Table of Contents

ToggleContext:

One of my family members sponsored my work visa early this year, and I migrated to Denmark. I continue working remotely with early-stage startups and advise WealthTechs in India. This blog post aims to share my learnings and draw parallels with the Indian startup ecosystem. I am grateful to both India and Denmark for this learning opportunity.

Caveat:

I am new to the Nordic startup ecosystem, and these are my first impressions of the local market. My blog objective is not to compare India and Denmark but to share my experiences in the startup ecosystem. Please browse through this story through the lenses of curiosity and learning. Examples used in this post shouldn’t be considered a stock recommendation or a caution. This blog post is not a sponsored one.

Chronology:

I started my career in 1996 in India and got baptised in the dot com bubble. Since then, I have been interested in the startup ecosystem; however, due to family circumstances, I chose to work in the corporate world. Since 2015, I have been actively engaging with the FinTech ecosystem. I was lucky to have lived in Powai (a residential suburb of Mumbai) and Bangalore. Both these locations are active startup hubspots in India. Since 2015, I have been tracking and sharing UK and USA WealthTech trends.

TechBBQ 2023

I attended my maiden startup event in Copenhagen, Denmark. TechBBQ is equivalent to TechSparks in India. Though there are many platforms in India, in 2015, Ms Shradha Sharma’s forum was the most sought-after. Similarly, TECHBBQ is a benchmark; I was surprised to see the conference crowd; the participant count was around 7500. Given the gloomy economic environment and funding winter, getting a footfall of this scale in Denmark is highly encouraging.

Technology adoption at the conference:

Similar to Indian startup events, there was a lot of buzz among the startup community about the TECHBBQ event. However, the quality of design, infra and adoption of tech were far superior.

Matchmaking feature:

During my Asset Management experience, I actively conducted conferences and onboarded event mobile apps to increase participation engagement. However, in TECHBBQ, Denmark, the “matchmaking” feature was intuitive. This also facilitates the participants to meet those in a similar domain and look out for specific requirements. For example, I mentioned in the TechBBQ event app that I have experience launching a USA-based FinTech B2B SaaS product in India and have experience in WealthTech. I was surprised to meet few relevant Founders, which I will share in the following paragraphs. A great networking tool indeed. The below image is the place where, in the event, participants can meet their matchmaking participant.

Acoustics:

Audio engineering is almost ignored in conferences in India as we are used to the loud atmosphere. However, at TECHBBQ, most of the stages had headphones. Even though there were over 7000 participants, the venue was calm. A silent conference, listening to content over headphones, gives a better engagement than thunderous speakers.

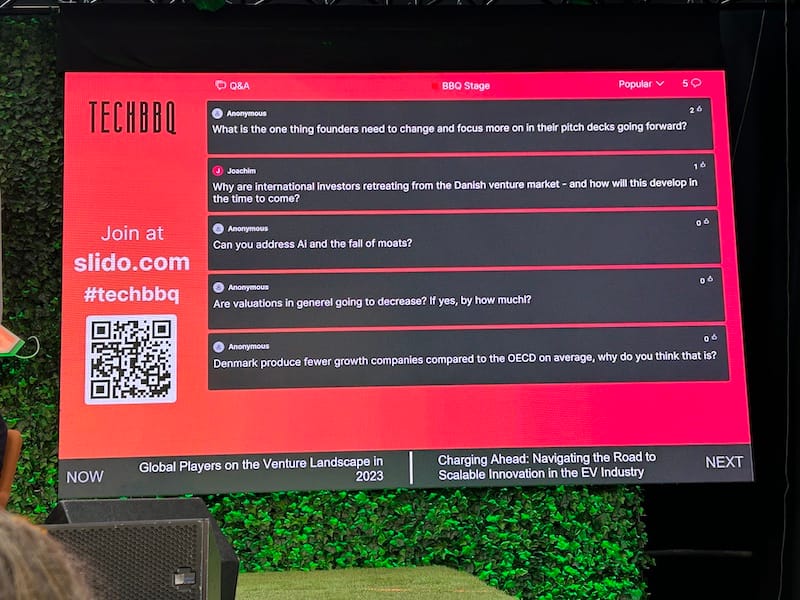

Questions from Audience:

Unlike India, the event flow was punctual, the panel discussions were over 30 minutes, and the last five minutes were for questions and answers. Instead of passing around microphones among the participants, Using engagement tools like Slido and posting questions is highly engaging and effective.

Parallel Tracks:

While the matchmaking feature solves networking and has diverse speakers, it facilitates learning. Having multiple stages or channels allows you to choose the domain you prefer. In the last few years, I have seen some large startup events in India, like TechSparks, have three tracks/stages. However, in the TECHBBQ, Copenhagen, there were eight stages. Multiple tracks allow the participant to switch and choose the relevant cohort. For instance, I chose only two subjects – Venture capital and FinTech.

TechBBQ 2023 Content:

Having discussed tech adoption in the event, let us switch to the learning and content.

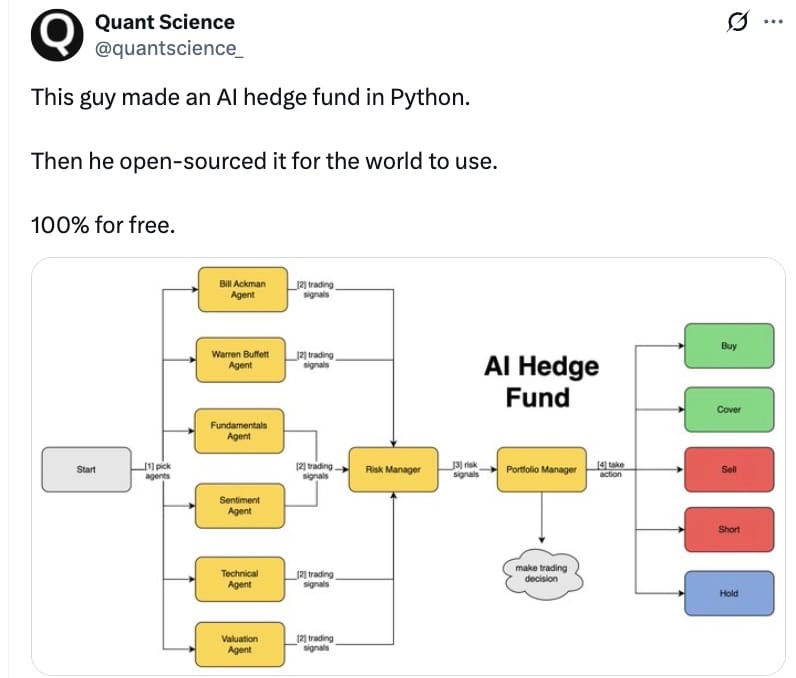

Data breadcrumbs

For the last three years, I have worked with over twenty early-stage startups, and one of the challenges early-stage founders face is fundraising. Reaching out to relevant investors who align with their growth and business plan is arduous. How should early-stage founders get the attention of the suitable VCs and angels? Creandum’s General Partner, Mr Johan Brenner, inputs were insightful. Unlike in the past, VCs now look at the Founder’s “data footprint” and “data breadcrumbs” to decide. There needs to be more than just networking for early-stage Founders. How many early-stage Founders or second-time Founders keep track of their digital footprint?

WealthTech

While FinTech was mentioned multiple times in many forums, I didn’t hear speakers or participants saying “WealthTech”. It may be due to bad experiences and gloomy economic conditions, as one of the speakers about the experience of the Robinhood Investment app. However, all speakers on the panel at “Democratization of Finance” agreed that educating consumers about personal finance is vital. This learning gap is indeed a business opportunity for founders passionate about personal finance / WealthTech; however, for B2C WealthTech startups, the complex puzzle is the GTM (Go To Market) strategy.

Blending two verticals: SaaS in the front and FinTech in the back:

I found this conversation engaging about how startups from different domains can leverage FinTech opportunities. On this panel were two startup founders:

a) Ms.Charlotta Tonsgard, CEO and Founder of a Healthtech startup

b) Mr. Jonatan Rasmussen, CEO and Founder of All Gravy. A platform that empowers “shift workers” with training and communication.

c) Mr Oliver Sjöstedt, Principal of Upfin VC, encouraged the panellists to consider their startups as FinTechs.

Ms. Charlotta Tonsgard articulated well that although surgeons/doctors have enough wealth, they need assistance to plan their holiday as they need a track of their earnings. The use case she mentioned is relevant: Should these Doctors take a two-month or one-month summer break? Do they have a dashboard to visualise their cash flow if they have a three-month break? This use-case is a good use case for B2B SaaS FinTechs / WealthTechs. For example, as we all know, a payment gateway is used in all B2C applications as a module or plugin. Similarly, why can’t health tech startups include a travel budget planning module for Surgeons? If we look at the use case for “shift workers”, do they have access to all the relevant tools to save and improve their finances? Compared to Europe and India, India’s DPG / DPI (Digital Public Goods / Digital Public Infrastructure) are very beneficial infrastructure to make FinTech modular and embedded in all businesses.

Global Players in the Venture Landscape :

Since I was looking for an outlook on the Venture Capital industry, I loved the panel discussion where the world’s largest VCs were present: Sequoia Capital, Obvious Ventures, Lightspeed, Angular Ventures and Bessemer Ventures. The panellist was Ms. Soulaima Gourami, the CEO and co-founder of Happioh. The big takeaway is that the VC framework has significantly changed, and analysts and partners in the VC’s office will hunt for signals contradicting the Founder’s story. In other words, Mr Vishal Vasishth, Co-Founder of Obvious Ventures, said that not everyone is an entrepreneur. Free cash flow is the most sought-after metric. Recovery of the funding environment may begin in 2024. I liked the panel as all the panellists were in candour mode.

Stereotypes in the Venture Capital ecosystem:

My earlier blog mentioned that 55% of WealthTech Founders in India are from IIMs, IITs (Tier 1 colleges) or Ivy College. In other words, startup founders not part of these institutes have only a 50% probability of securing funding. Listening to Ms Camilla Falkenberg’s fundraising experience helps us understand that VCs operate on bias. She is the Co-Founder of Female Invest. A financial education and community platform dedicated to empowering women to achieve financial success. Bias is pervasive in the VC ecosystem. According to reports published on VCs, women-led startups receive less than 3% of all VC investments. Ms Camilla shared her tough conversations with a few VCs and how she relentlessly made it. An inspiration for women early-stage startups.

At the TechBBQ 2023 conference, every panel discussion had a female representation. While writing this, I realised that, by design, the program focused on diversity in the male-dominated world.

Anti-Portfolio:

Continuing with the VC stereotypes, the panel moderated by Ms. Madeline Lawrence was intriguing. Humanising Venture Capital: Investors Spill the Tea

She posed many intriguing questions, and her “anti-portfolio” question is worth noting for all stakeholders in the VC ecosystem. Ms. Justina Chung, Bessemer Ventures, narrated how they missed out on investing in Snapchat. It’s great to see Bessemer having a dedicated page for their “anti-portfolio”.

In the past three years, I have spent time on over 250 Venture capital websites. Hardly, I remember one or two VC websites listing missing opportunities / anti-portfolio. Isn’t this an apt example to explain the theory of confirmation bias? In other words, VCs adore the stories or data points of portfolio companies they believe.

What are the most mentioned in the TechBBQ 2023?

Lifescience, Human Health, AI, DeepTech, Ideas that can make the world better, Climate Health, and FinTech.

On a final note:

What did I miss seeing? Angel Investment platforms. For instance, platforms like SeedInvest and AngleList are famous in the USA market. In India, Letsventure is a popular one. I found multiple large startup accelerators. However, I couldn’t get attention from the Angel platforms. Do HNIs directly participate in the private market through VC Funds? I will learn more as I meet and learn more in the Nordic ecosystem.

I always thought India was one of the most sought-after decisions for tech, but startup founders in the Nordic region prefer Poland or Ukraine. In contrast, the Nordic region’s large publicly traded companies have Global Capability Centres (GCC) in India, and the startup ecosystem doesn’t consider India a tech partner. I also observed a large local tech talent pool available for the startup ecosystem. Maybe the supply of local tech talent in the Nordic region and nearby countries matches the demand of the startup ecosystem.

During the panel discussion, Who, What, Where? State of the European Ecosystem. There was a question from one of the audience. Why should startups from the Nordic region consider the USA market for scale, and why not the East? This question is one of the most pertinent questions for this panel.

The panellists had a rich experience. Mr. Marc Penzel, Founder and President of Startup Genome, – the world-leading policy advisory and research organization. Their website mentions that they have advised more than 157 clients across six continents in 55+ countries.

I was hoping he might be citing India. On the contrary, he suggested looking at Japan and South Korea if startups could find a product market fit.

As I sign off this blog post, I am happy to share that I met a B2B SaaS Founder looking to launch in India and an experienced consultant in the Nordic region to help founders from India launch in Europe.