Table of Contents

ToggleThe new mobile app stumbles

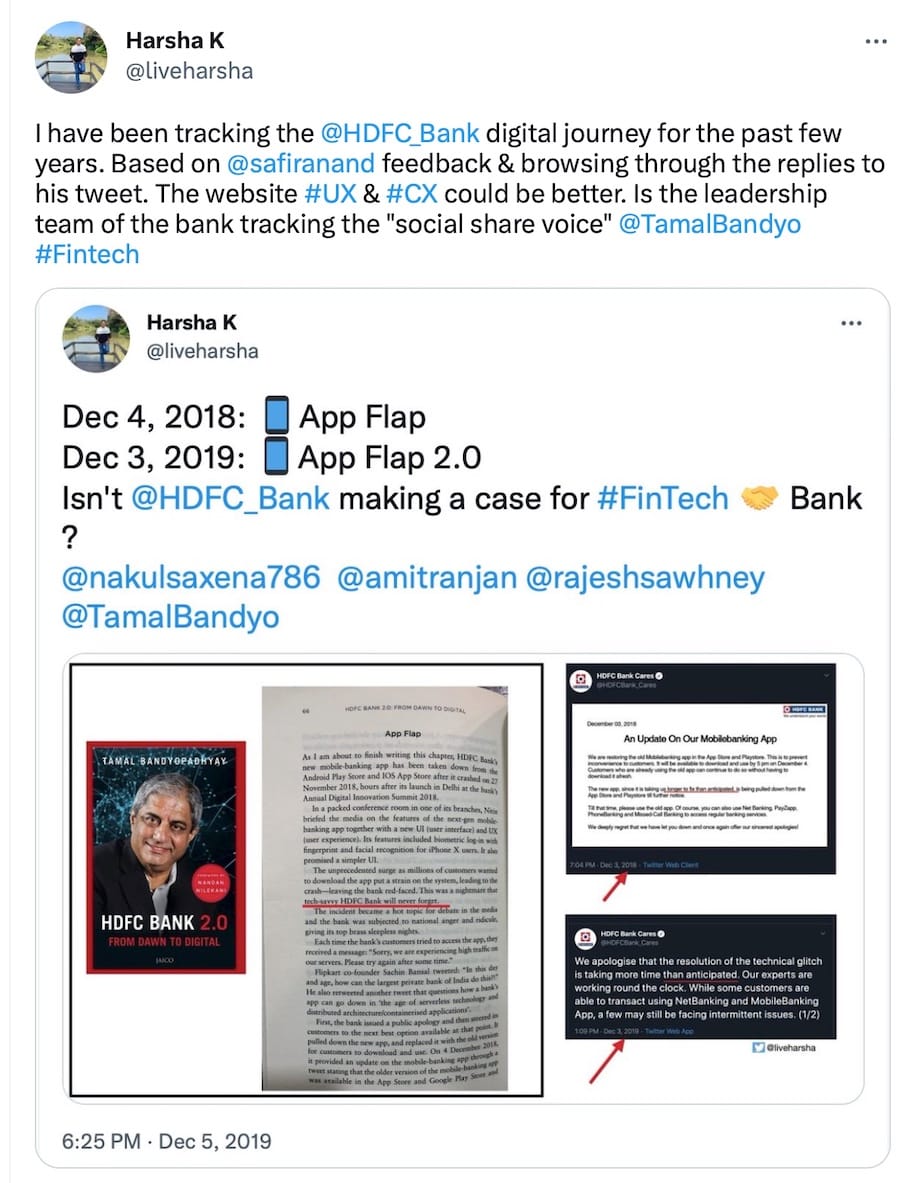

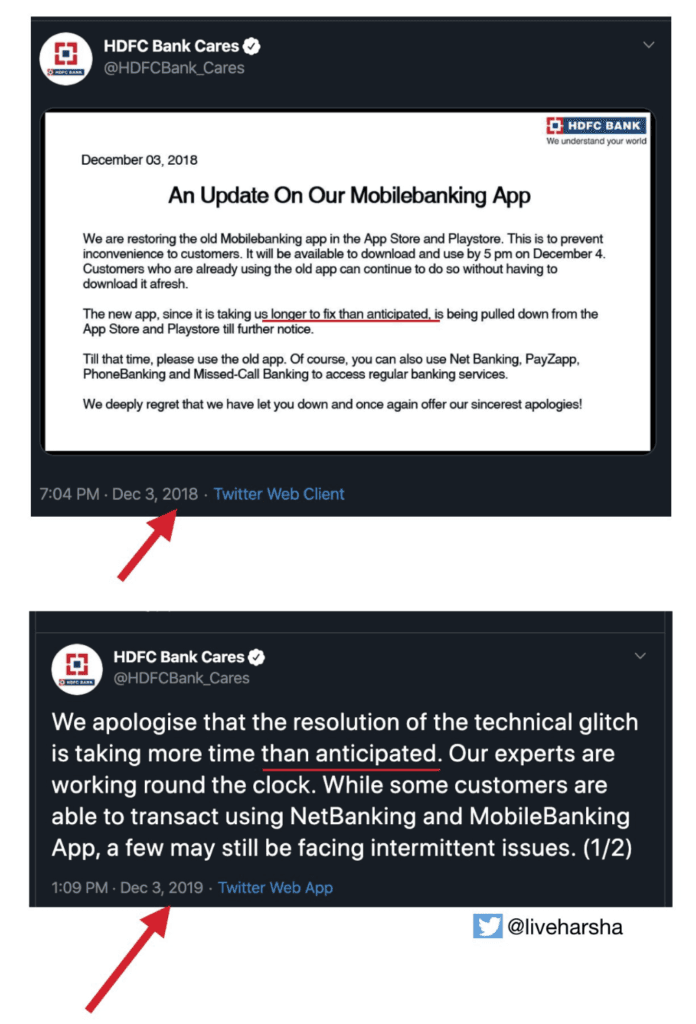

On Dec, 4th 2018, HDFC Bank released a press release that they are pulling out their new mobile app from App Store and Play Store till further notice. Users expressed their disappointment on Social Media. On Dec 3rd, 2019, exactly after a year, HDFC Bank faced a similar technical glitch in their mobile app and history repeated. Why did the largest private and most profitable banks have such fragile digital products?

Triumph in business, however, tragedy in UX

I read a similar story, “Triumph and tragedy on K2”, published by Financial Times in Feb 2021. A group of 25 experienced mountaineers spent over seven weeks acclimatising. Mr John Snorri, the first Icelander to climb K2, led this professional team. However, a tragedy struck them; five of the most experienced lost their lives. Why did this happen? One of the blogs mentions it is an error in judgement and a mix-up in logistics. There were many debates as to how to reduce these sorts of tragedies. One of the blog’s headlines was very apt in this episode. “how the forces of commerce and influencer culture collided this winter on one of the world’s most dangerous mountains,” the critical insight is the “balance” between commerce, ego and nature.

Digital Quotient – missing link

A large organisation with a dominant market share needs to catch up in their digital strategy. HDFC Bank’s mobile and website experience is exasperating for all its customers. Do these large banks choose the ideal tech architecture? In June 2021, too, they had an outage. While I am writing this in December 2022, from HDFC Bank’s perspective, 2022 is smooth; On Dec 6th 2022, one of the avidly followed lawyers tweeted about his bad experience with HDFC Bank. What intrigued me was the conversation on this user’s twitter timeline about the bank experience.

Hard Questions

Do these large banks have the necessary skill sets to understand user UX? Are they assuming that hiking is equivalent to mountaineering?

Usability testing and applying design principles are essential before tech development. So, how open are these firms to new tech stacks? I hope, in 2023, the bank will improve on digital.