You may have read about the new “data protection bill,” which is a defining moment for all business platforms. In the Morning Brief Podcast, IT minister Mr Ashwini Vaishnaw says there will be a significant behavioural change in the organizations that collect and process data. These firms must implement various protection mechanisms to comply with the law.

Over time, the new rulebook will change the design to drive trust among the Indian digital user community. Given the context, the adoption of Digital Public Goods (DPG) will be far higher. Presenting four new use cases for B2B FinTechs.

Table of Contents

ToggleCaveat

a) I am not a SEBI Registered Investment Advisor (RIA)

b) A few FinTech players may be working on these new use cases now.

c) My opinion on the names of the companies and startups mentioned in this post should not be considered as a stock recommendation or a caution.

Use case 1: How will the “buyer” application create awareness or educate about the “sellers”?

A quick recap on ONDC

You may read or heard about Open Network for Digital Commerce (ONDC). A quick primer before we get into the B2B FinTech use cases.

The secret sauce of ONDC is “un-bundling” and “interoperability”. For instance, when you shop on Amazon or an equivalent B2C marketplace, you may have observed that a few brands or products may not be available. For example, can you buy all Sout Indian snacks and pre-mixes from Amazon? The chances are minimal. The reason is that the local small businesses producing these “ready to eat” products cannot afford the price demanded by large e-commerce platforms. These e-commerce platforms are the gatekeepers to onboard the products.

Looking from your point of view – why should you not have a choice to discover more products beyond the list shown on e-commerce platforms? Removing the gatekeepers is one of the unbundling processes. There are a few more variables that are getting unbundled. However, I am not highlighting those as they are irrelevant to this post.

The government of India has initiated a platform wherein the sellers / (both large and small businesses) can onboard all the buyer platforms. Customers like you have a choice to choose the buyer platform. For instance, how would the experience be if you were restricted to speaking with friends only in your mobile service provider? Telecom service providers allow interoperability to talk with other operators. However, this doesn’t exist in the e-commerce world.

Sellers:

In the new world of un-bundled e-commerce, Open Network for Digital Commerce (ONDC), the onboarding process for a seller is easy. Onboarding a large e-commerce platform for a small business is expensive and time-consuming. In the new world of decentralized e-commerce, onboarding is an effortless process. Indeed, it is a fabulous initiative from the government of India. In one of the forums I attended in 2022, Amazon India presented that they have over 11 million unique products listed on its platform, onboarded 1.1 million sellers and 260 million digital transactions daily. By 2030, this number will increase by 5x. In the new un-bundled e-commerce world, a large segment of the small and business categories will be onboarding ONDC (Open Network for Digital Commerce).

Buyers:

Let us look at it from the users’ / buyers’ perspective.

As per Blume Venture Capital’s report – Indus Valley Annual Report 2023, 55% of 125 million Urban households in India already have e-commerce exposure. The next set of new e-commerce users will invariably be for rural India, as the penetration is only 19% of 167 million. Will the new users log into the un-bundled e-commerce world quickly? I see two hurdles for these new users/buyers: a) new to the e-commerce world, so they must catch up in adopting b) the Fake Reviews menace. For example, Trip Advisor mentioned in their 2023 transparency report that they identified over 1.3 million reviews as fake. In Oct 2022, Amazon put a press release that it filed its first criminal complaint in Italy, its first civil suit in Spain, and ten other legal actions against bad actors in the US in its ongoing effort to protect customers and small businesses from fake reviews

How should the ecosystem of ONDC motivate new users to use the un-bundled e-commerce world? Given the background, there will be new user segments for both the Sellers and Buyers segments.

New Rating Layer:

Why can’t the seller application build a new API layer similar to the “fit and proper” assessment? For example, the ONDC portal says it will facilitate “sellers” to be discovered in multiple buyer platforms, online catalogues, inventory, customer, order and reports management. The ONDC ecosystem can include a new service, the quantitative and qualitative “rating” layer.

The new API layer can fetch data points like Goods and Sales Tax (GST) returns and credit scores of the seller’s business or promoters of these businesses. These sellers / SMBs need not necessarily be in the GST purview as one can look out for other data points of the small business owner. A FinTech using Account Aggregator / Open Banking feature Labelling different sellers based on their financial discipline will help build trust among the seller-buyer community. Who could create this new rating layer? An Account Aggregator (AA) and Technology Service Provider (TSP) can make this layer on the Seller platform in the ONDC ecosystem. However, this can happen only with both users’ consent, so there may be buyers who opt out and are labelled as “yet to be rated.” This new API layer can share the “fit & Proper” rating on the buyer platform akin to customer/ user reviews. These ratings will be more credible than mere customer reviews. Given the AI / ChatGPT revolution, having alternate methods for customer reviews is essential.

Use case 2: Why will the kirana store owner trust the new wholesaler from another town on the B2B Buyer App?

As per Hindustan Unilever Limited India’s (HUL) 2022-23 annual report, there are 11 million retail outlets in India. This report mentions that Traditional trade has seen a resurgence, with the neighbourhood kirana stores back at the forefront of growth. This small shop owner/kirana store who sells groceries and sundry items in a village or a small town could also access new products. For example, let us assume that this Kirana store, which sells grocery and FMCG products, also sells feature phones, the older generation phones (not smartphones).

Generally, the kirana store owner in a rural area picks up stuff from a nearby town from known sellers. In other words, the store will only have access to a few feature phone suppliers to place in her village store. However, using the ONDC network / B2B Buyer App unbundles, the Kirana store can access many new sellers from cities near her village or urban locations. While the access to products makes it compelling for the kirana store, will the store owner trust the new wholesaler on the B2B Buyer App? Not all B2B Buyer Apps may take ownership of the fulfilment process.

KYBP: (Know Your Business Partners)

Introduce a new layer similar to KYC (Know your Customer). KYBP: Know your business partner. On the one hand, the kirana store deals with large brands like HUL and ITC; how will the store start working on other smaller businesses that will add more product variety?

Imagine in the above example that the store logs into buyer ONDC platforms and browses through different new suppliers of the feature phone.

If she shortlists one of them nearest to his village, then she can get to the next level of knowing each other ( KYBP)

Account Aggregator (AA) and TSP (Technology Service Provider) can build this layer for the seller application. This layer could build trust between the store and the small business owner located in the town.

Use Case 3: Why should the Big-Box item “buyers” be in the same cohort as “grocery”?

In 2022, I was a consultant for India’s leading furniture brand. The problem we were solving was to increase online sales. My role was to identify suitable vendors in Tech, Operations and Marketing for this leading furniture brand. On every occasion, the tech service providers presented a solution to generate new sales from the Direct channel / D2C. However, the promoters of the business were very prudent in avoiding getting carried away by the Direct channel; their focus was to improve sales from both B2B and B2B2C digitally.

Big Box Items

Assuming a seller app onboards a furniture brand looking to expand in new locations. The ONDC network, backed by the government, onboards this furniture brand in all relevant B2C Buyer apps in the Furniture category. How will this furniture brand identify a user in the buyer-ap whether she belongs to Direct, B2B or B2B2C? The B2C buyer app identifies the user’s location and showcases the relevant furniture shops. However, there may be individuals representing all three segments. For example, a user may be representing a corporate house procurement department. Another may be a user who is looking for a franchise business. All three cohorts use the same B2C buyer app from their smartphone or laptop. This problem is solved if ONDC B2B buyer apps exist for the furniture category.

Using the Account Aggregator (AA) + Technology Service Provider (TSP), the buyer app can identify different cohorts of buyers. Why should Big Box items not be treated separately in the buyer application? The buyer app can segment the users based on the data fetched by AA post the buyer’s / user’s consent. This layer will help the Big Box Item seller to customize the message based on the user profile in the buyer app.

While writing this blog, I checked on the ONDC seller app now, and it has only one seller app and two buyer apps that offer the Home and Decor categories. The buying experience for B2B or B2B2C of the big box items must be more effective than the current format. Hence, the adoption is low.

Use Case 4: Why shouldn’t the new users from rural India give access to saving products like spare-change or round-off?

TAM for Investment Products for Rural India:

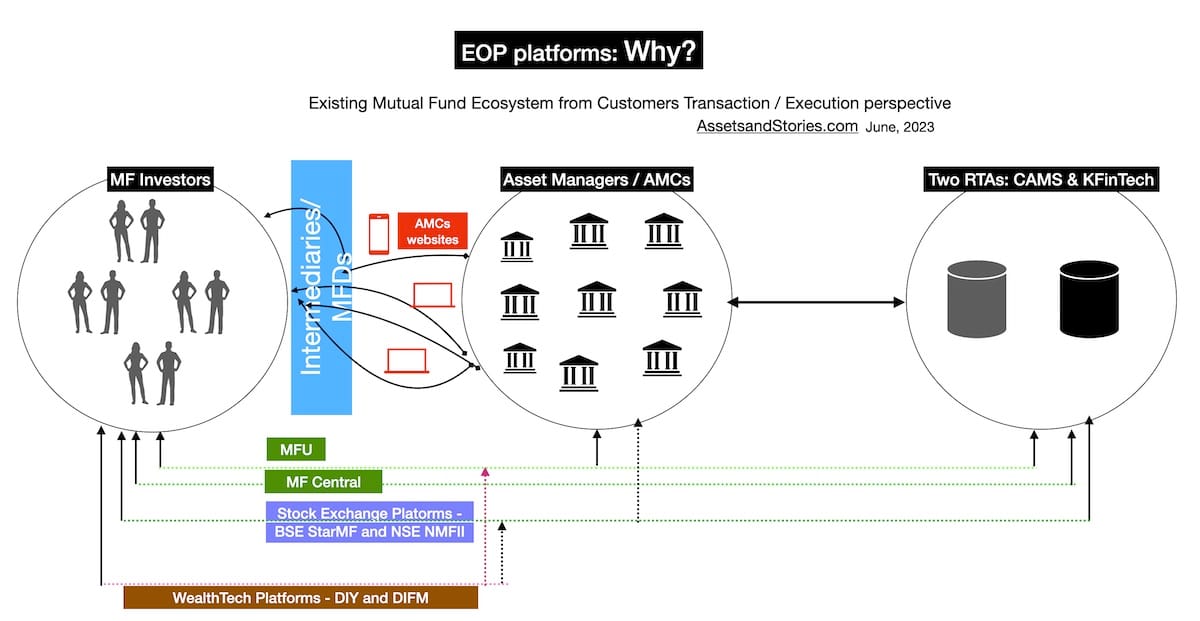

You may have read the debate on Twitter (now X) on why there are just 30 million unique MF investors in India and whether there is room to increase the penetration. The consensus is that 100 million could be the acceptable TAM (Total Addressable Market) for the savings product. For instance, digital gold as a product is gaining traction in Tier II and Tier III cities.

How is the 70 million investing? They may be investing in products that are not regulated or unorganized. The peer group influencers in their villages or small towns may drive the investment decisions of these retail investors.

One of the WealthTech startups mentioned on Entrackr is worth mentioning. This platform allows users to purchase gold in small increments, as low as Rs.1 (0.012 USD). It’s interesting to see their daily volume from users in the rural area has risen from $120 to $18,035.

Disclaimer: This startup may have generated traffic by way of performance marketing.

This example validates that the rural segment is looking out for new investment avenues that are easy to understand and in micro format.

Spare change-saving product:

While few wealth tech platforms have ventured into round-off savings / investing the spare change. I am not suggesting a traditional round-off product akin to Acorn or Deciml. Please note the existing Mutual Fund Schemes will not be suitable for this cohort. Instead, a new variant of Mutual Fund product that is easy to understand and invest in by a user who has just studied high school.

In other words, ONDC + SEBI RIA (Registered Investment Advisor) + TSP ( Technology Service Provider) could build a new platform tailored for the rural market. These new round-off savings or spare change savings products will be on the Buyer app of the ONDC.

4 of 13 buyer applications in the existing ONDC network belong to the Financial Services industry. I am confident that one of the buyer apps belonging to the Financial Services firms will pick up this use case of micro-investments.

Moreover, given the background of three new AMCs getting licenses, one of them – Reliance Jio, has a significant market share in the rural market. This use case may become a reality soon.

A FinTech startup can build a wealth-tech layer using ONDC + AA + RIA + TSP.

I am open to a conversation on these four use cases, and I will gladly share deeper over a Zoom call.