discovery process”. Not all robo-advisors and asset managers have a simple discovery process for retail investors. An investment product is similar to choosing the right airline to fly with your family to a new holiday destination that is far away. Navigating from the “discovery process” to the “experience”. You may have done all the homework and selected the correct itinerary. The question is, would the aircraft take off on time after you check in at the airport? Will the aircraft land on time? Can you connect to your next flight at the right time?

Similarly, the retail investor may have picked up the appropriate investment product, but the question is whether the underlying investment product will deliver performance.

GenAI will partly improve the investment experience of retail investors.

Product Hook 2: Can GenAI improve Portfolio performance?

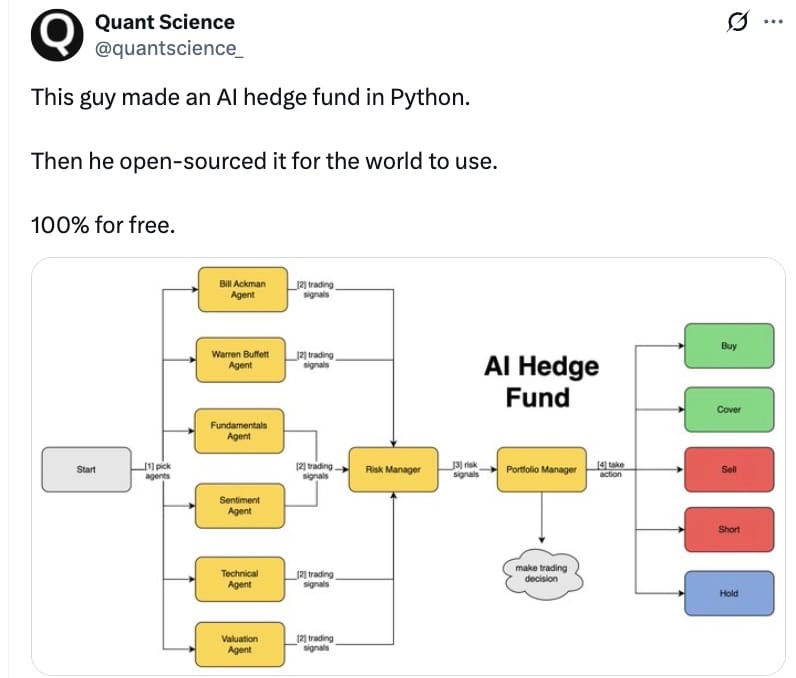

Now, how does GenAI help the portfolio managers?

BlackRock states that LLMs (large language models) turn unstructured textual information into meaningful relationships across stocks and themes.

GenAI helps derive insights from a large amount of unstructured data that wasn’t available in the past.

But what does this advanced technology mean for individual retail investors? Retail investors could invest in one of the large asset managers with LLMs. For example, BlackRock started educating retail investors about AI and GenAI in the context of investments.

Even JP Morgan and BNP Paribas have launched their LLMs.

For consumer-facing platforms like Finamaze and Sqsave, AI isn’t just a tool’s competitive edge; it’s a ‘moat’ on the website.

Therefore, many portfolio managers are betting on GenAI to deliver portfolio performance. Few also use this as a marketing tool to lure retail investors. Recently, the US regulator SEC penalised a couple of them.

GenAI will certainly help portfolio managers to drive alpha.

Product Hook 3: can GenAI broaden the investment product range?

Can GenAI offer more investment products to retail investors? Using the previous analogy, you are planning a new holiday destination with your family. Can GenAI offer more intelligent routes, a seamless booking experience, understanding your preferences of flight timing, guidance about luggage, and tracking your luggage, too, and giving more choice of airline categories at a compelling price point? In reality, GenAI is being deployed by all large airlines to resolve customer queries, and a few may be working on improving customer experience.

Similarly, MSCI, S&P, and Wealthfront are actively working on and promoting the GenAI portfolio in the investment world. If you browse the Flybridge AI index, you can see that many products are being developed, and many indices have been launched. As a result, retail investors may have more products with a GenAI prefix or suffix.

Product Hook 4: Can GenAI reduce the pricing for the retail investor?

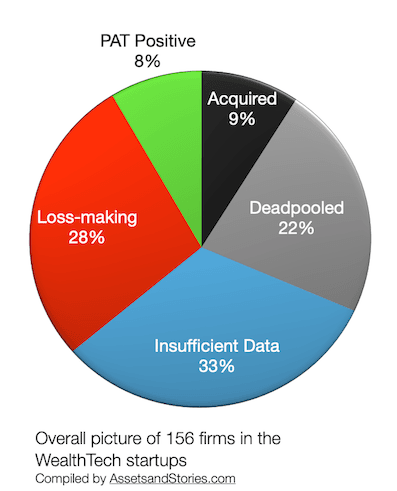

Most of the direct-to-consumer investment platforms are not profitable. Given the stress on Roboadvisors’ profit and loss accounts and the wafer-thin margins of asset managers, can GenAI reduce the cost of their business operations?

My take on this question is that if the robo-advisor is a “GenAI-first” startup, then this startup will use GenAI tools to generate creatives and content. For example, the Swedish Fintech firm Klarna has posted that it has reduced marketing costs by 25% using GenAI tools. Now, think about it: What if these Robo-advisors use tools like AI-powered SEO, Anvil, and RunwayML and iterate their products quickly?

The path to profitability may become shorter, and the team will be lean and reach PMF (Product market fit) quickly.

In turn, leveraging GenAI tools could lower the price for the end retail investor.

Product Hook 5: Can GenAI help retail investors with their goal-based investments?

Can GenAI be your co-pilot in devising a strategy for your investment portfolio to meet specific financial objectives?

Assume you choose a robo-advisor similar to Goalsgetter, choose your dream house, and keep a target of $0.5mn for your summer house. The platform must choose the apt investment product using GenAI and monitor whether the underlying product delivers. Portfolio managers depend on GenAI tools to analyse structured and unstructured data and manage the portfolio.

GenAI has to choose the investment product, forecast the product performance, and rejig if required. Then, GenAI assists the retail investor in staying on course until she reaches her goal, that is, until her portfolio value reaches $0.5mn.

I haven’t seen GenAI tools on Goalsgetter; however, few platforms showcase comprehensive dashboards and tools. Surprisingly, I haven’t encountered a robo-advisor incorporating GenAI for goal-based retail investor investments.

Summary:

GenAI is dependent on LLMs. Only some LLMs are designed for wealth management use cases, and only a few organisations can build them, as LLMs are expensive. LLMs are like foundations; few WealthTechs or Asset managers will build proprietary data source layers on top of these select LLMs. Some WealthTech firms will buy GenAI tools off the shelf.

After reading Portfolio Pilot’s story, I learned that the GenAI trend has begun in the financial advisory space. Given the change in the landscape, regulators will also be open to understanding the nuances of AI-based advice.

GenAI-first Robo-advisors who comply with IA regulations can have a second life.

Disclosures, Caveats and Assumptions

a) I am not a Registered Investment Advisor (RIA) and hence not registered with SEBI, FINRA, FCA or DFSA. Therefore, my opinion on the firms’ names shouldn’t be considered a stock recommendation or caution.

b) I consult for a few early-stage wealth tech startups and not for one of the firms mentioned in this post. In other words, this is not a sponsored post.

c) I may have inadvertently missed mentioning a few names in this blog post.

d) I may be biased towards GenAI.