Table of Contents

ToggleContext

From 2020 to 2022, I led the market strategy for a US-based early-stage WealthTech to launch their business in India. During this time, I was based out of Bangalore. Hence, I was able to work with over 20 startup founders on their fundraising initiatives. I migrated to Denmark in June 2023 and explored being part of the Nordic (Denmark, Sweden, Finland, Norway and Iceland. ) startup ecosystem. Unlike my experience with the U.S. and U.K. startup ecosystem, my experience with Nordics was intriguing. And this led me to compile these data points. How many Venture Capital transactions took place between the Nordic and Indian startup ecosystems? How thick is the relationship between the Nordic and Indian startup ecosystems?

Problem Statement

In 2023, out of 900 Venture capital funding transactions in India, only 11 VC transactions were from Nordic countries. In 2024, only eight out of 670 transactions originated from Nordics. Then, I analyzed the twenty-one leading technology venture capital firms based out of Nordics, and none had investments in India.

If one were to compile India’s leading global investors/venture capital funds, the top international investors who lead these investments are from the U.S., Japan, and Canada. Why has the Indian startup ecosystem not attracted capital from the Nordic region? Unlike the Japan-India corridor, US-India corridor, and UK-India corridor, why is there no startup corridor for Nordic-India?

Why do these two mature startup ecosystems not talk to each other?

Data source: Bain & Co and Dealroom.

Meeting with Mr Avnit Singh, CEO of TechBBQ, Denmark.

After three months of effort, one of my contacts from the Indian diaspora in the Nordic region referred me to Mr Avnit Singh, CEO of TechBBQ. TechBBQ is one of the largest startup organizations in Europe, working to build the Nordic startup ecosystem. Avnit was born and raised in Denmark and has experience working in the startup world for the last 15 years in the Nordics. In the first meeting, we “hit it off” right away as we both had a lot of common ideas about the engagement between the two startup ecosystems.

Thus began the project at TechBBQ, Denmark, to build the Nordic-India startup corridor. We quickly connected with ICDK Banglore Eske Bo Rosenberg and then got the Industry Foundation on board to fund a project to attempt to build this bridge.

Unlock Nordic Markets: Why Indian Startups Can’t Miss Out!

Regarding average wealth per adult, Denmark has the fourth highest global wealth. The top three are Switzerland, the U.S., and Australia. Norway is the sixth. In other words, the four Nordic countries are among the top 13 countries in the Global Wealth per person index. Denmark has a high wealth density and hosts a vibrant startup ecosystem. In 2023, its Danish Fintech startups secured the third most V.C. funding per capita among the top 10 European ecosystems. In the Nordic region, there are over 72 unicorns.

“Startup Founders: Connect the dots between Nordics and India.”

“Startup Founders: Connect the dots between Nordics and India.”

The above image refers to the most funded sectors in the Nordics and India. How should an aspiring founder look at this? There is an overlap between FinTech, SaaS, and CleanTech. Two years ago, CleanTech was not in India’s Top 10 funded sectors. However, we are seeing traction now.

Nordic B2B FinTechs:

For example, why has no B2B FinTech from the EU teamed up for Sahamati / Account Aggregator in India? Yodlee / Envestnet from the US have registered as AA; why is there none from the EU? What are the key learnings from the EU PSD2 / Open banking? While the architectures of PSD2 and AA differ, the consumer is the common denominator.

Continuing in the FinTech space, the Monetary Authority of Singapore and the Danish Financial Supervisory Authority have an agreement in cross-border B2B payments. As we all know, there are multiple friction points in B2B international payments; why is it that the Nordic Fintech can look at building a product for the Nordics and India?

I will write a separate post for the Founders and the VC community on connecting the dots between Nordic and Indian startups.

Why should the Indian startup ecosystem be chosen to be absent from the world’s wealthiest countries?

In 2024, Indian-Americans co-founded over 70 of the 650 unicorn startups in the U.S. However, there are over 75 unicorns in Nordics, and none of the Founders are from India. Not only in the startup ecosystem but even in the overall trade, India exported just over 0.20% of its total exports to Denmark and 0.11% of its total imports. If we further break down India’s top exports to Denmark, the top exporting sectors are textiles (which it has been since the 1970s), machinery and electrical, base metals, chemicals, and animal hide. There is room to improve the trade dependence, too.

“The Challenges Indian Founders Face When Establishing in the Nordics”

Unlike the U.S. and Netherlands, the Indian Tech / I.T. Industry doesn’t have a backstory in the Nordics. As a result, awareness of India’s talent among the Nordics is very low. For example, none of the Nordic countries are among India’s top 10 global destinations in software exports. The top 10 countries contribute to 88% of software exports for India. The Netherlands and Germany are two of the top 10 countries in the E.U. region. The Indian Founders who want to start afresh must first sell the “back story of tech outsourcing: India being the global software powerhouse” and then take the thread of digitization and now A.I. While there are multiple forums to promote trade between Denmark and India, only a few focus on the startup ecosystem. As we all know, the critical variables for a favourable startup ecosystem are Capital, Talent, Policy, Culture, and Institutional Support. The founder will have to manage all these on her own.

Data source: Invest India and ESC.

Missing Link

In January 2024, we at TechBBQ began our outreach for sponsorship and participation in the Nordic-India Startup Summit. While conversing with one of the potential sponsors in India, I realized there was a big missing link. Let me share one of the questions posed by a senior executive in India. Is Nordics relevant to the Indian Startup ecosystem?

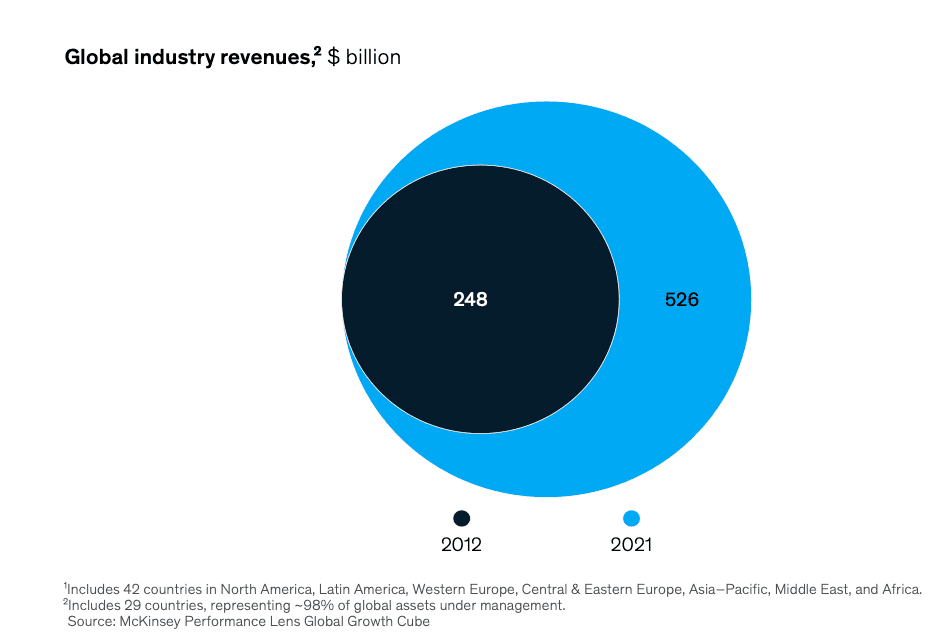

In turn, I asked this senior executive: In 2023, India received over $10bn of VC capital. How much have Nordic countries raised?

Do you have any guesses?

Invariably, none of my Indian acquaintances got this number precisely.

In 2023, Nordic startups raised over $9.3Bn in capital. Yes, the capital raised by Nordic founders is equivalent to the Indian startup ecosystem.

If you compare 2022 vs. 2023, Indian startup funding declined by 60%, and Denmark is the only country in the EU region where VC investments were marginally higher in 2023.

Similarly, in Denmark, too, many asked us why TechBBQ chose “India. Why not Singapore? Few in Nordics know India is the third-largest startup ecosystem, with over 1,40,000 startups.

Way forward

To my mind, history is repeating. Europeans set out for India first. Similarly, entities from Denmark, namely ICDK, Bangalore and The Danish Industry Foundation, sponsored the maiden Nordic-India startup summit. I am confident that the Indian startup ecosystem will join with Denmark and support building this startup bridge. We at TechBBQ are excited to host the Nordic-India startup summit. I will share what I have learned in my next post.

Disclosures, Caveats and Assumptions

I am not a Registered Investment Advisor (RIA) and hence not registered with SEBI, FINRA, FCA or DFSA.dk; therefore, my opinion on the firms’ names shouldn’t be considered a stock recommendation or a caution. I may have missed mentioning a few data points inadvertently or may be biased.