Table of Contents

ToggleContext: “GenAI” and not just “AI”

While AI (Artificial Intelligence) is a term commonly used across industries, GenAI (Generative AI) stands out as a specific application of AI in the context of Wealth and Investment Management. Will GenAI become ambient in Wealth Management and Investment Management?

According to McKinsey1, GenAI can be adopted in three forms: a company could be a taker, shaper, or maker. Let me break down these terms for you.

Taker: The firm which uses the off-the-shelf solutions.

Shaper: this firm takes the next step by including a proprietary data source layer in the off-the-shelf solutions.

Maker: Customise GenAI solutions for narrow use cases, which are costly. These are the firms like OpenAI.

What problem do Wealth Management Software/ Platforms solve?

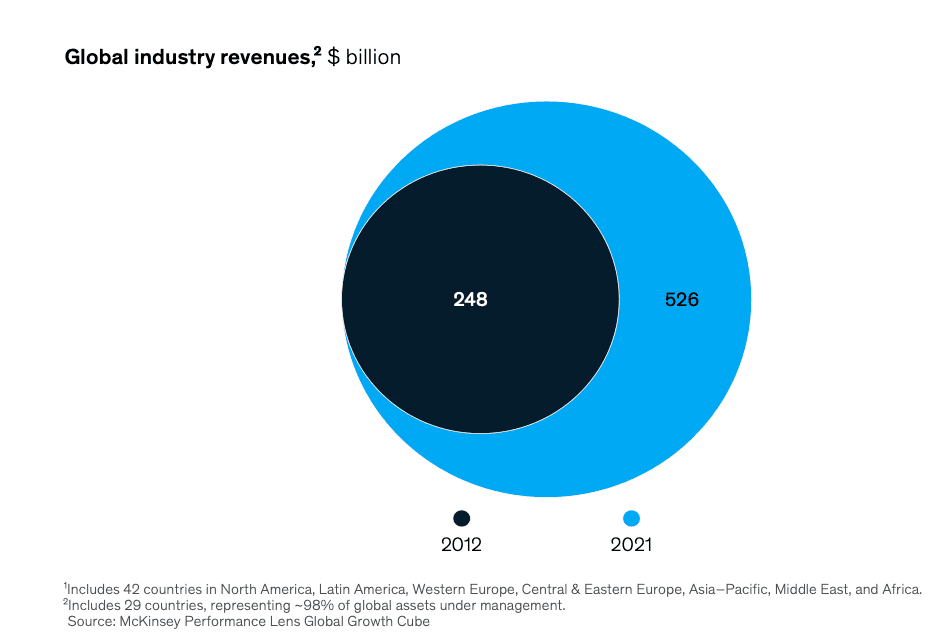

If you are new to Financial Services, what problem do the Wealth Management and Investment Management platforms solve? Wealth Management Platforms are software providers to financial advisors/distributors and banks in assisting them in client acquisition, servicing, and planning for their client portfolio, research, operations and reporting. Asset management platforms or investment platforms help fund managers facilitate the building of their portfolios, analytics, and trading.

Have the wealth management platforms started integrating GenAI tools?

I answered this question by curating a list of prominent global Wealth Management SaaS platform firms beyond the Series A+ stage. I started browsing the websites of these platforms for their product proposition. Have these platforms started promoting GenAI tools?

Existing Wealth Management Platform Product Hooks:

Broadly, these four product hooks are offered to banks, advisers, and distribution platforms. a) Improve client experience, b) research and data insights, c) manage operations and reporting, and d) grow the business. Of 15 prominent SaaS platforms2, thirteen are actively promoting GenAI solutions. Like me, you will be curious to browse the GenAI solutions on these platforms.

After spending a good time on these 15 SaaS platforms, I spent time on Investment Management Platforms. You may be wondering what the difference is between Wealth Management SaaS and Investment Management Tech.

GenAI tools in Wealth management:

If you are a financial advisor, a wealth manager or part of an investment product distribution platform, you will like these two GenAI tools.

Vise Intelligence:

This tool3 is similar to ChatGPT. The firm claims they have leveraged LLMs( large language models) fine-tuned with data to enhance operational efficiency and client portfolio communication for the wealth management domain.

OpsGPT by Broadridge:

This tool is a co-pilot4 for operations, and the team manages operations across the post-trade lifecycle. Why did I like this tool? For the past two decades, I have been interacting with financial advisors and distributors. They spend over 60% of their time on operational tasks. These types of GenAI will help increase their face time with clients.

Sage:

TIFIN’s Sage6 offering intelligence to wealth advisors seems promising. Overall, TIFIN’s positioning and media coverage on GenAI are worth browsing.

What’s familiar with Investment Management and fine dining?

Let me draw an analogy of a fine dining restaurant. The serving staff here represents the financial advisor who understands the meal preferences. In turn, the serving staff communicates the menu to the Chef in the Kitchen. The Chef cooks the food according to the client’s needs. The Chef represents the portfolio manager. Wealth Management tools help the serving staff in a fine-dining restaurant, and Investment Management Tech assists the chefs and cooks in the Kitchen.

Continuing with the same analogy, imagine this restaurant also takes care of healthy food and the customers’ dietary needs. The complexity of the serving staff will increase. The role of the serving staff is to discover and share the right menu and help customers choose the right food. The Chef has to prepare palatable food based on taste and dietary needs.

Just as a financial advisor’s role is akin to serving staff, she must have the tools to manage clients’ preferences. The complexity increases for the portfolio manager. Hence, InvestmenTech has evolved much more than wealth management.

GenAI tools used in the Investment Management Platforms:

Please browse through my disclosures, caveats and assumptions listed below as this is related to Investment Technology.

Existing Investment Management Platform Product Hooks:

Like the wealth management SaaS platforms, I chose the prominent names in the Investment Management Tech platforms and studied their product propositions. Seven5 of the ten platforms have mentioned AI as one of their product hooks. Indexing, Risk Analytics, Data Insights, and Digital Infrastructure are the four existing product hooks used to create and execute the investment products.

S&P AI Benchmarks:

S&P Global and Khenso Technologies have created this tool. This seems to be very helpful and add value to the AI ecosystem. As Mr Bhavesh Dayalji, CEO at Kensho Technologies and Chief AI Officer at S&P Global, put it aptly, this benchmark will encourage innovation across the FinAI community. This benchmark will help compile all AI strategies used. I was able to see 19 submissions in the public-facing leaderboard.

eFront Copilot:

This GenAI tool doesn’t offer investment advice; however, it provides Insight analytics and is a visual layer for the private market.

Axyon AI:

Axyon has listed three tools namely Forecast Drivers, Optimised Indices and model strategies and AI-based ranking.

Alphasense:

This firm is the most well-known in the startup ecosystem as it has $200M in ARR. From investment management, their AI search capabilities, analyzing qualitative and quantitative research, and mining unstructured data are indeed beneficial for portfolio managers

QF.Al:

MerQube and QueensField AI Technologies have come together to launch an AI product. Why am I curious to know more about this? This product specializes in large-cap equities. Since it is applied to the public market and well-known listed entities, we may see the results in the next few years.

What’s the capital market regulator’s view on the GenAI?

A recent article by the U.S. Securities and Exchange Commission (SEC) chair, Mr Gary Gensler, was highly engaging and insightful. In a nutshell, SEC’s comparison of GenAI and AI to these three movies is a telling message to all GenAI tool developers. The FCA of the U.K. has recently announced7 its view on A.I. in financial services; it has set out the principles that will act as the foundation of the upcoming law. ESMA (The European Securities and Markets Authority) is apprehensive about A.I. adoption in the E.U. robo-advisor space. MAS (The Monetary Authority of Singapore) was also an early adopter of AI. However, the US SEC was the first regulator to penalise financial advisors for mis-selling using AI narrative.

The foundation of regulation has been laid, for example, in the principle of explainability of AI models. Once all these regulators develop a formal regulation, the existing GenAI tools may run into issues similar to Google’s. In other words, these LLM models must tread carefully, following the principles laid down by multiple global regulators.

How will GenAI impact financial advisory in India?

The asset management industry has over 40 million mutual fund investors, and there is room to grow to 100 million within the next five years. In April 2024, the industry’s net inflow marked its 38th consecutive month of growth8 due to increased retail interest in the equity markets. If we break down the distribution of the Asset Management Industry, Independent financial advisors, aka mutual fund distributors (MFDs), are the dominant channel and own approximately 40% of the existing equity assets. Direct (DIY), National Distributors and Banks are the other channels.

In my blog, I consistently raise the question of whether the Asset Management industry and the relevant ecosystem service providers have adequately invested in technology to enhance the user experience. The industry’s operations are still troubled by issues, such as the ongoing KYC mess9. This situation clearly indicates that there is a significant gap in the technology infrastructure of Asset Managers and RTAs. It is imperative for them to enhance their technological capabilities to address these challenges and improve the industry’s overall efficiency.

What’s familiar with “fast casual dining” and smallcase platform?

I’m bringing up the analogy I used earlier: Investment Management and fine dining. In the Indian customer context, this will be like a fast-casual restaurant. The fast-casual restaurant category is between fine-dining restaurants and McDonald’s or Domino’s Pizza (QSR). These types of restaurants are highly prevalent in urban India. Customers who visit this restaurant category can sit and dine, stand for lunch, or take away. Unlike the fine-dining restaurant, the menu is standardised but innovative to the local cuisine.

The fast-casual restaurant category is unlike McDonald’s takeaway, which can be compared to robo-advisory. For instance, Smallcase is a compelling platform for investors to choose their preferred investment product. Like their preferred snack, meal or burger, the investors can choose the investment thesis they like. Or they can select the fund from a renowned investment advisor. smallcase provides investors with a wide range of options, allowing them to choose investments that align with their preferences.

If we apply the GenAI layer to this, it can generate hyper-personal narratives and portfolios. Platforms like smallcase will allow financial advisors and manufacturers to simplify their products for investors.

Recently, a leading Indian fintech company unveiled India’s first Large Language Model (LLM) designed for the Banking and Financial Services sector. Most large banks and FinTechs and their existing customers are likely to adopt this technology. Banks and WealthTechs with access to risk capital will adopt GenAI and deploy tools to increase their market share. However, the role of Indian AMCS and SaaS providers in enabling Independent Financial Advisors, also known as Mutual Fund Distributors, to access the GenAI tools remains uncertain. The question is, who will start offering GenAI tools like Sage6 and Muninai10 to MFDs?

In summary, I see the landscapes of Wealth and Investment Management changing because of GenAI. I am happy to converse about this and learn more. Please email [email protected], and I can set up a Zoom call at a mutual convenience.

Disclosures, Caveats and Assumptions

a) I am not a Registered Investment Advisor (RIA) and hence not registered with SEBI, FINRA, FCA or DFSA. I don’t know; therefore, my opinion on the firms’ names shouldn’t be considered a stock recommendation or caution.

b) I consult for a few early-stage wealth tech startups and not for one of the firms mentioned in this post. In other words, this is not a sponsored post.

c) How did I choose these wealth management or investment platforms? My filter is to select these based on popularity, so that this list may be incomplete.

d) I may be biased towards GenAI.

| Reference Number | Web Link |

|---|---|

| 1 | According to McKinsey1, GenAI can be adopted in three forms |

| 2 | 15 prominent Wealth Management SaaS platforms – Addepar, Orion, emoney, Morningstar Office, Envestnet, TIFIN, SS&C, Profile, Investcloud, Vise, Broadridge, Avaloq, Docupace, Onevest, Weinvest |

| 3 | Vise Intelligence |

| 4 | OpsGPT by Broadridge |

| 5 | Prominent names in the Investment Management Tech platforms: eFront, Kensho, Axyon AI, Datarobot, Alphasense, SesamM, Upvest, MerQube, Bloomberg Terminal, |

| 6 | TIFIN’s Sage |

| 7 | UK FCA on AI |

| 8 | Mutual Fund Netinflows |

| 9 | KYC Mess |

| 10 | Muninai |