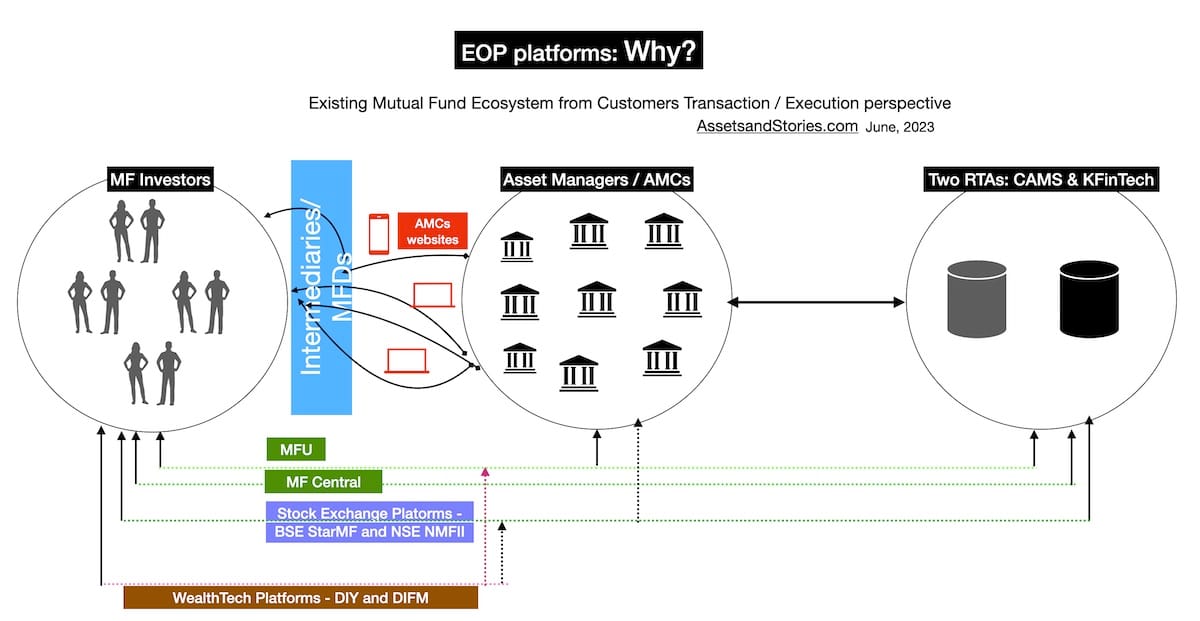

Today for an Indian retail investor, many investment platforms are available online. In 2006, many platforms / administrative tools existed in the U.K. market to aggregate investments. This archive post of the Financial Times post listed the big brands then which were operating these platforms. In early 2008, Fidelity launched their new mutual fund distribution business in India- Fidelity FundsNetwork. The plan was that IFA’s independent financial advisors could manage assets of non-Fidelity funds assets too in this platform. It gained good traction among advisors in the U.K., hence the plan to launch in India. Fidelity Fundsnetwork planned to establish both direct-to-consumers and the IFA platform. Fidelity started to develop the product for Indian consumers in 2008, and in 2009 FundsIndia launched its Mutual Fund platform. I was lucky to be part of the founding team of FundsNetwork in India.

Table of Contents

ToggleFather of Systematic Investment Plan (SIP)

I relocated to the Head Office in Mumbai to onboard the Fundsnetwork founding team. I was lucky to be an early member of the businesses launched by Fidelity – Asset Management and their distribution. Unlike my previous role, FundsNetwork was a tech-platform-driven business. As a result, I could visit London and was part of a couple of IFA seminars organised by the fund platforms. I observed the advisors in the U.K. were adopting tech for solving their back office. I was all ears to hear about tech in the asset management industry. So I began tracking the tech trends. Mr Suraj Kaeley led this new team and encouraged me to start presenting the tech trends to IFAs in Mumbai, Bangalore and Delhi. Many may have yet to learn that Suraj was the first investor in India to invest in Systematic Investment Plan (SIP). He was the one who evangelised SIP among the distributor community in the 1990s. As I write this, The M.F. industry received ₹13,600 crores of monthly SIP contribution. I was fortunate to be part of Suraj’s team.

Anxious times begin for distributors.

In 2009, the ban on entry loads by Mutual Funds was a pivotal decision in the M.F. industry. As a result, distributors became uneasy about their business prospects and revenue. During these times, the new regulation in the U.K. – Retail Distribution Review started hitting the headlines in the advisor market. In India, SEBI banned load/entry costs borne by an investor. In the U.K., regulator FCA introduced a new regulation – RDR (retail distribution review); in other words, the financial advisor should have only one paymaster. (either the fund or fee from an investor).

As we all know, post-September 2008, capital markets worldwide got into turbulence. There were too many headwinds in India – the global market crisis, the domestic stock market dip and the new SEBI regulation. So in April 2009, Fidelity quarantined its new distribution business – Fundsnetwork. Shelving the investment platform business was a setback for me in my career. After that, however, I was back in the Asset Management business to own up the IFA channel.

Fidelity abruptly exits India.

In early 2012, we got shocking news– Fidelity intends to wind up its Asset Management business in India. For my colleagues and me at Fidelity then, it was a heartbreak. Even several industry stakeholders couldn’t believe that this marquee brand had decided to exit. Leading business dailies published several articles about Fidelity’s decision.

Switching to the story of my career – this was my third adversity – first was the .com bust, then Fundsnetwork and now Fidelity’s exit. After a few weeks, I realised that the longevity of corporates was on the decline, and I willingly reached out to senior management to help them in the transition. During these times, I contacted many corporate trainers and worked with them on intervention programs.

Insights

a) Relocating to Mumbai was one of the best decisions in my career. I was able to meet the best brains in the Asset Management industry.

b) I commenced my foray into tech and started sharing new ideas on Tech / Digitals with the distributor.

c) Being part of the transition team helped me understand organisational culture’s significance.

d) I should have documented and posted all my thoughts on the Web. I started a blog. However, I needed to be more consistent.

e) How powerful could it be to have pictures or videos of these seminars conducted from 2008 to 2012? I never clicked pictures during these seminars. i missed capturing these moments.