Table of Contents

ToggleHow many new investors join the Mutual Fund industry on an annual basis?

Indian Asset Management Industry has garnered impressive growth of assets over the last decade. For example, one post on Cafemutual mentions over 10 million new investors joined this new asset class in 2021 and over 6.5 million in 2022. However, let’s go deeper into these numbers. Is this good enough? How far are Indian Asset Management industry from the retail investor? In other words, how easy is it to invest or redeem for a retail investor?

I have chosen asset managers in the listed space to answer these questions, as data is only available for those AMCs listed on the stock exchanges.

Devil is in the details.

The objective of my blog is not to recommend or interpret the stock price of these companies; however, to understand the steps taken by these organisations to improve the consumer/investor experience. I am choosing two cohorts of investors –

a) Direct / DIY(do it yourself) investors and

b) Assisted by a Mutual Fund Distributor or a Registered Investment Advisor.

Direct investors prefer to interact with an Asset Manager directly, so invariably, these investors may reach out on their website or mobile app. The second cohort, viz. distributors or advisors, may use digital platforms and tools promoted by Asset Managers.

How easy is AMC’s website or app to use?

Let’s go further about how these cohorts have adopted the digital tools of these listed Asset Managers.

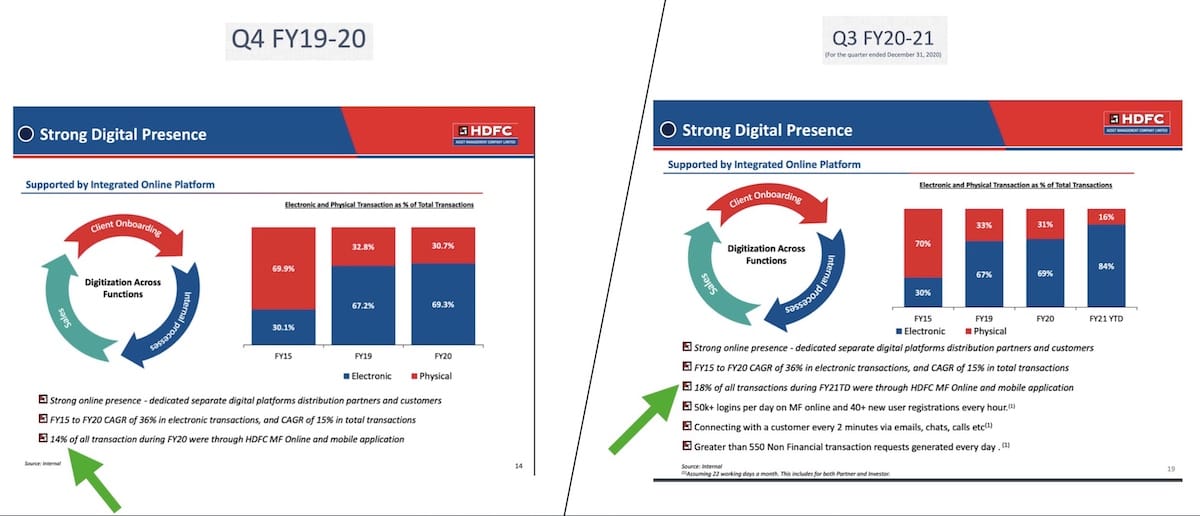

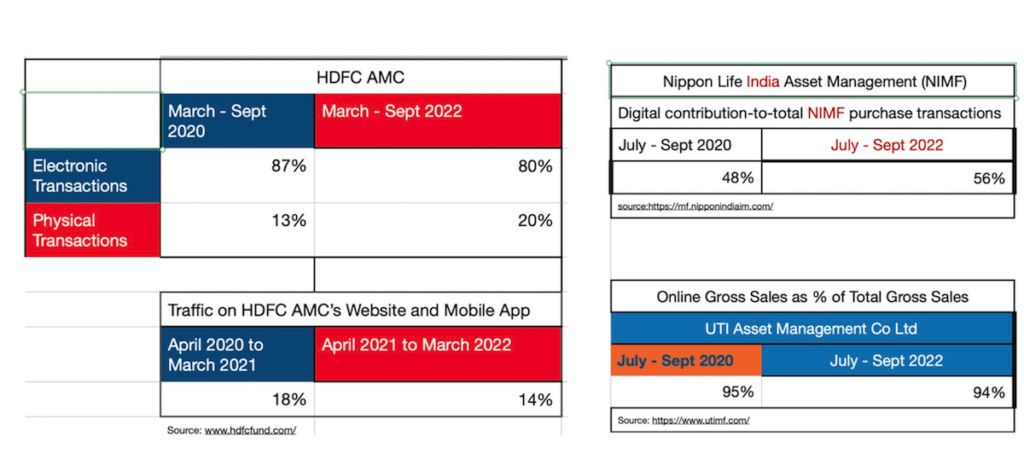

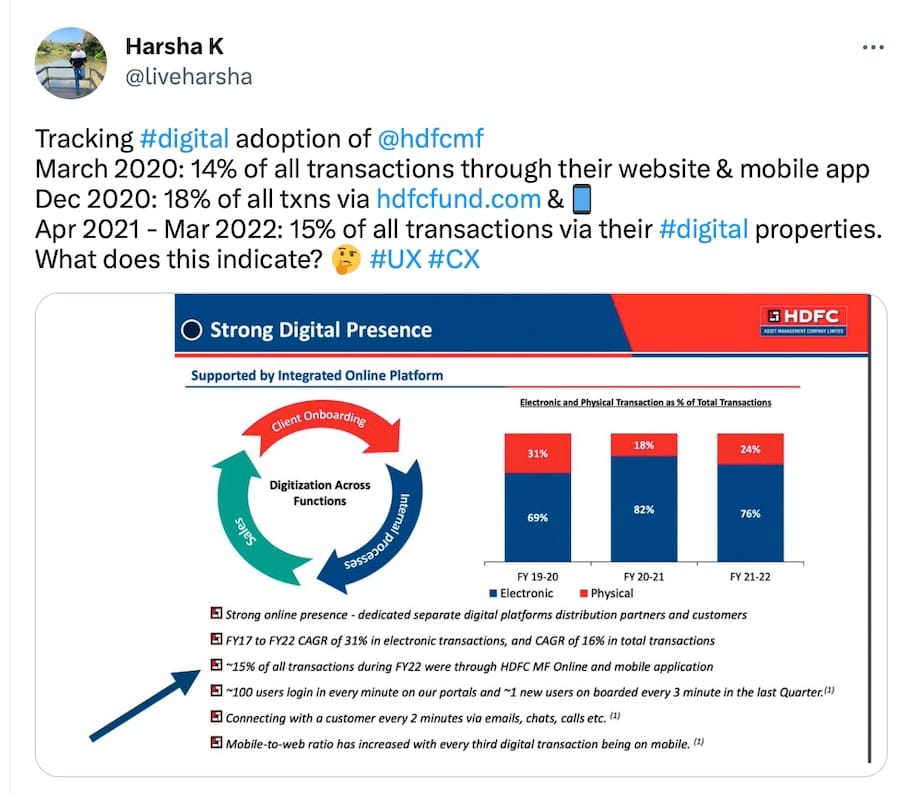

In Oct 2020, I posted my analysis on Twitter. HDFC Asset Management co ltd has compared its electronic and physical transactions. In 2015, only 30% of transactions were digital, and 70% were paper-based. However, it’s good to see that in 2021, digital grew from 30% to 87%. It’s intriguing to notice that 13% of transactions are paper-based. Nippon Life India Asset Management has used a different metric to analyse its digital adoption; 48% of business transactions are through its digital platforms. I assume business transactions include all financial transactions, excluding non-financial transactions like a change of address or nomination. UTI Mutual Fund posts only new sales through its digital platforms. How should one track the redemption or switch transactions, then? The report mentions 95% of all their latest sales happen online.

Digital adoption metrics

Insights

a) Looking at these data points, Digital adoption isn’t an important metric for the Asset Management Industry in India.

b) Tracking the relevant metrics and improving the user experience, won’t this help the Asset Manager’s growth and profit

c)doesn’t it help retail investors, mutual fund distributors and registered investment advisors to focus on investment decisions rather than spending time on paperwork?