Table of Contents

ToggleContext:

In 2021, one of the large private banks hired me as a wealthtech consultant. I identified gaps in their wealthtech architecture and shared global best practices. The contract ended after a year. I was up against the Big Four consultants; they scored higher than an independent wealthtech consultant. Nevertheless, I got a reference to speak to another large private bank. With this new lead, I have been sharing my thoughts on their existing wealth management practice. However, I realize the large incumbent banks in India act like proverbial ostrichs. Customer user experience isn’t an essential metric to them. I started getting these questions – Is the Wealth Management division profitable to large banks? Why don’t banks give importance to digitizing the critical elements of wealth management? Is this trend across the Globe or only in India? Given this context, I became curious about the answers to the following questions.

Questions:

1) How is the Wealth Management division performing in the large banks in the US?

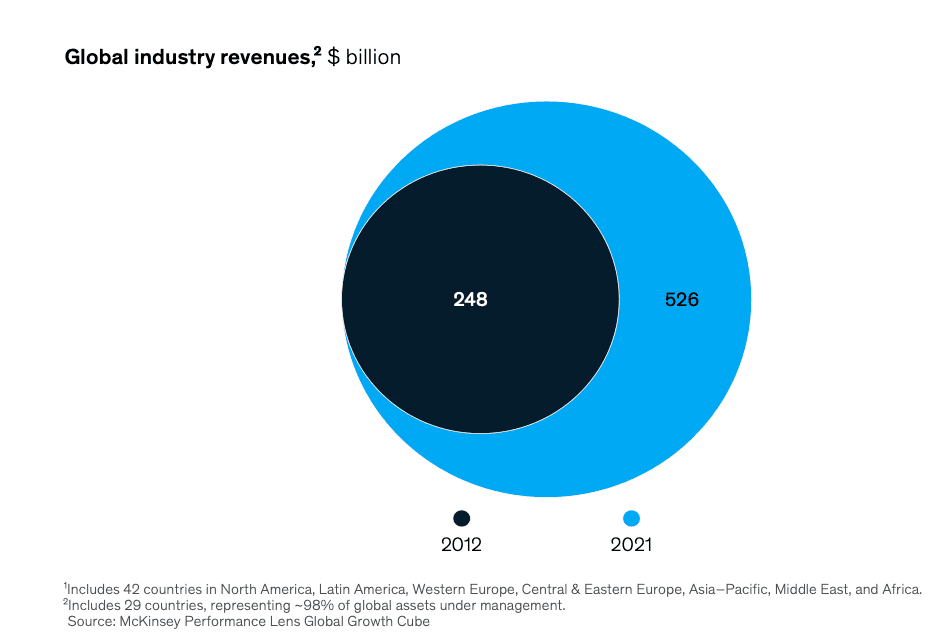

As per McKinsey1, the US wealth management operating revenues grew 6.4% CAGR from $141 billion in 2012 to $246 Billion in 2022. As per BCG2, the Return on Client Business Volume (RoCBV) has dipped from 0.60% in 2020 to 0.58% in 2022. The volume and Return on client business have dropped even in the Asia Pacific region. While writing this post, the results of both JP Morgan Chase and Citibank have beaten the analysts. I double-clicked on the wealth management revenues of Citibank3 – it mentions that the Personal Banking & Wealth Management division has contributed 34% of their total revenue. I was looking for an absolute number of Wealth Management division contribution to the entire revenue pie. The earning call script mentions that the annual growth of wealth management division is up by 2%. In the case of JP Morgan Chase 4, they also included both Asset & Wealth Management and reported their net income of $1.1 billion. I was looking at the contribution of the wealth division independently. I couldn’t find the answer to this question.

2) Is digital innovation relevant to large incumbent banks?

Gartner5 Forecasts Worldwide Banking and Investment Services IT Spending to largest growth with an increase of 13.5% in 2023. I couldn’t find Gartner data on bank spending on wealth tech or upgrading the wealth management division. This data point led to my next question.

3)How many wealthtech startups got funding from the top US banks?

To answer this question, we must rewind to 2014. During this period, banks and asset management companies started having strategic partnerships with WealthTech startups. In 2015, I even switched my career from my traditional role in the Asset Management Industry to FinTech engagement. Since then, I have been tracking this space. I am sharing one of my earlier tweets from year 2017 on the Twitter (now X) platform.

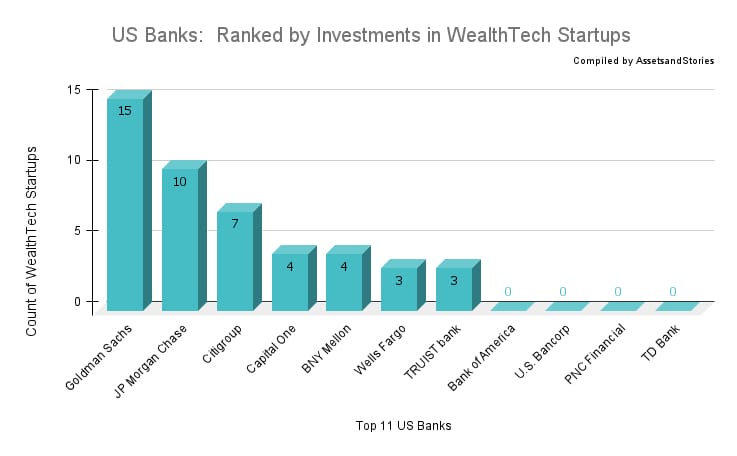

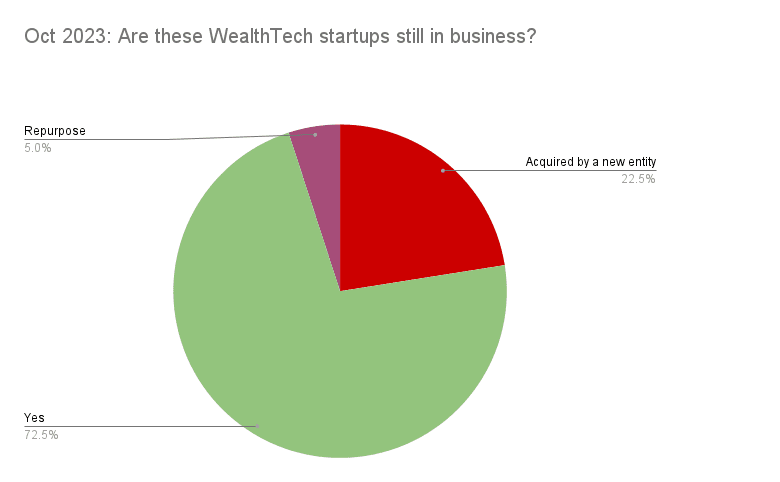

In my independent analysis, from 2015 to August 2023, over 46 wealthtech startups have been funded or acquired by the Top US Banks. Please browse through my caveats and assumptions.

Caveats and Assumptions:

- I am not a registered investment advisor. I am not recommending or discouraging the companies mentioned in this blog. The objective of this blog is for general information purposes only.

- I compiled my analysis from three prominent research / business analytics portals and a few venture arms of these bank websites. Only few banks have published the portfolio on their venture arm portals. Therefore, the data presented in this post may not be 100% accurate.

- The scope of the data points is for the top 11 largest banks in the United States.

- Includes those M&A transactions from 2015 onwards.

- I have filtered those banks’ names where they have a direct equity stake, led the round or acquired the wealthtech startup. In other words, these banks may have indirect exposure to wealth tech startups through the underlying funds.

- A startup may have attracted multiple banks in their cap table / co-invested. This count is not unique.

- These banks may have invested in several stages; few may be at the seed stage, and some may be at series C. I haven’t focussed on what stage the banks have invested in.

- These Top 11 US banks may have invested in the wealthtech startups beyond the US region.

- I have categorized these wealthtech startups, viz., B2B, B2C or B2B2C, based on their products/propositions.

- Having no investments in wealthtech doesn’t mean the banks are not good at digital innovation. The bank may have hired a new internal team for innovation.

Break down of these WealthTech startup investments

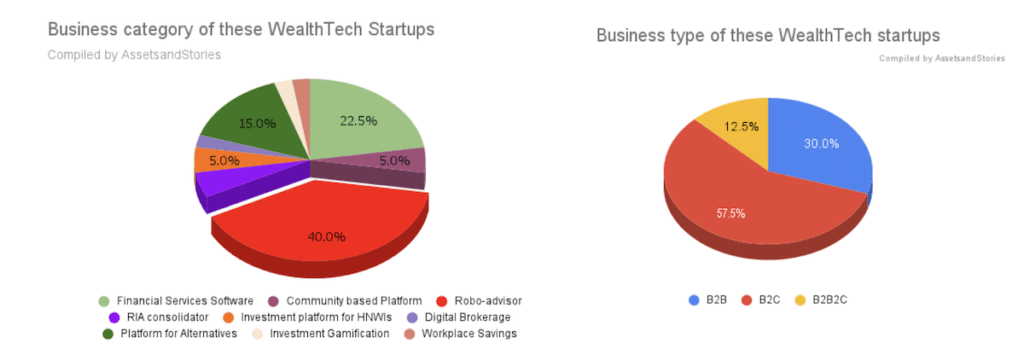

These three graphs are based on the count of wealthtech startups which have got investments or acquired by the Top 11 US Banks.

4) Insights:

Herding:

These banks have followed each other and co-invested in many transactions. Out of the fifty wealthtech startups I analyzed, I saw multiple banks have participated directly in four transactions. Over and above this, there may be venture funds in which these banks may be investing. In turn, these funds may have exposure to other names in these fifty names. Why chase the same startup? This stereotypical behaviour is prevalent in the venture capital industry. The same banks reversed these decisions after a couple of years.

Who are the winners of these Wealthy WealthTech deals?

Indeed, it is a difficult question. It is helpful to browse through one of the prominent transactions.

Honest Dollar

This startup was founded6 in 2014, focusing on retirement solutions for the gig economy and gaining good traction. In 2016, Goldman Sachs acquired7 and renamed it Marcus and focused on retail clients. In 2018, Marcus bought8 Clarity Money, another Robo-advisory platform. In 2023, you may have read that Goldman Sachs has offloaded9 a part of Marcus. What did Goldman Sachs gain from this acquisition? The Founders of both Honest Dollar and Clarity Money are not part of the Marcus team. But the fact is that the Marcus platform exists, the current team will have learned the nuances of the WealthTech product, and the acquired entity will have data points to make the next pivot.

Nutmeg

I will track this story closely as JP Morgan Chase spent10 $972.79 million to buy out this roboadvisor.

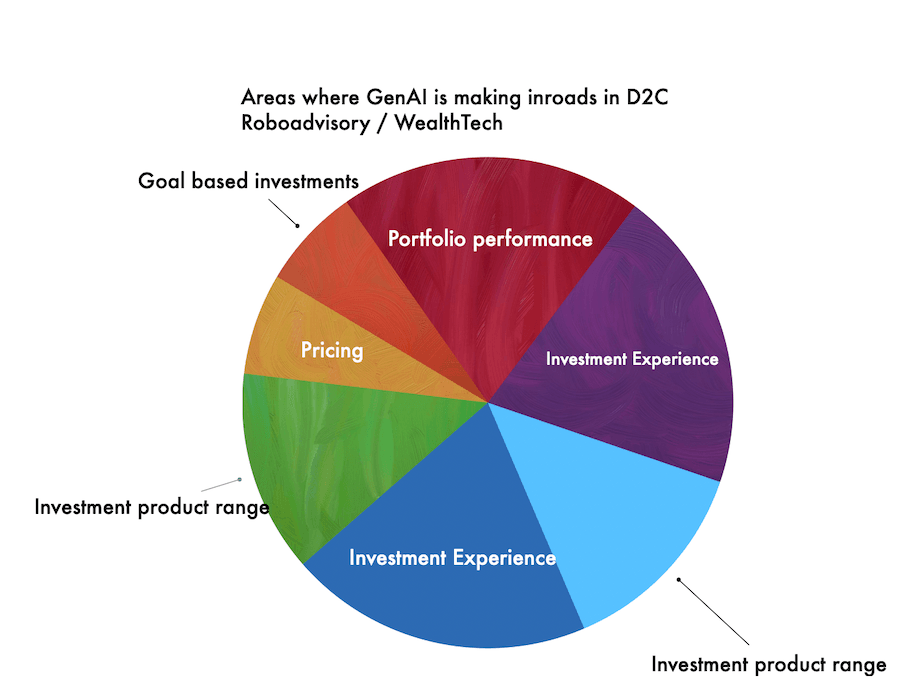

B2C Vs B2B2C:

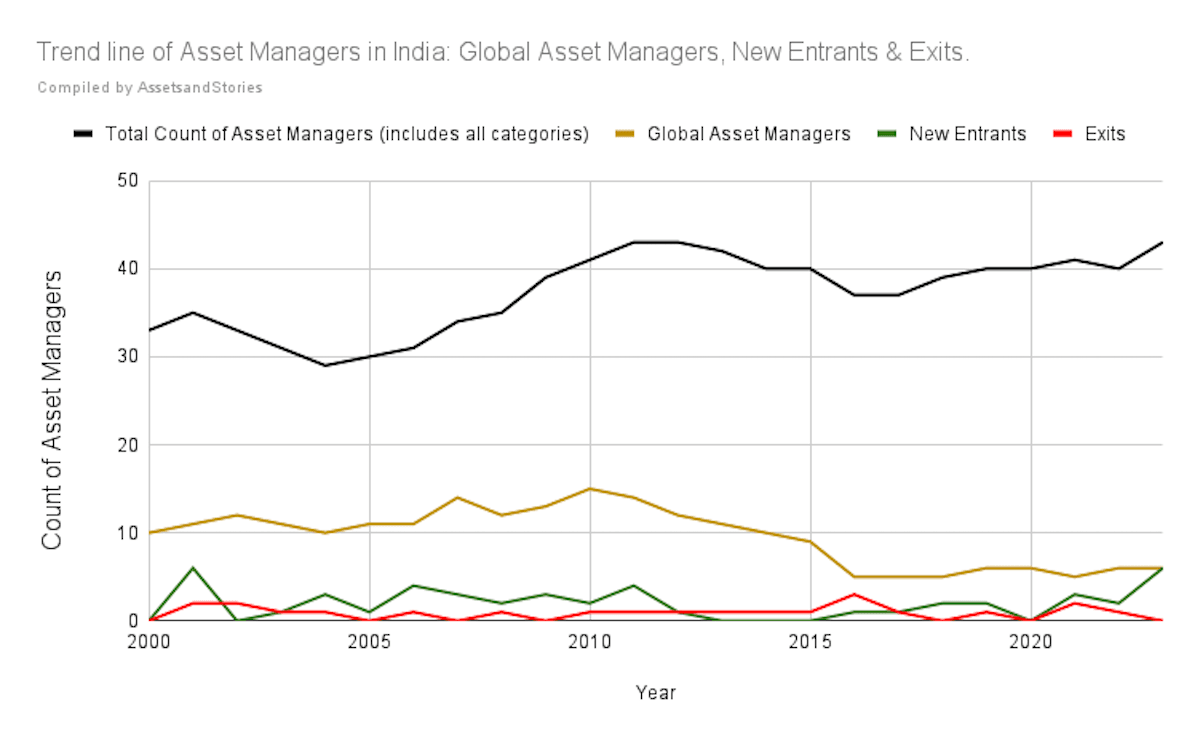

The Asset Management and Wealth Management Industry stakeholders discussed this on social media. Will D2C (direct-to-consumer) work or Hybrid-Advice work? However, during this period, D2C attracted more capital. One notable transaction in the RIA consolidator didn’t pan out as expected.

How’s this trend in 2023? Are these large US banks continuing to invest in wealthtech startups like before?

I browsed through the FinTech 100 startups published by a well-known business analytics platform in October 2023. Out of 100 startups, 12 startups belong to the category of WealthTech. Of these 12, only two startups have attracted these Top 11 US Banks in their cap table. One of these startups is market intelligence, and another is the HNIs platform. This data point demonstrates that these Top 11 US banks may not be reckoning wealthtechs as they may have driven down the learning curve.

I also observed that these twelve wealthtech startups, part of FinTech’s 100 names, had attracted global venture capital funds and renowned asset managers as their investors.

Another way of looking at this data point is that the founders of these twelve wealth-tech may not have preferred onboarding the large banks.

5) What are the key learnings for Banks in India?

How many wealth management functions are still in traditional mode?

Wealth Management has three activities – Front office, middle office and operations. When I analyzed all the activities during my consulting role, I found over 49 activities. My question for large banks is, how many are still in traditional mode?

The large Indian banks haven’t yet invested in digitizing all the elements of the Wealth Management practice. Hence, a few banks are losing market share in the Mutual Fund distribution. A few banks continue to generate fees on their existing legacy assets, which looks good in their quarterly investor presentation.

In Bandhan’s Mutual Fund trend presentation for the financial year ending March 2023, the distribution channel-wise gross/new sales are worth noting. The FinTech / Registered Investment Adviser channel sales grew by over 132%, and the Bank channel grew by 6%. A few argue that the base was the smaller number. Suppose you correlate with the metric of a large bank that recently published its quarterly result. Their third-party retail fee income has dropped by 1% compared with last year’s quarter ending September 2022.

Client Engagement:

If large banks conduct a client satisfaction survey about their wealth management division, you will agree that they may not get a good score. Net Promotion Score (NPS) isn’t critical for large banks. How many banks publish this score in their quarterly investor report?

Banks’ wealth management division largely depends on the branch’s relationship manager. In the recent Bank of Baroda fraud11 case, why did the bank lean so heavily on the bank branch personnel? Why aren’t tech tools built into the app to focus on user acquisition and mitigating compliance risk?

Platform for High Networth Individuals (HNIs)

I see a business opportunity for banks to launch a dedicated HNI wealth management platform. While HNIs prefer hybrid (human+tech) advice, there is a perceptible shift to digital adoption.

If you were to look from an HNI client’s point of view, has the bank given a choice as to how she wants to consume their investment portfolio reports? In other words, do they provide the HNI with a choice of which data point they intend to consume from their investment portfolio? The answer is no. A report in a similar format is emailed to all HNIs / private bank clients. The only difference between HNIs and other client segments is the insight layer. Again, this insight layer (suggestions by the bank product) is standard for all the HNIs.

The intuitive tech layer is missing in the private bank proposition.

It may be due to stringent Investment Advisory regulations, or the Head of these departments may have a view on the WealthTech layer.

Tech Talent

I was asked to look for relevant tech talent for digitising the wealth management division during my consulting role. In turn, my first go-to-market was Bangalore. To my surprise, no tech talent (product role) was interested in considering a large private bank. Why is it that tech talent doesn’t prefer large banks? The resources I spoke with believed that banks are archaic and highly bureaucratic.

Let me quote another data point about the banks’ tech / digital talent crunch. I asked one of my contacts about his experience with banking apps he used for his savings/investments. During my conversation, I learned that consumers get confused with the bank and equity broking mobile apps. About 11 mobile apps are on this bank’s label (one of the large private banks). How will the customer discover the relevant investment mobile app on the app store? This kind of customer experience reveals the quality of staffing in the bank’s digital team.

Switching to tech talent. As you may have observed, the premier tech talent prefers to work for global startups. These startups give them good learning opportunities. Why can’t banks nurture a select cohort of tech internally? Why can’t 5% of their IT/ tech budget be given to this innovation team? For instance, industry data suggest that the new business for the Mutual Fund investments is slowing down. Why not share this problem to solve for this innovation team?

For example, how many banks have explored the new execution-only platform (EOP) opportunity provided by the capital market regulator(SEBI)?

It will likely be none.

In other words, large banks are followers and not leaders.

Conclusion:

Indian banks also have a fair share of learning from the “payment” category Fintech M&A transactions from 2014 to 2018. However, in the WealthTech sector, the large banks need to catch up to the learning curve.

The bright side for all these large banks is that consumers prefer financial relationships with established firms, viz., the large banks they trust. The bank personnel know this and don’t give importance to their digital user experience (UX). In other words, large banks have more power balance vis-a-vis a customer, so UX is optional.

Hence, by design, I have posed more questions in this post and fewer answers.

The question is which bank will upgrade the wealthtech layer to improve the customer experience.

However, I am hopeful one of the large incumbent banks will lead, build, or buy the next version of the wealthtech layer.