Table of Contents

ToggleContext

I had the privilege of leading the second edition of the Nordic India Startup Summit (NISS) at TechBBQ in Copenhagen, Denmark. The inaugural edition took place on 9th Sept 2024 and focused on raising awareness of the startup ecosystems in both India and the Nordic region. In 2025, we saw a remarkable increase in participation from India, with four times more representatives compared to the previous year. Unlike the first edition, which was a standalone event, this year’s NISS was held as a side event during the main TechBBQ on August 28th.

In this blog post, I aim to share my learnings and explore a fundamental question: Why is NISS essential, and how can it propel the Nordic and Indian startup corridor forward?

Fact Sheet: Cross-border VC Capital Flows between the Nordic-Indian ecosystem.

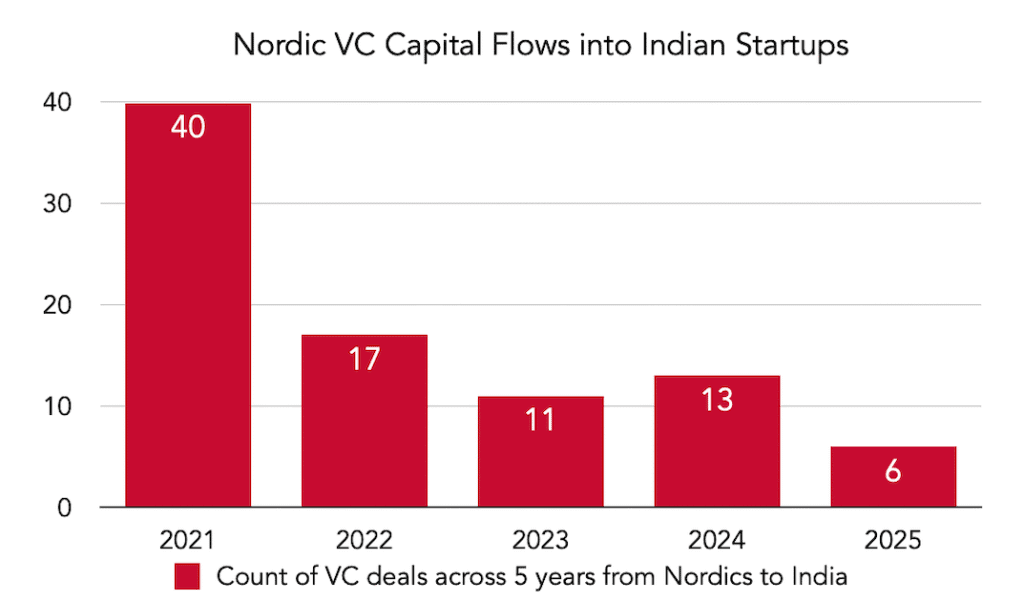

How many Venture Capital (VC) transactions originated from the Nordics to Indian startups?

According to the India Venture Capital Report 2025 from Bain & Company and IVCA, India had about 1,270 VC deals. Comparatively, only a tiny fraction—less than 1%—of these deals came from the Nordic region. This pattern has been steady over the last four years, showing very low VC activity between India and the Nordics. I gathered the Nordic deal information from two premium research websites, one from the EU and one from India.

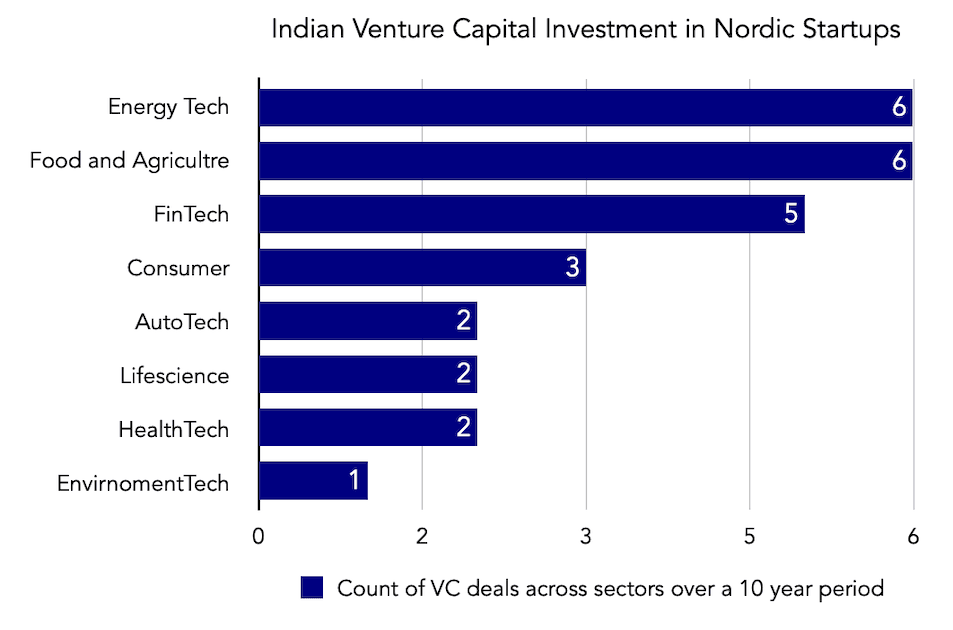

How many VC transactions originated from the India to Nordic startups?

In the past decade, over 27 transactions have taken place, and these were from 21 VCs. Two startups have received funding from two different Indian VCs. As a result, over 25 unique startups in the Nordics have received capital from Indian VCs.

While the Nordic–India collaboration in the green transition is a work in progress, I am excluding both the larger investment deals in the Green Transition and the PE activity from this blog. Please do browse through the caveats and assumptions at the bottom section of this blog.

“Why is cross-border VC activity so low among Nordic-India Regions?”

During early 2024, while I was reaching out for the inaugural NISS, I found it intriguing that prospects from India posed questions about the Nordics. When I presented data points about Nordic startups, their interest was very high, and they requested additional information.

As a result, highlighting the startup ecosystem is the next logical step.

If one were to break down the startup ecosystem stakeholders in the context of the Nordic India Startup Summit. They are as follows,

- Startup Founders

- VCs and Corporate Venture Capital (CVC)

- Enablers ( government bodies, policymakers, foundations, universities, accelerators, Angel Networks and advisors)

- Business Media for highlighting this opportunity to the relevant audience.

Startup Founders

There were three cohorts of startup founders at the NISS

- Cohort 1: Native Nordic startups

- Cohort 2: Nordic startups with Indian-origin founders

- Cohort 3: Startups from India that travelled to NISS, TechBBQ.

For the second edition of the NISS, we had active representation from all three cohorts. Over 25 startups traveled from India, and five native Nordic startups presented during the NISS track.

Names of these startups are Oasicare , HyKin Energy , Go-Pen, Commu, Cellverse, CarePlix, QpiAI, PRAYOGIK and Jamnaa Healthtech.

During my panel discussion with the founders of Zumutor Biologics (bioscience), vCare (MedTech), Border Plus (MedTech), and Recykal (circular economy), I asked them a specific question: Why did they attend NISS, and what are they hoping to achieve? Are they looking for fresh capital or strategic partnerships? The responses were clear: they primarily seek capital, closely followed by the desire for partnerships.

VCs and CVCs

It was good to host Mr. Amit Kakar, Managing Partner and Head of Novo Holdings Asia, and Mr. Rajeev Suri, Founding Partner of Blue Green Ventures . Their insights were very helpful to the VC panel. At this point, I would like to thank Ms. Zenia W. Francker from CVX Ventures in Denmark. CVX ventures is a leading VC in Nordics which has helped over 100 companies through investments and board positions. Zenia was an apt Master of Ceremonies for both NISS 2024 and 2025, and I gained valuable inputs by interacting with her about the Nordic VC ecosystem.

You may have observed the transaction counts from VCs and CVCs in the previous chart, an important question arises: are there any use cases that demonstrate business synergies between the Nordics and Indian startups?

Use Cases Relevant to the Nordic-India Startup Ecosystem

Life-Science

According to discussions from the Rainmatter forum, a well-known fund for early-stage investments, Indian HealthTech startups are primarily focused on telemedicine, premium fitness and wellness apps, and SaaS tools for doctors. However, there are significant opportunities in diagnostics and chronic disease management.

As per EIFO (Export and Investment Fund of Denmark) Life science accounts for one third of the Danish venture capital market growing significantly since 2018.

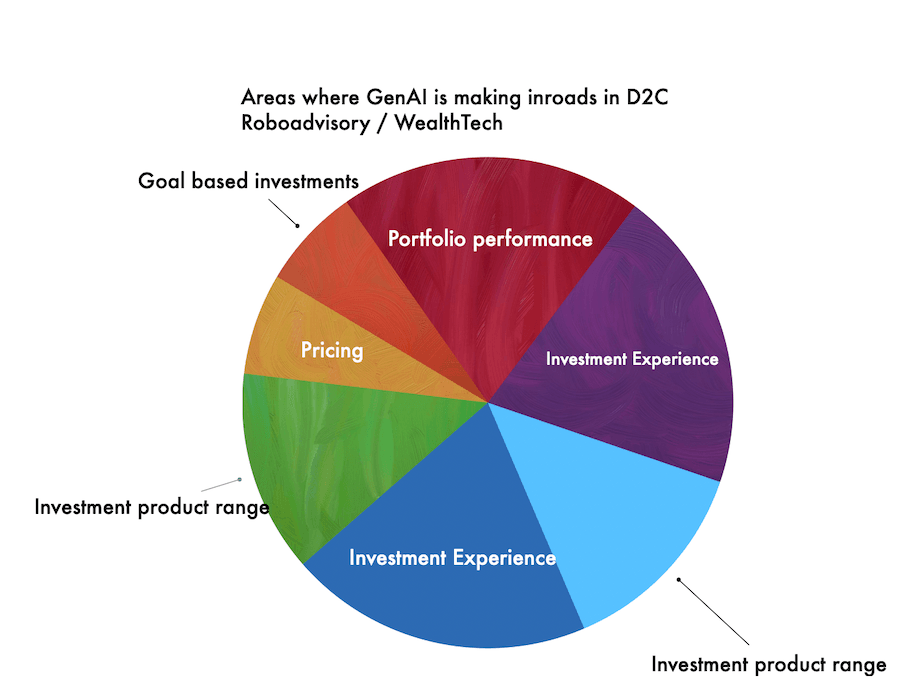

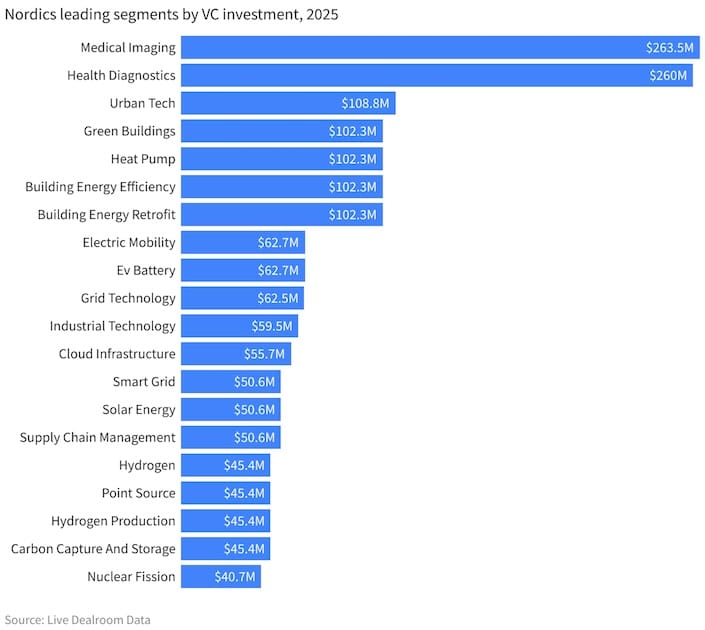

The chart below highlights the leading segments in the Nordics by VC investment in 2025.

Segments within Life-science VC investments in Nordics

Indian VCs investing in Danish life science startups will have the opportunity to share their learnings from the Nordics and explore business synergies from their Indian portfolio startups.

DeepTech

Recently, two prominent VCs from India shared their thoughts on DeepTech.

Mr Pranav Pai of 3one4 Capital emphasized that translating breakthroughs in fields such as autonomous vehicles, drones, artificial intelligence, defense technologies, energy security, space and quantum technology, and security systems from the lab to leadership in emerging markets is becoming increasingly challenging each year.

Similarly, Mr Dilip Kumar from Rainmatter VC noted that over the last 15 years, India has primarily focused on consumer applications, but the emphasis should now shift to DeepTech.

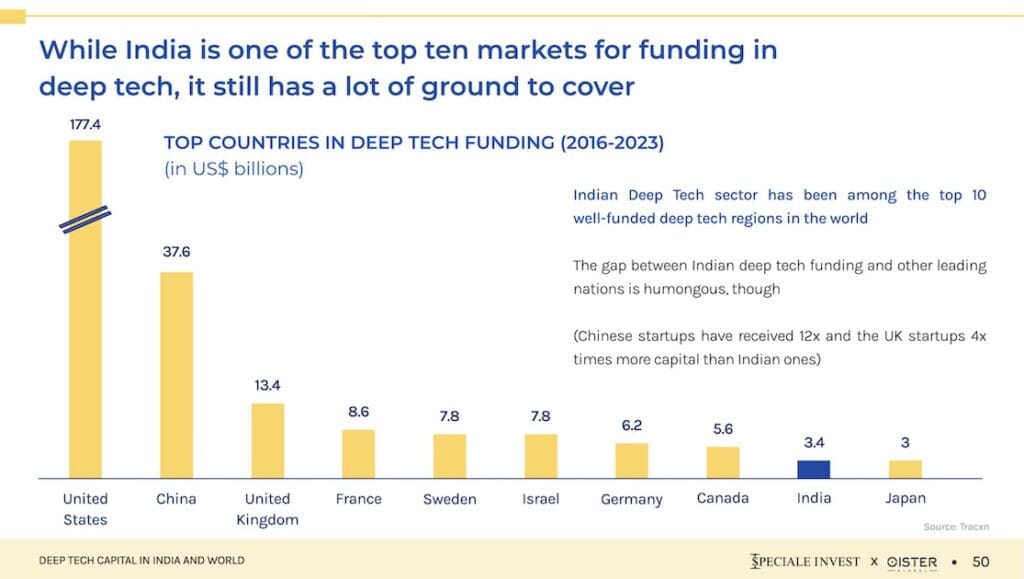

If we track the total funding in the DeepTech sector across the globe from 2016 to 2023, we find that Sweden, one of the Nordic countries, has raised 2.3 times more VC funding than India. Reference: Speciale and Oister Deep Tech Report.

Isn’t this a case for Indian VCs to reckon with the Nordics?

EU Data Space

My earlier examples underscored the knowhow on the Nordic startup ecosystem. this use caseis about India’s success in Digital Public Infrastructure (DPI). The EU’s Common European Data Spaces (CEDS) is in the process of implementing create business sector-specific, sovereign pools of data governed by EU rules. It’s based on the principle of “data altruism” – individuals and companies can voluntarily make their data available for the common good under strict trust and control mechanisms. The common themes of India’s DPI and EU CEDS are the foundational principles and architectural choices.

So, even Nordic countries are working on to implement CEDS.

Given the background of the EU data space, we at TechBBQ were lucky to host Mr. Pramod Varma, who was the Chief Architect behind many of India’s most impactful

DPI initiatives, all of which now operate at a population scale. He accepted our invitation and joined us on the first day of TechBBQ.

Both the Common European Data Spaces and India’s DPI/ONDC are working towards digital sovereignty for individuals and societies, built on a foundation of open networks and public infrastructure. India has made significant progress on this initiative. It would be valuable for Nordic startups to track the data points of India Stack.

I see more use cases in other business areas, I will compile these in a new, separate blog post.

Enablers

Enablers include government bodies, policymakers, foundations, universities, accelerators, and advisors. In the following paragraphs, I would like to highlight and acknowledge the enablers who have already contributed to NISS.

Embassy of India in Copenhagen, Denmark

Firstly, I would like to extend my gratitude to His Excellency Manish Prabhat, Ambassador of India to Denmark, as well as to Counselor Mr. Ashish Kumar Singh Arya and Mr. Ashok Polur, Commercial & Marketing Officer at the Embassy of India, for their guidance and support in outreach efforts.

It was a pleasure to host delegates from SIDBI, DPIIT, and the IT & BT Department of Karnataka.

Ministry of Foreign Affairs, Denmark

I am also thankful to His Excellency Rasmus Abildgaard Kristensen, Ambassador of Denmark to the Republic of India, for his attendance at the NISS.

Novo Nordisk Foundation

I appreciate the contributions of Dr. Jakob Williams Orberg, Head of the India Branch Office, and Ms. Drishya Nair, Scientific Manager of Innovation.

ICDK Bangalore

I would like to express my sincere gratitude to Mr. Eske Bo Knudsen Rosenberg, Mr. Peter Winther-Schmidt, and Ms. Inayat Naomi Ramdas for their invaluable support.

TiE Bangalore

It was encouraging that Mr. Madan Padaki, President of TiE Bangalore, met with the founders of Indian origin in Copenhagen and expressed interest in initiating a chapter in Denmark.

Prominent Supporting Stakeholders

Mr Kunal Singla from COBO Consult, a Danish-Indian advisor for Nordic small and medium-sized enterprises (SMEs), was important to NISS. Mr Sanmit Ahuja, the Managing Director and CEO of Bharat Technology & Impact Accelerator (Bharatia), shared valuable data points about his business activities in the Nordic-Indian corridor.

It was also amazing to see representatives from the Infosys Innovation Fund, Next Step India (an initiative of the Indian Danish Chamber of Commerce), and the Danish Industry Foundation, as well as the India Advantage Summit.

Media

How will the relevant stakeholders become aware of the cross-border Nordic-India startup ecosystem? Business media plays a crucial role in this process. Thankfully, for the second edition, we received a few inquiries about NISS.

Missing Links

Awareness

Compared to 2024, there has been an increased interest from both the Nordics and India. However, startup founders I have interacted with over the past two years from both regions have yet to identify the relevant cohorts (demand) that align with their product offerings (supply).

Investment Vehicle / Structure

One of the early-stage startups from Denmark with an Indian-origin founder generated interest from Indian Angel investors. However, the investment structure isn’t simple for this founder to raise capital from India.

Outbound capital from India

Indian angel investors have the option to invest in overseas portfolio investments through the Liberalized Remittance Scheme (LRS) or the Overseas Direct Investment (ODI) route. The LRS allows for investments up to USD 250k per financial year. While some angel investors may wish to support founders of Indian origin, facilitating these investments can be challenging.

Inbound Capital to India

Capital flows from overseas to Indian Private market is on rise. The total VC funding is around $13.7 billion, marking a 1.4x increase from 2023. Most of this capital comes through VC funds, with limited partners (LPs) investing in their preferred Indian VC funds. However, there is still a significant need for increased awareness and understanding of the structure and benefits of GIFT City and the International Financial Services Centres Authority (IFSCA).

In India, the capital market regulator SEBI now requires all Angel Investors to become Accredited Investors. This is a progressive one; however, in Denmark, I haven’t come across a conversation of Angel investors investing in India.

Academia

We have got representation and interest from IIT and KU from Denmark. The Indian Institute of Science (IISc) actively engages with ICDK. However, we were unable to garner attention from universities in both India and the Nordic region for NISS.

Corporate

I found less interest as I discovered that the corporates haven’t had cross-border partnerships with the accelerators. This also demonstrates that a landing pad for startups in both the Nordic and Indian regions is missing.

Way Forward

It’s time to track the outcomes and engagement following the events. For example, a couple of startups from India generated interest from investors and secured partnerships for market access.

Can NISS facilitate deeper engagement between these two ecosystems?

In the coming months, we will continue to monitor these ongoing conversations and share our findings in the next few quarters.

Disclosures, Caveats and Assumptions

- This is not a sponsored post.

- I have focused exclusively on startups and venture capital (VC) transactions, excluding private equity and corporate transactions.

- I have referenced several prominent VC names from India that I follow, so there may be some bias in my perspective.

- Please note that some startup names or data points might inadvertently be omitted.