Table of Contents

ToggleContext

If you work in the financial service sector, you may have already framed an opinion about the Robo-Advisory business proposition. If you are not from the financial service sector, you may want to know how it may add value to your savings or investment accounts. I have been actively tracking this space since 2014. Given the new wave of AI and deep tech, what is the trend in robo-advisory business in 2024?

Changes in consumer behaviour due to the digital age, social media, and new investment products gave birth to Robo-advisors. B2C or D2C Robo-Advisors is a subset of the WealthTech business domain with other verticals, namely B2B, B2B2C and investment-tech. This post is about the trends and insights on consumer-facing / D2C investment platforms. I spent a few months reading about 100 leading robo-advisors globally (please refer to the above image for all these names). I revisited the questions: why, how, what, and for whom are robo-advisors? Is there any trend we can draw upon from different geographies?

How did I choose these 100 robo-advisors?

a) I chose Investment platforms / Robo-advisors that are client-facing. What does this mean? From a retail investor’s perspective, does the platform lure them to read more about their finances or savings? It doesn’t matter if it is an independent platform, an online broker, or a platform of a large bank.

b) Based on users’ popularity, I chose the list of 100 robo-advisors across 26 countries.

c) These platforms could be independent or a subsidiary of a financial services corporation.

d) A few large equity online broking platforms have also launched investment and savings products. Hence, I included these names as well.

History of Robo-Advisors

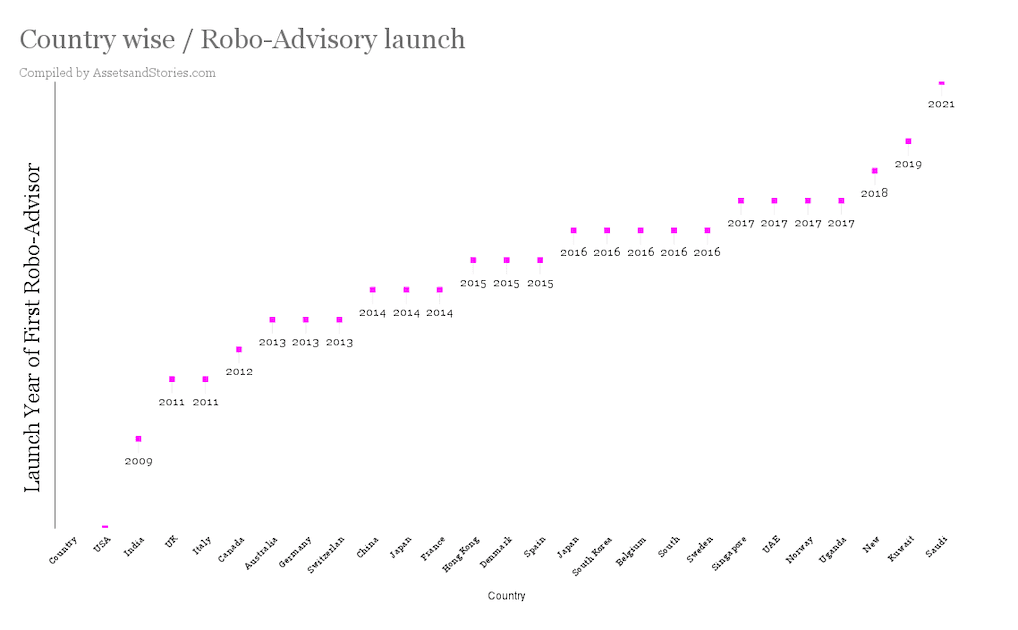

Morningstar states that Financial Engines1 is the first robo-advisor, and the industry journals quote Mint2 as first platform. How did the wave of robo-advisors catch up across the globe? The graph below shows that the robo-advisor wave started in 2013 and went on. Saudi Arabia adopted it in 2021.

Will robo-advisors survive? Would investment-tech platforms turn out to be like “Segway” or “e-bikes”?

To draw parallels, as a product proposition, will Roboadvisor turn out to be similar to Segway ( self-propelled transporters), or will it get adopted akin to e-bikes? As you may have known, in 2001, Segway initially caught the Venture capital’s attention, attracted over $90 million3, and these early investors estimated sales of half a million units within a year, but this self-transport product failed in adoption. On the other hand, electric bikes have seen reasonable adoption.

Referring to robo-advisor traction, How has the client adoption of robo-advisors across the globe been? Can the existing robo-advisor platforms retain current users, or will they lose customers?

When I started digging metrics for client/user adoption, most platforms invariably highlighted the Asset Under management (AUM). Would this metric alone be suitable for assessing the industry segment? Instead, tracking these two metrics is relevant to a) active clients/users and b) the average investment amount of these users. However, getting hold of this metric for all platforms may not be possible. Hence, I looked at how many investors/users/clients are using the leading platforms of the respective countries. Retail investors’ market share helps us understand adoption in these regions. I clarify that these numbers are indicative, and I suggest you browse through my caveats and assumptions. The adoption metrics of these six countries are leading indicators of adoption.

Singapore

Singapore secures the first spot in the crypto adoption index4. Even FinTech and Robo-advisors are well adopted.

USA

Next to Singapore, over 30 million5 investors used Robo-advisors, translating to 22% of investors who have tried robo-advisors. If you were to analyse the assets under management (AUM), Robo-advisors manage over 2.3% of the total retail market AUM6.

UK

During 2015 and 2016, ‘robo-advisers’ was a hot topic in the UK. Large banks were launching digital advice. Boring Money report22 states that Robo-advisers have gained a 20% market share. However, you may have read many robo-advisors shut shop in the UK, and few have iterated the platform and achieved market share.

India

The question to answer is, how many users in India have tested Robo-Advisors? I used SIP (Systematic Investment Plan in mutual fund schemes)as a proxy asi it is a well-known feature in India. I calculated the count of SIP accounts, and the result is that around 12% of TAM (Total addressable market) have used one of the top five popular investment platforms to invest. In other words, a lot to catch up on user adoption.

Australia

Similar to India’s increase in retail participation in Equity markets, Australia has had a similar trend. Its ETF market has increased8 by 230% since 2020. The Robo-Advisor platforms got good traction and attracted these retail investors to their investment platforms.

Denmark

Denmark is one of the countries with a high average wealth per adult and has seen a divergent trend. Only a couple of robo-advisors have got good traction. Retail investors in the Nordic region still need to adopt the investment platforms.

Similar to the reasons for Segway’s failure, where it was banned on sidewalks and roads, Robo-advisors also had multiple challenges. Initially, it was onboarding customers / KYC, and then it was “Investment Advisor” regulation. For example, in India, the EOP regulation has yet to be adopted widely. Robo-advisors are like e-bikes; we have seen adoption in a few geographies and may need more product iterations to achieve more significant growth and acceptance.

Who is the audience of robo-advisors platforms?

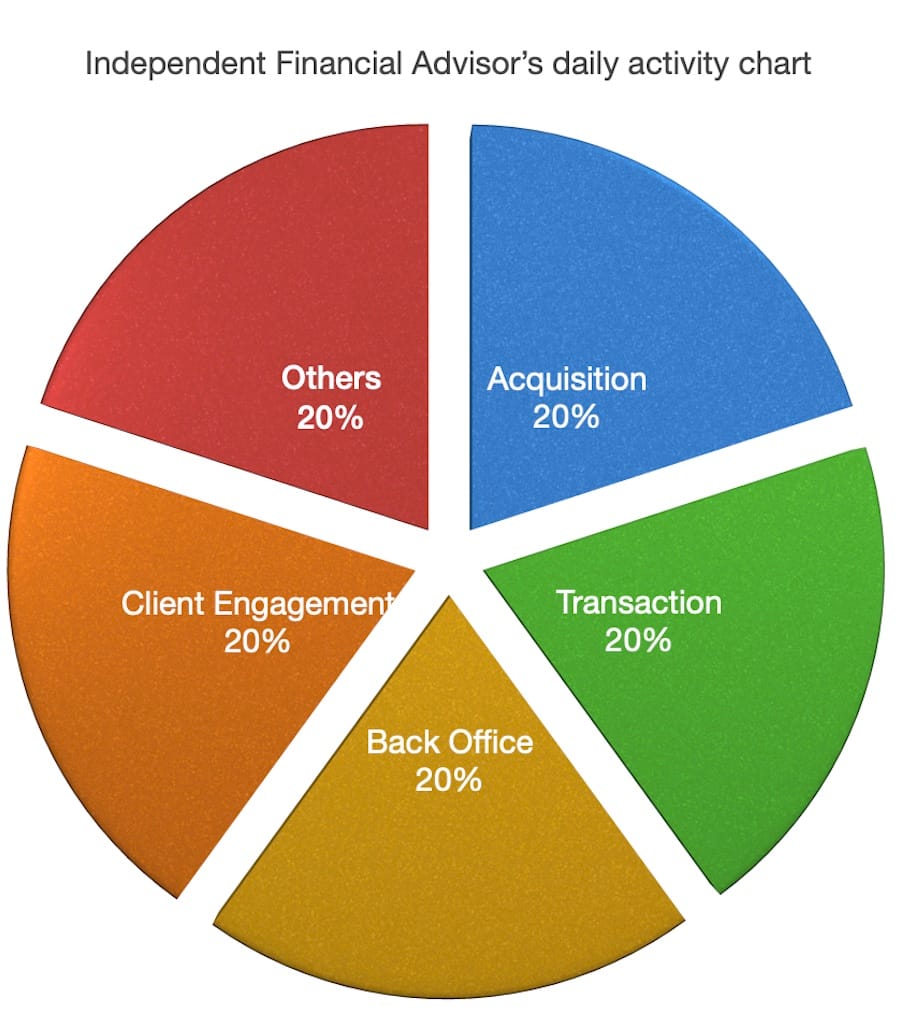

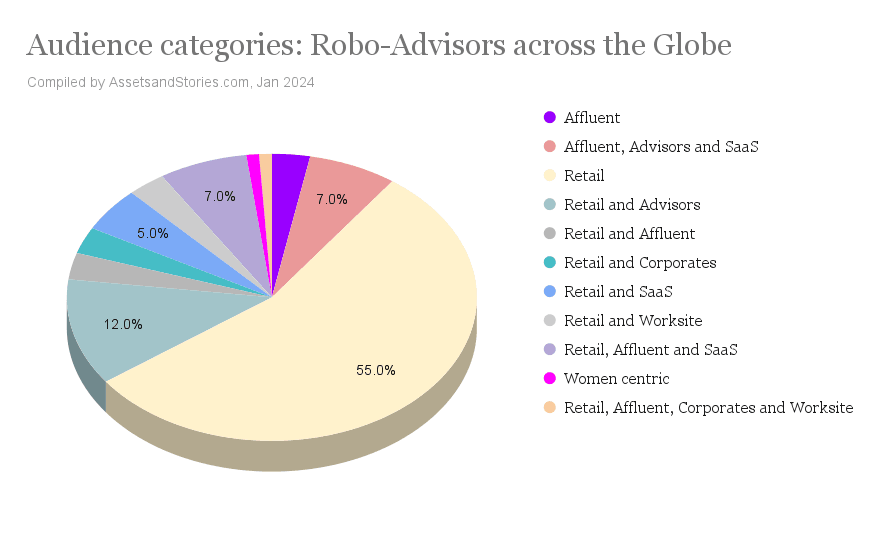

Most of the robo-advisors are targeting retail investors. However, countries with greater adoption have launched platforms targeting high-networth individuals (HNIs) / affluent and offering private market products. Few robo-advisors have begun offering SaaS (Software as a Service) to Institutional clients, which is a logical progression. You may have seen the trend many D2C robo-advisors have re-purposed and switched their business model to B2B.

As the hybrid model ( digital and advisor) is catching up, many platforms are attempting to cater to different types of client cohorts. Platforms will start targeting new cohorts. For instance, “Impact Investing” in the EU region and India focussing on new customer cohorts21 like India 2.1

What are the different product hooks in robo-advisors platforms?

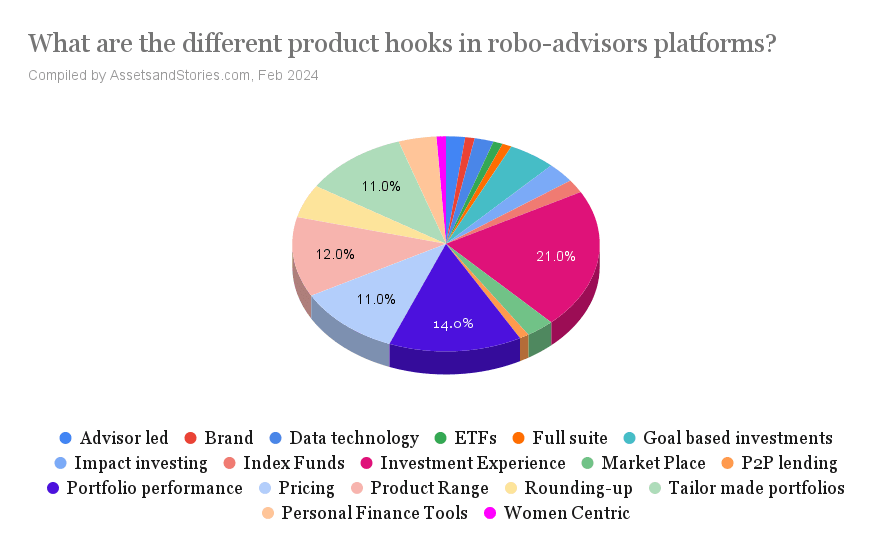

What’s the script used by the robo-advisors to onboard their customers?

The four top product hooks are investment experience, portfolio performance, product range, and pricing. Investment experience means how the investors onboard the platform and experience their investment journey. Unlike an e-commerce portal, the customer/ retail investor may not get instant gratification as investment is subject to market conditions. So, both investment experience and portfolio performance have dynamic ETAs (estimated arrival time). However, I wonder if all retail investors understand the complexity of their investment journeys.

Another critical insight after spending months analysing robo-advisors is that platforms seem to be using “equity trading” as a hook. For illustration, let’s compare Investment-Tech platforms to “restaurants”. Some restaurants serve full-course meal menus, and most focus on their speciality dishes. However, imagine if “desserts” are served first instead of “starters”. Desserts are quick, sweet treats.

Similarly, out of the leading 100 robo-advisors, around 11 offer the full array of all investment solutions. However, most robo-advisor platforms use equity trading as a primary hook to gain traffic. In other words, this offering will take care of retail customers’ “greed”.

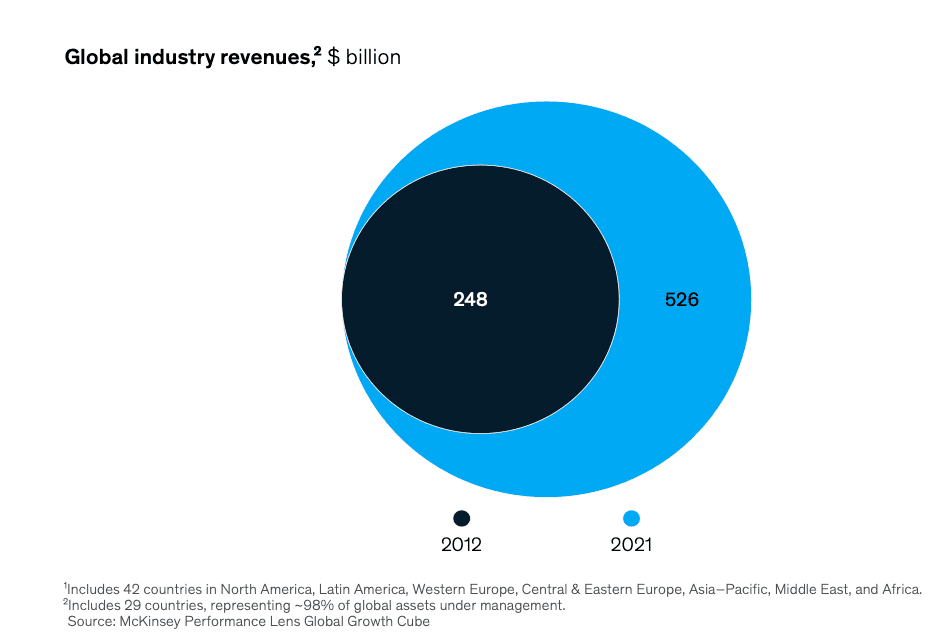

What is the revenue of leading robo-advisors?

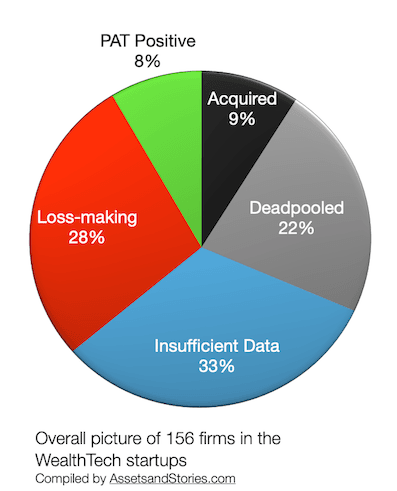

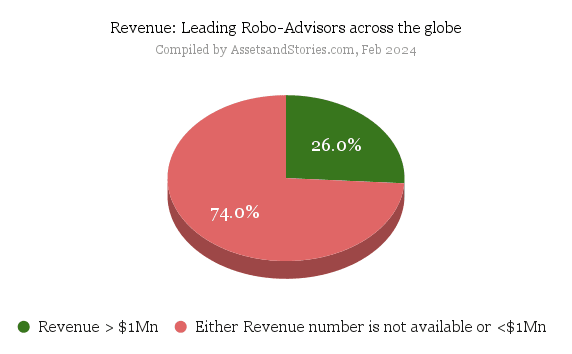

In venture capital terminology, if the startup reaches $1mn ARR (Annual recurring revenue), then the startup’s product has achieved PMF (Product Market Fit) if we apply this filter and look at the results of 100 leading robo-advisors. around 26% of robo-advisors have revenue greater than $1Mn. However, I couldn’t fetch ARR data for these 26 and revenue numbers for the remaining 74 robo-advisors.

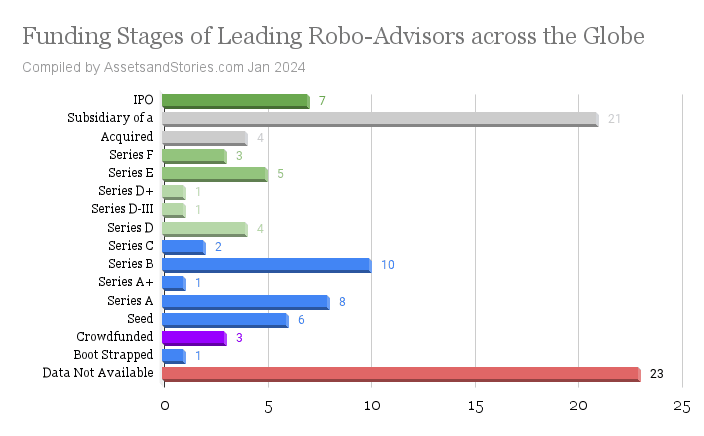

Funding stages

Tracking the funding stage of businesses is also a relevant metric to assess the company’s PMF (Product Market Fit). The startups that have crossed beyond Series C are considered to have crossed the break-through stage. Around 20% of leading Robo-advisors are in Series D to F and IPO stages.

Insight: 26% of robo-advisors have crossed $1mn ARR, 20% have traversed beyond Series D, and there is an overlap of 11% among these two sets. My take: 30% of robo-advisors in my cohort have achieved PMF. Would the other 70% graduate from MVP (minimum viable proposition) to PMF? How many more iterations may be required to get to PMF, and would these firms have enough runway capital to survive?

It has been over a decade since robo-advisors became mainstream, and the venture capital industry has invested millions of dollars in this category. In the next few quarters, I will write a post on the different venture funds that have invested in robo-advisors.

Who are the outliers?

Ellevest, US

Ellevest is a woman-first9 financial company founded in 2014. In 2024, they will have over 3 million users and a leading financial service like Morningstar has invested in this startup. Startups like Ellevest inspire the women’s community as the need is alarming. It’s good to see startups like Femaleinvest10 in Denmark and Basis11 in India.

Avanza, Sweden

Avanza, was founded in 1999 to democratise stock trading for individual investors. It is listed on the Stockholm Stock Exchange, and it has over 1.9 million customers and claims to have a 35% market share in 2023. It has approximately over 6.96 Billion USD of Net fund inflows. A vital metric is that this firm is profitable12.

Moneybox, UK

Moneybox has achieved profitability13 with one million customers and an AUA of £ 5 billion. Moneybox launched its round-up proposition, and evolving as a solution provider for home-buying and retirement is commendable. Given the economic environment in the UK and the crowded market in the robo-advisor space, achieving this milestone in 8 years is worth noting.

The most anticipated Robo-Advisors in 2024

Pluto.markets, Denmark

This robo-advisory funded by six unicorn founders will launch in July 2024, focussing on Nordics and Germany. In the past, I track US and UK robo-advisors and now i get to follow a new robo-advisor.

Aaritya, India

I have interacted with many pre-seed and seed-stage wealth tech founders in India. Raising capital has been very hard in the last three years. However, when I read the funding news about Aaritya15, it was amazing to see that large VCs have invested in an idea-stage startup. In other words, the founders could raise capital in the idea stage. The platform may be very novel.

BlackRock and Reliance Jio, India

You may have read about the strategic JV announcement of these two firms. BlackRock failed in the D2C robo-advisor business; however, their enterprise platform Aladdin is used by over 130k B2B users16. Can BlackRock launch a platform to offer a proposition to 470 million17 Jio users?

Whats the way forward for robo-advisors?

Artificial intelligence (AI)

When businesses in kitchens and tiles can include Artificial Intelligence (AI), there is no surprise for robo-advisory platforms. When analysing the 100 leading robo-advisors globally, I was looking for platforms that mentioned AI in their product proposition. Around 5% of Robo-advisors have mentioned using AI to suggest portfolios to their customers. I found doomoolmori18 positioning intriguing. This South Korean platform claims it is the future of finance using AI and data technology. Even BlackRock plans to roll out products using GenAI. You may observe that. Robo-advisors will start including AI extensively in their platform positioning.

Affluent Category

Apart from Singapore, I could only discover a few platforms centred around accredited investors / High net worth individuals. As private market products are gaining demand, this is an emerging category of platforms. A Digital Family office platform developed by Ex-Googlers Mr Caesar Sengupta19 and his team is worth mentioning. This platform has already launched; a few more platforms may emulate this model.

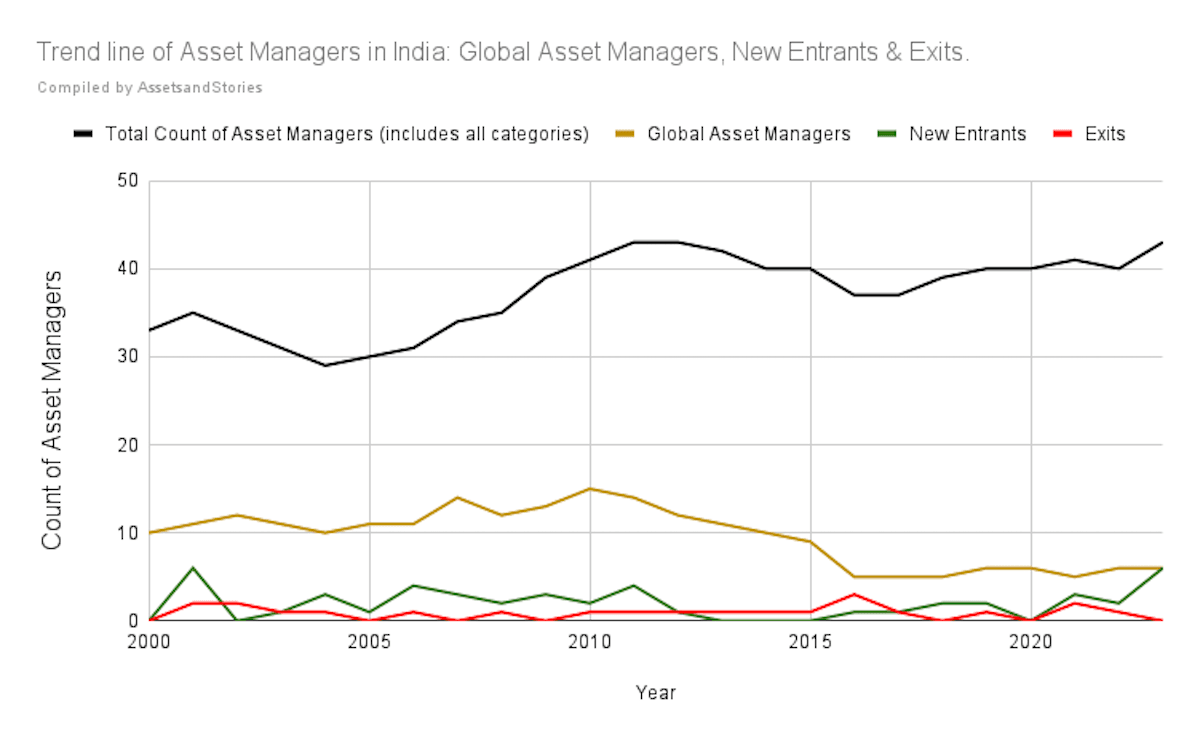

Traditional Wealth Management Vs. InvestmentTech

a) Will the traditional wealth managers continue to hold their existing assets and gain “wallet share” from their existing customers?

b) Will investment tech platforms gain new market share?

These following four variables will decide the way forward: 1) market sentiment, 2) regulation, 3) innovative investment products, and 4) adoption of deep-tech / AI in WealthTech.

A recent post by Mr Anders Hartmann20, The CEO & Founder at Norm Invest A/S, Denmark, could be quoted to summarise the trend.

It seems that there is also a structural change going on. A change where customers are looking away from old-fashioned expensive investment solutions that rarely beat market returns – towards modern digital investment solutions where the customer is in focus.

Reference web links

Disclosures, Caveats and Assumptions

- I am not a Registered Investment Advisor (RIA) and hence not registered with SEBI, FINRA, FCA or DFSA.dk; therefore, my opinion on the firms’ names shouldn’t be considered a stock recommendation or a caution.

- I consult for a few early-stage wealth tech startups and not for one of the firms mentioned in this post. In other words, this is not a sponsored post.

- How did I choose these 100 robo-advisors? My filter to select these 100, is based on the popularity. Hence, this list is incomplete.

- I compiled the Robo-advisor data points from multiple portals / secondary sources; hence, the data points may not be 100% accurate.

- I may have missed out on mentioning a few names of robo-advisors and countries inadvertently.