Table of Contents

ToggleAn engineering conglomerate acquiring the world’s largest asset manager assets

L&T enters the ‘turbulent’ mutual fund business without an edge. I read this article in early 2010. First, a quick disclaimer – I am not a registered investment advisor. Hence, my opinion on either L&T or L&T Finance shouldn’t be considered a stock recommendation or a caution.

Generally, large corporates, with their surplus cash, pivot into new businesses. There is an inherent bias with these big corporates that they can also continue thriving in their new businesses. This post is the story of one of the largest engineering conglomerates with a financial services subsidiary.

L&T Finance was on an acquisition spree.

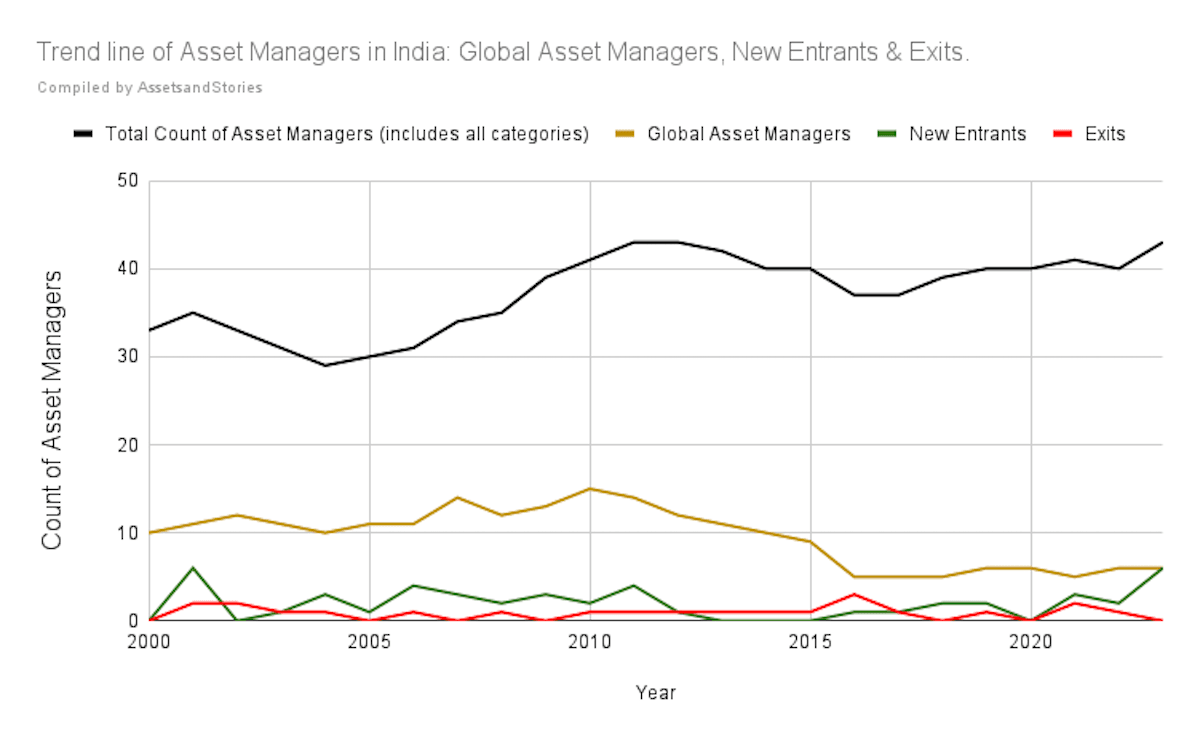

In 2009, L&T Finance acquired Cholamandalam DBS’s Asset Management business. The Murugappa group AMC had less than 2% market share in the Indian Asset Management industry. In November 2012, L&T Finance made its second acquisition – Fidelity Asset Management India’s business. I was part of the Fidelity Asset management team. Being part of this acquisition raises several questions in my mind. Please look from the retail investor perspective who had invested either in Cholamandalam or Fidelity. There have been several such transactions in India in the last two decades. Who wins in these mergers and acquisitions? Let’s park this question for a minute.

L&T Mutual Fund

In Fidelity, I was part of the Business Development role managing the IFA (Independent Financial Advisor channel.) I took a sales role for the West region in the new combined entity. The west region accounted for 43% share of new business. Onboarding a sales role for a new Asset management brand was a mountainous task. As a result, the new entity’s market share in equity assets dropped from 2.5% to 0.40%. As a result, I stopped engaging with IFAs to share tech trends. My sole key result was returning the new entity’s market share. During those two years, I noticed the cultural difference between a multinational firm – Fidelity and L&T Mutual Fund. The entire organization turned into a sales engine. Lo, in the next two years, the new combined entity made progress in the market share.

Who wins in these mergers and acquisitions?

2009: L&T Finance acquired Cholamandalam DBS’s Asset Management business.

2012: L&T Finance made its second acquisition – Fidelity Asset Management India’s business.

2022: HSBC Asset Manager acquires L&T Mutual Fund.

Will a retail investor gain if she continues to hold in these mutual fund schemes through this entire merger and acquisition period? Is there any study made to track all the merged and acquired schemes by AMCs?

From an acquirer and acquiree point of view, the investor is just a record / ID in the MS Excel sheet; however, when the asset manager sells a fund, a captivating story gets narrated. The question posed by many financial advisors in Nov 2012 was very valid. Like many mergers and acquisitions, the story of L&T and Fidelity is worth pondering. The investment bankers of this M&A transaction would have gained a windfall, as not many retail investors in the mutual fund schemes.