Table of Contents

ToggleWhat’s your ETA?

Does your personal finance tech platform notify you that inflation in 2023 has delayed your estimated arrival time (ETA) to reach your financial goal?

Visualise that this is your first trip to the base camp at Mount Everest. It’s a fourteen-day course, and you have completed four days of trekking. And suddenly, you suspect that you may be on the wrong route. Furthermore, you realise that only one navigation device you had has turned glitchy. How could you have avoided this risky situation?

How many tools do you use to navigate?

Using more tools will help you to navigate the suitable terrain. How many devices are you using? GPS, compass, altimeter, map contours and triangulation. In mountaineering, navigation experience is critical and hiring a guide helps. Mountaineering is a skill which is grown organically / slowly. Similarly, your wealth tech platform may give you a similar experience in your personal finance domain.

Advice-gap

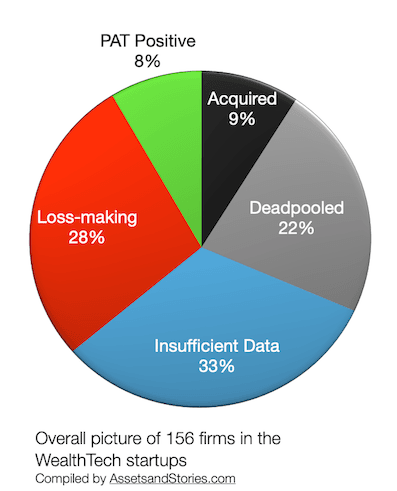

I was intrigued reading that over 20 million people in the U.K. need financial advice. How’s the experience in India? India has one IFA (independent financial advisor) for every 16,200 people. Therefore tech can play a crucial role in filling this gap. During 2015-2019, I met around 50 wealth tech platforms in India. How many exist now? How many could you name? Maybe five. Why do these platforms not exist now? What if you were using one of those platforms?

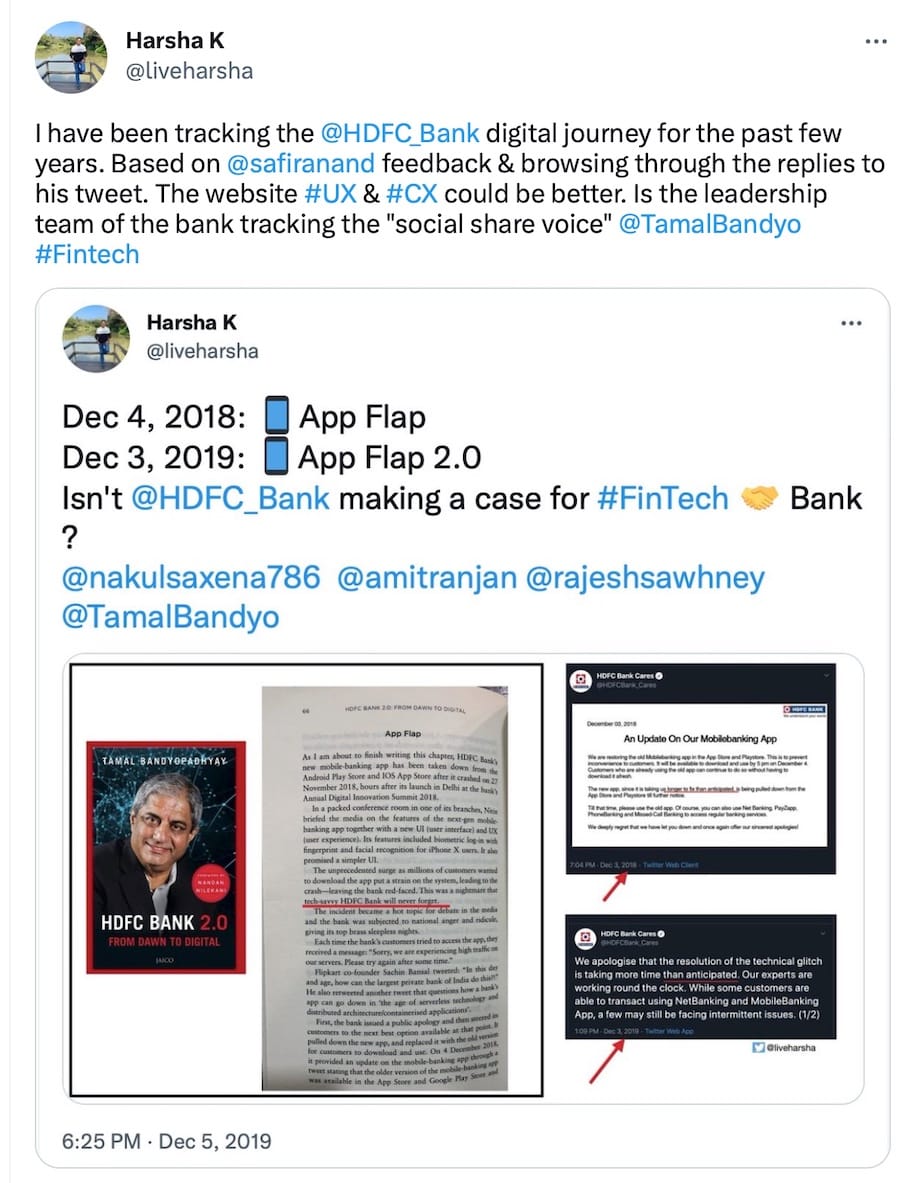

Most wealth tech platforms have yet to use tools to navigate the user/investor to safer terrain. For instance, how many wealth tech platforms have minimised the difference between the investor and fund % return? Is there a simple dashboard tool to alert the ETA for the user?

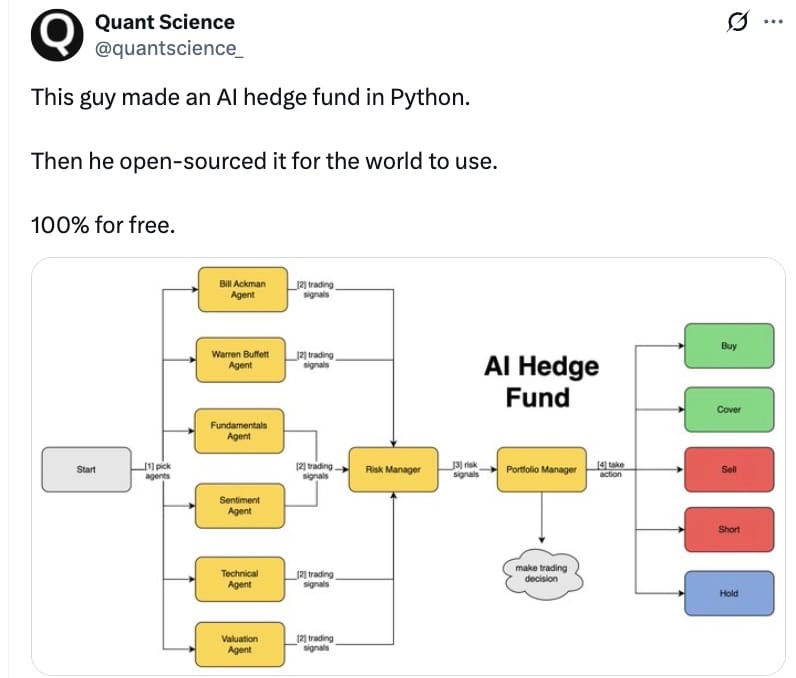

WealthTech platforms manage multiple users/investors who all are in different levels of skill sets and various altitudes. Imagine this platform has to guide users of numerous groups of experience. How would the algorithm understand the need, want, aspirations and risk tolerance of all users and recommend them to reach the summit?

My Experience in WealthTech

Since 2015, my experience has been as follows,

a) develop a new version of an advisor-client wealth tech platform. Usage Numbers: independent financial advisors from 400 to 5000 in less than two years

b) bought a new idea to the table, onboarded the tech team, developed the business requirement document, oversaw the product development, gathered feedback from the bank investment team & iterated and launched the app. This mobile app helped employees to provide consistent investment advice to customers across Axis Bank. This new mobile app helped to relay a consistent message on the scheme recommendation by Axis Bank Relationship Managers to their customers.

c) Helped Syntoniq to onboard one of the World’s Top 10 Asset Managers and One of the largest Robo-advisory platforms in India. I have been sharing my thoughts on Twitter. My handle is @liveharhsa

I am open to conversing with the platforms to share my thoughts on both IFA and investor engagement.