Table of Contents

ToggleContext:

In the last couple of years, over twelve new1 Asset Managers have made announcements to launch their mutual fund business in India. These eleven new names are as follows. 1) Zerodha 2) Helios 3) Bajaj Finserv 4) Unifi capital 5) Old Bridge capital management 6) Emkay Global 7) Angel One 8) Capitalmind 9) Torusoro 10) PhonePe 11) Jio BlackRock. A few of them have got licenses from SEBI (regulatory body) and have begun launching their funds. What data points may have triggered these new Asset Managers to apply for an license?

In the last decade, assets have grown 5.5 times, and the Assets Under Management (AUM2) is around Rs 46 lakh crore (approximately $554 Bn.). Referring to the retail investors, it has doubled from 20 million in Jan 2021 to 40 million in Sept 2023. Will this retail growth rate continue growing like the last couple of years and hit the milestone of 100 million investors in the next few years? How has been this trend in the past 20 years? The objective of this post is to pose a few intriguing questions that may help discover new growth drivers to onboard new distributors and client segments.

Before I get into the crux of this blog post, you must understand my standpoint and experience.

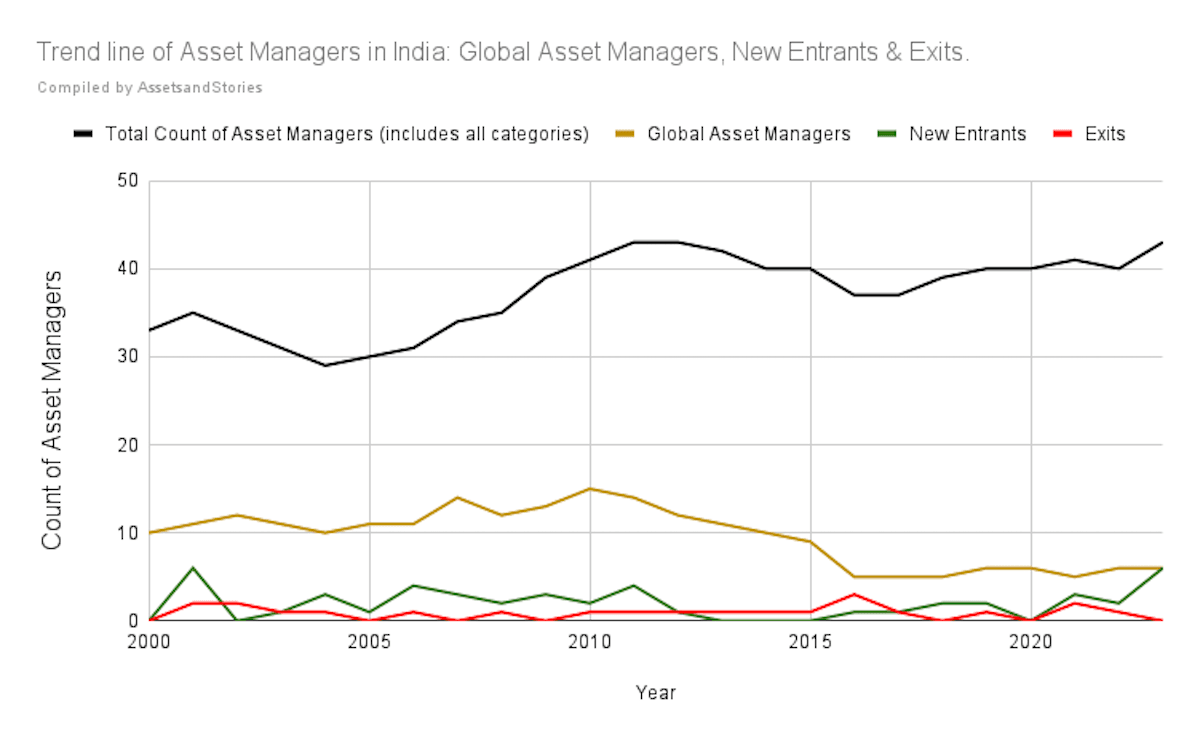

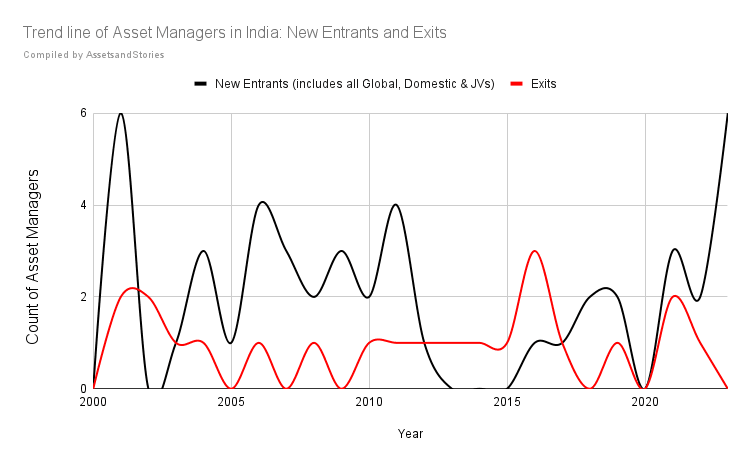

Let’s take a moment to glance through the history. How many Asset Managers have entered and exited India? The first private asset manager was set up in 1993. However, I compiled a list of Asset Managers from 2000 as I started understanding equity markets. Even in 2001, six new AMCs were established, similar to 2023. Why did over 15 Global AMCs exit3 India?

Distribution: How was the sales process in the Asset Management industry then?

Which business levers worked in the past? The asset size4 of the Asset Management industry in January 2003 was a mere Rs 1,21,805 Crs (approximately $12 Bn). Based on my 16 years of work experience in the Asset Management industry, the main business levers in 2003 were a) access to distribution channels, b) pricing, c) fund performance and d) the AMC brand.

Suppose one were to look at the Mutual Fund distribution channels today. In that case, it is 1) Direct, 2) National Distributors, 3) Banks, 4) PCG – Private Client Group, 5) MFDs (Mutual Fund Distributors), which have both independent advisors and WealthTech platforms, 6) RIAs / WealthTech platforms ( Registered Investment Advisers) and other smaller channels.

However, during 2003, it was Banks, IFAs (now renamed as MFDs), PCG and National Distributors and other smaller channels. In other words, unlike today, a “direct” option didn’t exist for investors to invest in Mutual Funds directly.

What questions did distributors pose to the AMC sales personnel? How did the distributors choose the Asset Managers to partner and promote?

The sales process in the Asset Management Industry was to customise the script to suit the distribution channel. However, the three common dominant parts of the sales script were market outlook, product (Mutual Fund scheme) performance, and pricing (commission). Distributors used to pose questions on market, product, or fund performance. However, few distributors focused only on pricing, and some singularly focused on “recent” fund performance. For instance, the relationship managers in the bank channel aligned with their Head offices / Investment Product team. The bank branch team had to choose a selection from the list shared by their product team. From this list, the bank branch chose based on the pricing and the relationship with the local Asset Manager sales personnel. Then, the Asset Manager’s sales team personnel used to share these products’ salient points with these bank relationship managers.

However, a handful of Asset Managers focussed on tools and training to help distributors educate about the market and products. Mutual Fund distributors had access to the bridge that connected Asset Managers (product manufacturers) and the investors. The distributor would choose those Asset Managers to showcase it to her client.

AMCs, who had street-smart sales team, won the dominant market share.

Pricing: How much % did the MF distributor earn from 2000 to 2007?

In some select schemes, the “upfront” commission5 was as high as 6% for preferred distributors. The regulator stopped the “upfront” regime in 2008, and the “trial” commission became a norm.

Now, visualise the power of the distributor those days,

a) Neither “Digital” nor “Direct” existed then. b) The distributor had access to her customers/investors, c) if she sells the Mutual Fund schemes to the customer, she gets paid upfront irrespective of the customer experience. Given these variables, the bank channel had a dominant market share as it had access to a extensive customer base. Now look at the potent winning combination for the Asset Managers – if they have a good relationship with a few large banks and offer compelling commission, then, why wouldn’t it be possible to gather new assets?

We discussed the power of Distribution and pricing, leading to the next question – how important is the mutual fund scheme / product?

How did distributors evaluate the fund performance?

Assume you didn’t have access to the internet, and you had access to only these two sources: a)NAV (net asset value) listing in the daily newspapers and b)your distributor. Would you choose an option to check the NAV of the scheme from the newspaper regularly and then compare it with other similar Mutual Fund schemes? Invariably, you will speak to your distributor. A couple of online portals published a comprehensive fund performance report and comparison of all mutual fund schemes. However, most retail investors weren’t aware of these portals. Hence, in 2003, access to fund performance information was limited as the internet and smartphones were not ubiquitous.

Asset Managers’ sales personnel printed the fund performance on a sheet and presented it to the distributors. Distributors utilised this fund performance sheet during their conversations with their customers. Now, is this the correct and effective practice? The main point I am making is that the distributor narrative was critical in the decision-making of investments. How will the less-known asset manager or new AMCs with limited reach / lesser distribution penetration get the investor’s mind space?

Many funds never got highlighted to the investors. Some of the evolved distributors were spotting the schemes which may do well based on the underlying portfolio of stocks. Often, the AMC sales personnel would highlight their competitor’s underperformance and switch the distributor to their performing schemes. For example, new mutual fund schemes used to be launched and labelled as IPOs (initial public offering) akin to equity company IPO launches. Most investors used to think buying these mutual funds at 10.00 NAV (net asset value) is a good value buy. Only in 2005 was the IPO terminology replaced by NFOs.

Fund performance has two elements – a) the fund has to perform well in the last four quarters, and b) this fund should be liked by distributors so that they highlight them to their customers.

As mentioned, distributors get paid an upfront commission every time the investment happens. The AMCs, which had a strong distribution, good pricing and reasonable fund performance, got a dominant market share.

Why were Global Asset Managers unable to get the mind space of Indian distributors?

On the last day of the Fidelity Equity Fund NFO in June 2005, I can only remember being on the road till 3 a.m., stuffing my car and its boot with application forms. In my earlier post, I wrote about my experience of Franklin Templeton and Fidelity fund launches. Even today, it’s worth remembering those days to understand the power of “Brand”.

Data suggested that the initial demand for Global Asset Managers was excellent. In other words, international brands attracted HNI and retail investors in their initial fund offering. In December 2007, over 40% of Assets managers in India were global asset managers, and the average assets6 under management was Rs 5,51,980 Crores (approximately $45 Bn). Global Asset Managers had the marketing budget, and a few had good stuff on the above and below-line marketing initiatives.

But in India, the business’s drivers were “distribution” and “pricing”. If the new global Asset Manager had to get a dominant share consistently, they had to befriend the distribution first, and as a result, the P&L statement did not look good. Global Asset Managers may have estimated that their brand and existing track record will secure market share in India. But this didn’t work.

While the Brand did help to get the mind space of investors initially, how compelling was the narrative of the distributor for these global Asset Managers? Was it compelling only during the NFOs (new fund offer), or did they switch the narrative later?

Fast forward to December 2023:

The answer is a wide gap in how the existing asset managers serve retail clients vis-a-vis the needs of the new segment of retail investors. What may be these strategic gaps/prospects for the new entrants?

To answer the above question. How much did the Asset Management industry contribute in all the marketing funnel stages? In other words, how helpful were the asset managers in the retail investors’ buying decisions online? How much effort does it take for all the stakeholders to go through the “discovery to conversion” process online? This entire journey could be through an intermediary or a direct (DIY investor).

For example, let me take the last stage of the buying process, wherein the prospect has decided to invest in a scheme. How much effort/clicks/hops does it take to complete this journey digitally?

If it were easy, why are 25% of new millennial investors still onboarding through paper mode?

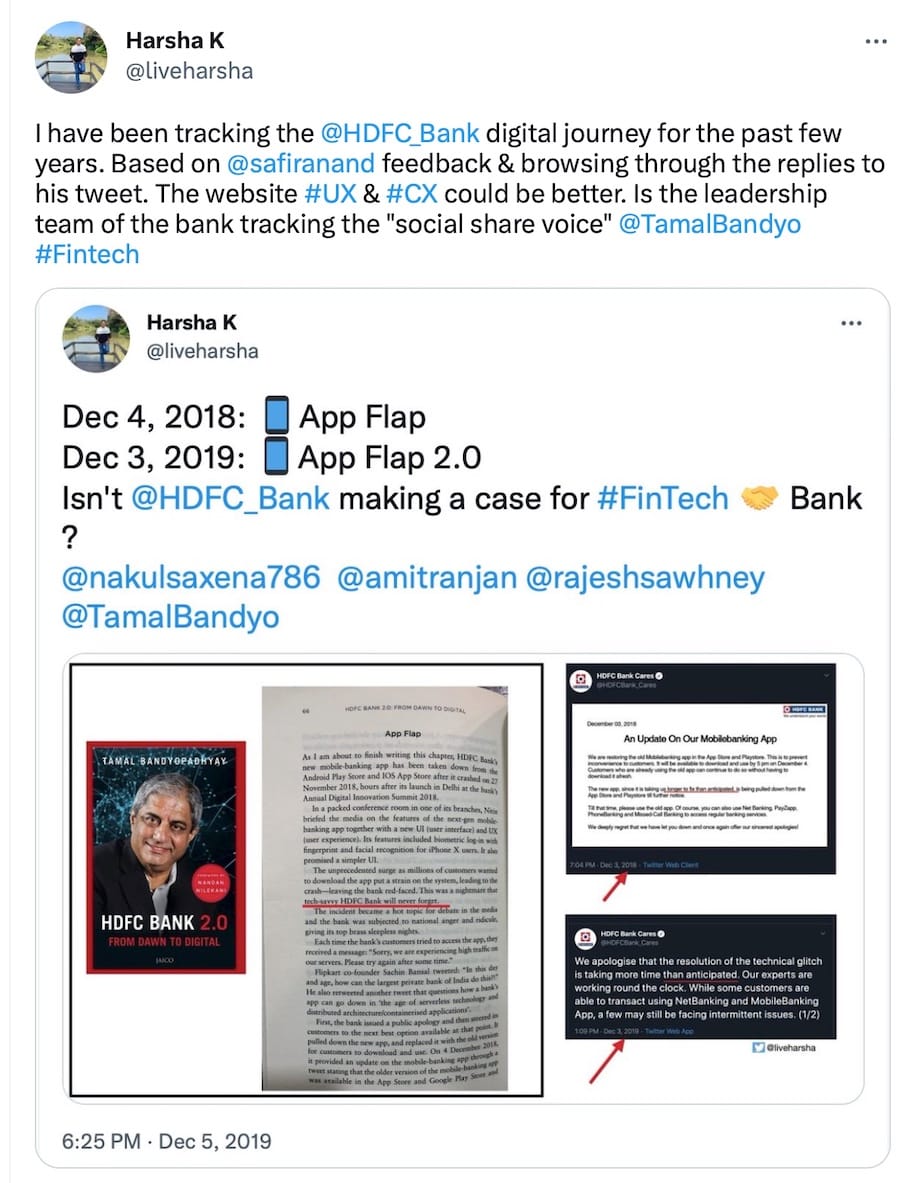

Why Customer Experience (CX) is ignored by Asset Management industry?

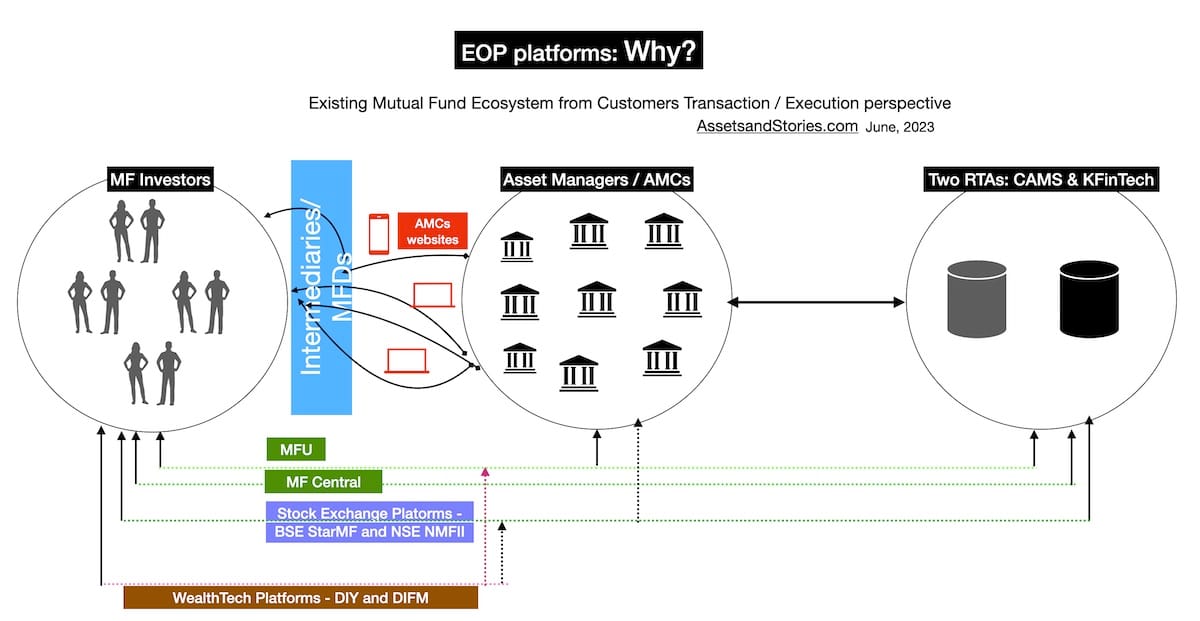

You may still be thinking about the strategic gaps in the “discovery to buying” process online for distributors and retail investors. Assuming the retail investor invests in one of the mutual fund schemes either through a distributor or directly. How is her experience with the Asset Management industry? In an Asset Manager’s vocabulary – it’s called after-sales service for distributors and investors. The Asset Management industry ignores the “Customer Experience” (CX) metric as they feel the onus of CX is on the distributor and the RTA (registrar and transfer agent) and not the asset manager.

In a recent Cafemutual Confluence13 event, the AMFI Chairman and CEO of HDFC Asset Management Company presented the growth drivers of the AMC industry. He mentioned that 1) Track record, 2) Transparency, 3) Tech and 4) Training (Investor education)

If you compare these growth levers to the one I mentioned in the prior section, three are new. Are these new three levers enough to scale to 100mn retail investors?”. Strangely, customer experience isn’t one of the growth drivers for the AMC industry.

Even the distributor experience is part of the customer experience. In other words, if the distributor has friction points in her operations team or with RTAs that will reflect the customer experience. A few shareholders’ presentations mention CSAT (customer satisfaction survey). However, these statements are narratives without including metrics like Net Promotion Score (NPS) and Customer Effort Score (CES).

Strangely, only two RTAs (Registrar and Transfer Agents) exist in the Indian Asset Management Industry. RTAs’ role is to store, update, and track all the data points of the mutual fund investors. Since there are only two companies, all stakeholders have limited choices. Surprisingly, most of the industry-renowned white papers don’t stress the existing archaic RTA tech architecture.

All the stakeholders in the AMC industry know that there is a large team in the RTA that responds to distributor queries. Why should a distributor/fintech platform not have access to seamless reconciled data feeds? Why do RTAs and Asset Managers have a large operations team to solve data queries? Why do these queries arise in the first place? Why can’t it be solved by design and revisiting the archaic tech architecture?

On the one hand, in e-commerce, India is a leader in innovation by unbundling e-commerce (ONDC) and interoperability of multiple platforms. On the contrary, the distributors of the asset management industry need help reconciling the feeds from the RTA after the transaction goes through.

Isn’t this a dichotomy?

Industry is re-arranging, but why the familiar faces in the Asset Managers CEOs club?

Industry is re-arranging, but why the familiar faces in the Asset Managers CEOs club?

A caveat: I respect the existing CEOs of the Asset Management Industry. However, a mutual fund is a product that could be a panacea for retail investors. The industry stakeholders should make the retail investor experience to get this benefit of MF.

Let me enumerate this with a couple of examples:

2017: Ms Radhika Gupta joined Edelweiss Asset Management Company as CEO. She was an outsider to the Asset Management industry in India.

2023: Edelweiss Asset Management’s assets14grew 10x. Because she was an outsider, her leadership approach was distinct. She didn’t follow the same old playbook. Moreover, I am glad the promoters of Edelweiss supported gender diversity.

Groww mutual fund platform: All four Founders of Groww are from Flipkart (Outsiders to the Asset Management industry). This team has become a leading mutual fund distributor platform with the most prominent brokerage and extensive active15 user base. In Oct 2023, as per my industry sources, Groww surpassed NJ India in the new SIP (systematic plan) regarding the new SIP count and the new SIP amount.

Both examples demonstrate that an outsider can bring significant innovation in product and design. Humans like familiarity, and the Asset Management industry is aware of all cognitive biases. They use these biases in behavioural finance; however, why is this missing in boardroom decisions?

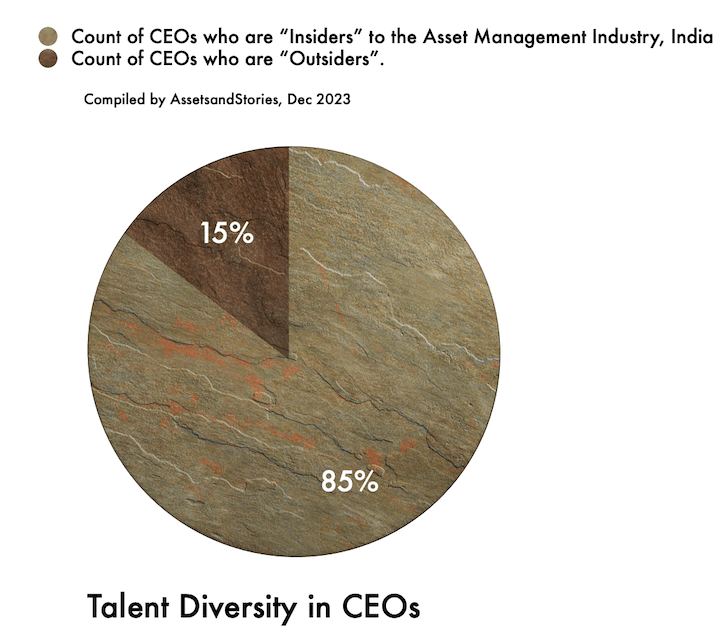

Suppose you were to analyse the work experience/background of the current 41 CEOs of the Asset Managers in India. The average work experience in financial services is over 25 years. Why should an outsider not be hired as a CEO or Asset Manager?

The data point I intend to analyse is not on investment management but the business and strategy part of Asset management.

I have defined an insider as someone who has spent over 20 years in financial services and may have been hired as a CEO from a competitor Asset manager or promoted internally.

As we advance, if the focus is on new retail investors and the target group is millennials, do you want to follow the same growth playbook used for 20 years? Wouldn’t bringing a new face into the leadership instead of a familiar face be prudent?

For instance, let me quote another example.

SEBI / regulator has allowed the launch of Execution Only Platforms (EOP) in Sept 2023. The regulator allowed balancing regulation and incentivising the distribution.

Dec 2023: How many AMCs are working with distributors on this? Or if the AMC industry feels this is a flawed model. Why was this new regulation launched in the first place?

Why is the industry unable to attract new mutual fund distributors?

Ironically, India has only 1300 SEBI RIAs and 120k MFDs, and the target market is 100 million.

Summary:

The business opportunities for asset managers are compelling as the entire industry is chasing the target of 100 million retail investors. In the past, asset managers with access to large distribution channels and pricing power showcased well-performing funds. As a result, they were able to garner assets. Not all asset managers could get the mind space of large distributors. Hence, many asset managers exited, including prominent global names.

The Asset Management Industry benefitted because of the tailwinds – India’s digital stack, increased financial savings, and rise in GDP per capita. Similar to many consumer tech products (mobile apps), one of the features of a mutual fund scheme is a SIP (Systematic Investment Plan). This feature became a hook among investors.

The variables on both the supply and demand side are getting re-arranged. The power of balance was on the “supply” side as the manufacturers / Asset Managers and distributors played a crucial role in creating the demand. The regulator and changes in consumer preferences alter the power of balance to the “demand” (consumer/investors) side.

The transition is happening, and at this juncture, answering these uncomfortable questions to existing Asset Managers in India is relevant.

1) Why do asset managers not strive for a superior Customer Experience?

2) Why does a duopoly exist in the Registrar and Transfer Agents (RTA) industry? Why not revisit the tech architecture of existing RTAs?

3) Why fail in practising when they preach to their customers?

In other words, the Asset Management industry nudges investors to consider global diversification in their portfolios. The concept used is “Familiarity Bias”.

Similarly, Why not explore new avenues to improve talent diversity? Why not hire CEOs from other sectors?

The new entrants with prior digital distribution experience and tech prowess will be able to capture the market share of this new segment of retail investors.

Disclosures, Caveats and Assumptions

- I was part of the Asset Management industry for 16 years; hence I may be biased.

- I am neither a SEBI registered Investment Advisor (RIA) nor a Mutual Fund Distributor (MFD); hence, my opinion on the names of the firms mentioned shouldn’t be considered a stock recommendation or a caution.

- I consult for a few early-stage wealth tech startups

- I have invested in the Mutual Funds schemes mentioned in this blog post.

- Mutual Fund is an essential product for retail investors as it helps with their personal finance.

- I compiled the above data points from multiple portals / secondary sources; hence, the data points may not be 100% accurate.

- This post is focused on building a new retail customer segment and excludes other client segments.

- I have excluded Infrastructure Debt Funds (IDFs) from the AMC list.

- Global brands are those asset managers who have or had set up independent businesses in India and not the ones who have domestic joint venture partners.

- Rupee (INR) to USD conversion will not be accurate as I couldn’t use the precise currency conversion spot rates.

- AUM mentioned in this blog may contain Institutional assets as well.

- Mutual Fund investments are subject to market risks, read all scheme related documents carefully