Fortunately for me, the tailwind of Fintech had just begun in 2014. So I was lucky to get a phone call from Mr Karan Datta, the then Chief Business Officer of Axis Mutual Fund. Karan had references from a few IFAs stating that I was enthusiastic about tech and discussed an opportunity to work on an IFA / Advisor platform. In 2015, Axis AMC completed six years and was already ranked 11th in total managed assets. Axis AMC was then known to be one of the innovative firms. So I willingly signed up to join Axis Asset Management. Thus began my career in the FinTech world.

Table of Contents

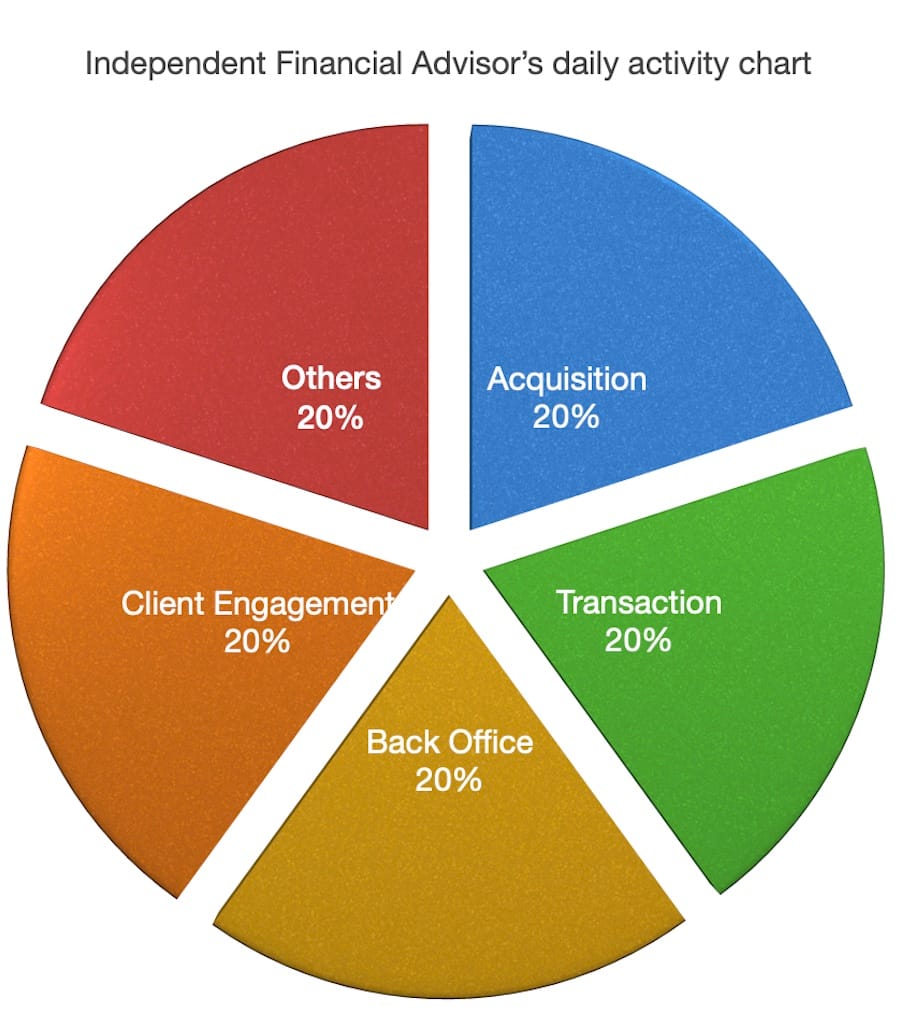

ToggleA day in the life of an independent financial advisor (IFA)

If one were to scan a typical day of an IFA in India, she or her team would spend over 60% of their time managing their back office. In other words, they need more face time with their clients. Why is this in-efficiency?

When IFAs meet clients, one has to compile data from all eight or nine of AMC’s back offices and compile a report. A cumbersome task indeed. At the same time, back office software existed that could solve these friction points, however, with multiple hops and iterations.

Axis Asset Management launched an innovative platform for IFAs labelled as Shubhchintak – “A well-wisher”. This platform allowed the option to upload investment records of all the AMCs in a single platform and help IFAs compile financial wellness reports.

During this time, ICICI Prudential’s IFA app was well known, and DSP also launched their IFA portal version.

Why was the Axis Asset Management IFA platform unique? This new platform allowed the users / IFAs to choose the schemes from the entire universe / including competing Mutual Fund schemes. In other words, it was the first of its kind – an open architecture platform. In Aug 2015, a similar initiative took place in the United States between BlackRock and FutureAdvisor.

In April 2015, Karan Datta asked me to lead this platform. This B2B2C platform already had 400 paid IFAs users. I spent a couple of quarters working on improving this platform. As a result, I was able to ramp up the users from 400 to 5000 IFAs by June 2017.

The FinTech wave begins in India.

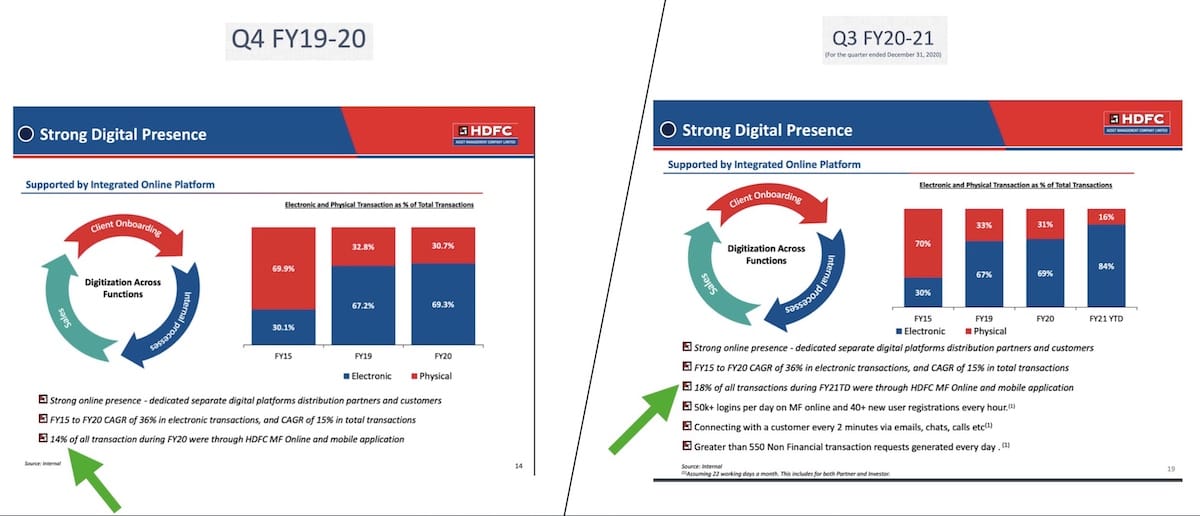

From 2015 to 2017, I met over 60 FinTechs and a few focussed on WealthTech products. Additionally, I worked closely with over 20 startups in helping with Business Development and tech integrations. The third-party tech service provider of the Shubhchintak / tech platform, FIINFRA, sold its business to Anandrathi. Karan and I couldn’t convince Axis to take a stake in this platform. I saw the opportunity for AMCs to increase their digital engagement. I met several CEOs and presented my ideas for strategic partnerships with wealth tech.

IFAXpress Platform

While Axis AMC looked at an open-architecture platform, DSP Blackrock developed a superior UX platform for IFAs. Santosh Navlani (now COO of ET Money) was the product lead of this platform. Undoubtedly, he was the only person in the Indian AMC industry who understood the difference between product and software. As a result, his product got good traction. I am making this statement not because Santosh is known to me. If one asks IFAs to name an AMC B2B portal that consistently delivers a smooth experience, it will be DSP. I would give this credit to Santosh as he was the one who designed the blueprint of the platform. In comparison, why couldn’t IPrutouch maintain the brand salience which it had in 2015?

Who onboarded Santosh to the AMC industry? It was Ajit Menon, Head – of Sales & Marketing at DSP (now CEO of PGIM)

PGIM

Ajit Menon was known for innovating new investment products. He joined DHFL Pramerica (now PGIM) in late 2017 and was building a new team to scale this firm. Since Ajit had a high conviction in the IFA platform, I joined his team in June 2018. Within a few months, we got hit by an avalanche – the DHFL Credit crisis. I spent a few months battling and managing the situation. Finally, I convinced Ajit that I would move out of the corporate world and venture into the startup ecosystem. While writing this in Jan 2023, I greatly respect Ajit Menon. In 2018, DHFL Pramerica ( now PGIM) lost over 80% of its assets due to the credit crisis. Ajit steered the team during this rough weather; in 2022, PGIM was one of the fastest-growing AMCs. Ajit’s leadership style has helped PGIM to turn around in India.

Insights:

- Despite onboarding 5000 IFAs on this platform, Why couldn’t the Axis group take a strategic stake in this platform?

- If we dig deeper into the corporate structure of this platform, there were learnings for me and very helpful for early-stage startups.

- During this time, I met over 60 FinTech / Wealth-Tech startups. The new SEBI Investment Advisor regulation lured many startups to launch Robo-advisory platforms. However, they should have discussed the revenue model. While I am writing this Jan 2023, in hindsight, it’s a good decision I didn’t join the 2015 wave of the fintech startup wave.

- Relevant Links – a) Cafemutual b) WSJ

- In the startup lingo – Axis AMC dived into this disruptive idea, and within two years, the arrangement and the idea ran into a problem. It had partnered with a startup / third-party firm to build this B2B2C platform. This service provider was keen to raise capital as the growth was visible. As a result, Anandrathi, a leading equity broking firm in India, acquired this business. After Anandrathi onboarded the cap table of this startup – FIINFRA, Axis Asset Management ended its strategic partnership with FIINFRA. I will be writing a separate blog about the learnings of this IFA / wealth tech platform. Axis AMC had all the winning variables – conceived, developed, and distributed the new idea. However, the structure of the strategic partnership could have been better.