Table of Contents

ToggleContext: Why is Mutual Fund’s website essential?

Demand:

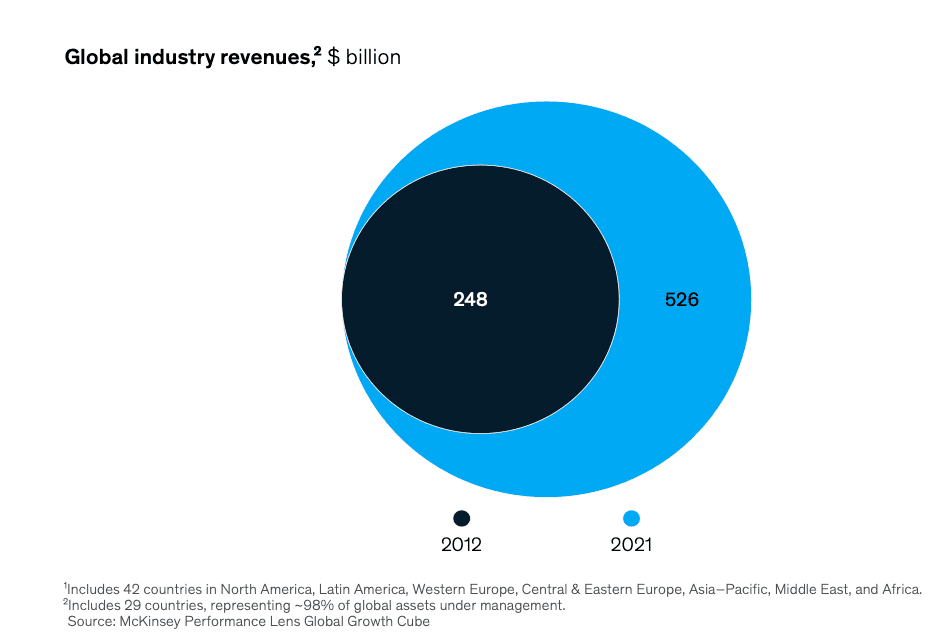

The Mutual Funds in India are mandated to spend 0.01% of the combined assets of the industry, which is approximately $ 69 million in 2023, to create awareness of the product category. Apart from this combined massive marketing dollars, all AMCs have independent marketing budgets to generate interest in their mutual fund schemes. Both the Ad campaign and the bull market have created an enormous demand. In April 2024, the Asset Management industry’s net inflow marked its 38th consecutive month of growth. There are about 40 million mutual fund investors, and this investor base has doubled in the last couple of years. The target of reaching 100 million investors seems to be plausible.

Supply:

Over 44 AMCs offer over 1,400 equity-oriented mutual fund schemes.

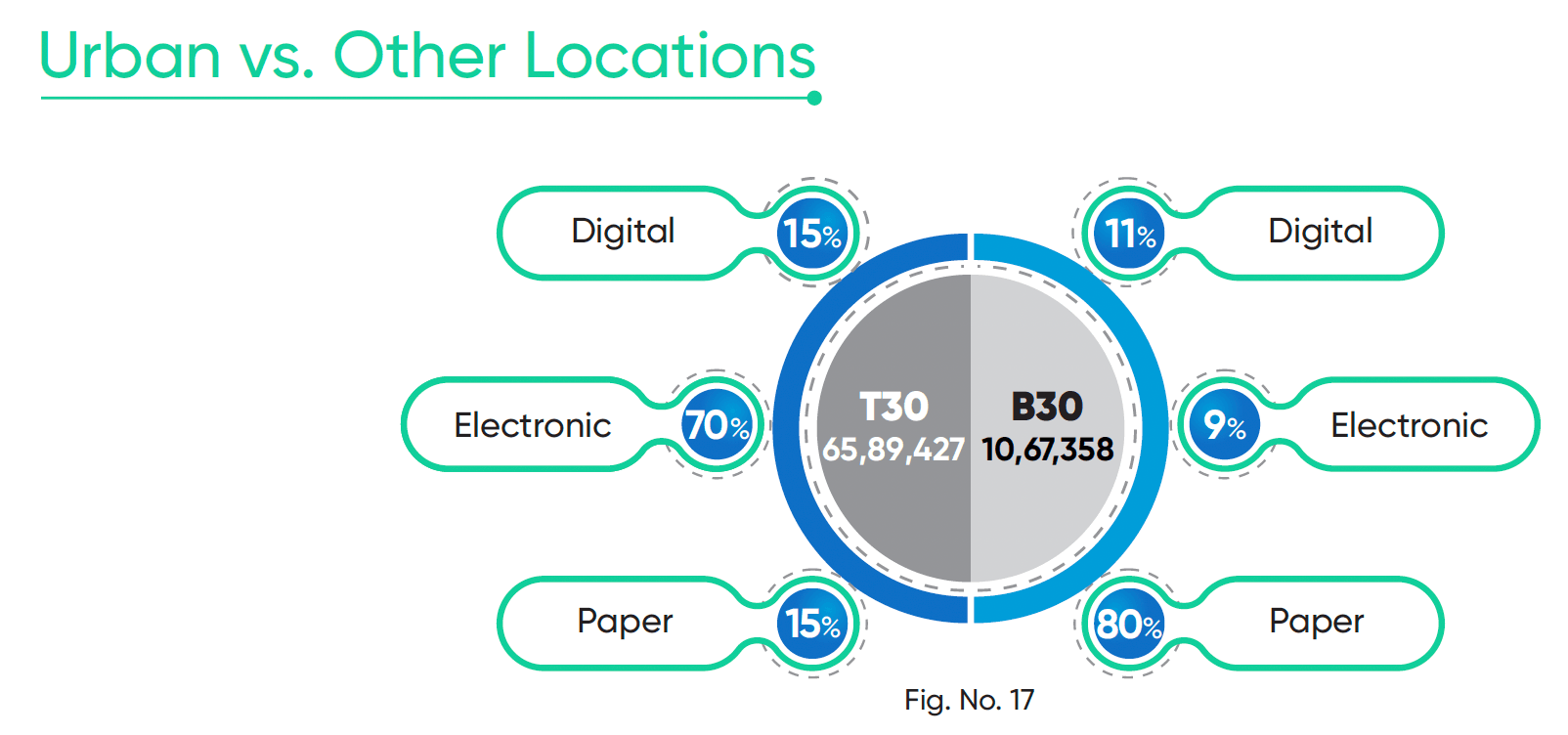

Upon closer examination of the distribution channel mix of mutual funds, the role of Independent Financial Advisors (IFAs), now labelled as MFDs (Mutual Fund Distributors), emerges as the main channel. Banks, National Distributors, and Direct (including FinTech) channels follow them.

Will the existing MFD / IFA channel cater to the surge in demand?

The registered MFD count is over 120k, and my estimate is that over 70k MFDs may be active. If you include the relationship managers in banks and national distributors, the total count (Employee Unique Identification Number (EUIN)) will be around 270k. How can this small segment cater to a large retail segment of 100 million?

While select AMCs have made efforts to build the MFD channel, this blog is focused on the Direct channel, which is crucial. From an investor perspective, she can invest directly or through an agent/distributor. This direct segment of investors is rising; please refer to the table.

“Direct” Plan:

How many retail investors opt for a direct rather than an agency route?

In the above table, I have mentioned HDFC Asset Management Company Limited (HDFC AMC), UTI Asset Management Company Limited, Nippon Life India Asset Management Ltd and Aditya Birla Sun Life AMC Ltd, listed companies in the Indian stock market, and the data is publicly available. Other Asset Management Companies(AMCs) are not obligated to share the distribution channel mix publicly. Generally, there is a hesitation in sharing the distribution channel mix of equity assets. For instance, Nippon Life India Asset Management Limited gives the overall market share direct vs distribution and does not narrow it down to the equity asset class. Why does disclosing the data point of Equity asset class matter? Retail investors invest predominantly in the equity asset class.

How do you read the above table? Over 25% of HDFC AMC’s equity assets are from the Direct channel (DIY investors)

If we were to understand more about the direct channel, retail investors would invest through one of these channels.

a) DIY FinTech Transaction platforms / WealthTech

b) SEBI Registered Investment Advisors ( these could be independent financial advisors or boutique wealth management firms)

c) Asset Managers’s captive website and mobile app.

Please browse through the Disclosure and Caveat below, as this is related to Investments.

How many retail investors buy or sell directly through AMC’s website or app?

As we all know, the retail cohort is increasingly interested in equity markets and mutual funds. For instance, the Nippon Life India Asset Management Ltd (NAM India) shareholder presentation mentions that 60% of transactions are digital, so why not mention the percentage of transactions from the NAM India website or mobile app?

HDFC AMC used to quote this number in their earlier presentation to shareholders; however, in March 2024, they mentioned 62,000 users logged in daily. The UTI AMC shareholders’ presentation quotes that the Digital TransactionAmount capitalized post Digital KYC is Rs 7.19Cr.

Why is this question not widely written or discussed?

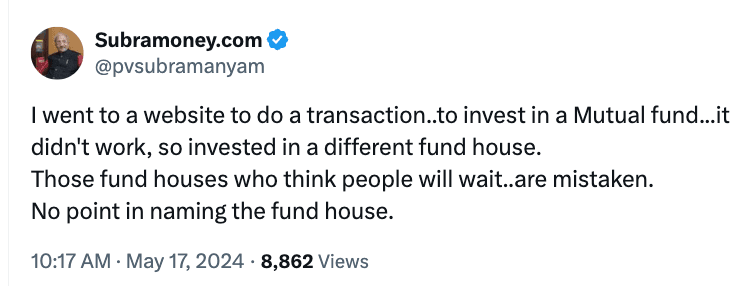

Sharing one of my earlier tweets on the Twitter platform (now X)

The asset manager sales team sound like a “broken record”

All the Asset Managers have a ready-made script to respond to questions on the Direct channel. Let me list these. This might sound like a “broken-record” narrative if you were from the financial services industry.

- We are product manufacturers and don’t understand the end consumer/investor.

- The regulation doesn’t allow us to advise investors.

- We firmly believe in the value of the MFD channel, which is why we prioritize it over the Direct channel. However, we acknowledge the presence of numerous Direct / DIY Fintech platforms where investors can transact. We also collaborate with these platforms, ensuring a seamless investment experience for our clients.

- If the investor still wants to visit us, she can visit our website.

However, the question remains: Who is tracking the consumer experience of those investors who visit the AMC websites daily? For example, please refer to the conversation below on the X platform. This is from an experienced and renowned investor. Imagine the plight of an investor new to the MF industry who landed on the AMC website after watching a TV Ad campaign during IPL.

Bangalore Cantonment Railway station

Similar to the surge in demand for mutual funds, there is a considerable demand for domestic railway travel. Imagine a family travelling from Nagpur to Bengaluru for the first time to meet their families. They arrive at the Cantonment railway station and are supposed to travel to South Bangalore, which is around 15km.

While there is no organised public transport from Cantonment station, they must rely on an auto to reach the nearest bus stand or take Ola or Uber.

The Asset Manager is like the one at Bangalore Cantonment railway station, which doesn’t worry about the passengers. They opine that the passengers will figure out how to reach their destination or alight the right train from the station.

What are direct retail investors looking for on your website, and what are they staring at?

The Tata Mutual Fund website image does not seem optimised for mobile use. The user has to deal with two photos on her iPhone. Which one should she click for the next steps?

The user landed on this Nippon AMC web page and had no option but to click the “download the app” button. The user may have inadvertently landed on this web page. She couldn’t navigate.

Which mutual fund website is the most user-friendly one for new investors?

Discoverability:

How quickly can a first-time investor/ website user identify the landing form in which to invest?

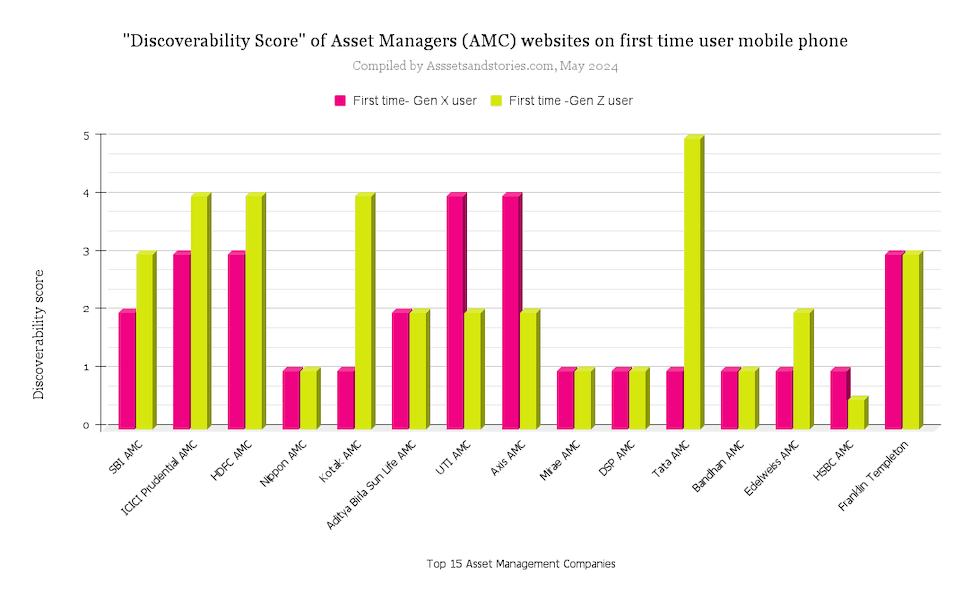

I reached out to two cohorts, Gen X and Gen Z. This is not an elaborate exercise, and you can label it as subjective as the sample size is small and the users prefer to keep their opinions anonymous.

The graph below explains the discoverability score. Can a first-time user find what she is looking for?

Both cohorts prefer to browse on their mobile phones rather than their laptops. In turn, I was using my computer to check if they had landed on the right web page.

How do asset managers (AMCs) improve their website first-time user conversion?

To summarise, Asset Managers prioritise what they want to say, making it difficult for the first-time user to discover what she wants to see.

My three suggestions listed below focus on user experience and do not delve into digital marketing metrics like SEO and organic session metrics.

1. Segmentation of “Direct” investors

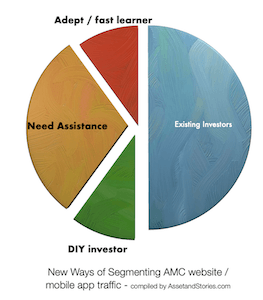

While there may be many ways of segmenting the traffic, which may land on captive digital AMC assets, broadly, the current segmentation is “existing” or “new investors”.

Consider including three new categories in the new registration: 1. DIY (do it yourself), 2. need assistance and 3. Adept/quick learner. These three new segments will help design the workflow based on user context. A couple of AMCs have created content for fast learners.

2. Similar to Quick Invest, why not highlight the “Instant redemption” feature?

Most websites highlight the “Quick Invest” feature, so why not highlight the option of “Instant redemption.” Highlighting how quickly they can withdraw will further bolster your trust in your brand and website usability score.

3. Lead generation engine for Mutual Fund Distributors (MFDs)

Few AMCs have included a call-back option, which is very helpful. However, why not create a digital workflow to connect retail investors who need assistance with relevant MFDs?

The marketplace model helps retail investors by providing them with a convenient platform and benefits the B2B MFD fraternity.

Summary:

As we all know, Indian consumer behaviour is shifting towards exploring the equity asset class. How many new retail investors understand that a mutual fund is a better product than direct equity? Since AMCs have already lost out to FinTech and digital broking platforms on SEO and SEM, the retail investor will invariably land on a new-age wealth tech platform.

Unlike the West and developed markets, AMCs have acquired wealth-tech platforms to improve investor experience, and in India, it’s the other way around. Mutual Fund distributor platforms have pivoted into the AMC business. Maybe FinTechs / WealthTechs saw the business opportunity that incumbents missed.

How many users visit the AMC website and discover and reach the “path to purchase?”

In my next post, I will highlight the gaps for the existing users. I am willing to talk and share my insights at a mutual convenience.

Please drop a line to [email protected]. While I was with the first-time users, observing how they were accessing the website on their phones, I was browsing parallelly and noted my immediate thoughts from a first-user perspective. You can download my meeting notes.

Disclosures, Caveats and Assumptions

a) I am not a SEBI-registered Registered Investment Advisor (RIA); therefore, my opinion on the firms’ names in this post shouldn’t be considered a stock recommendation or a caution.

b) I am not a Mutual Fund Distributor

c) This is not a sponsored post.

d) I may be biased towards a few AMCs listed in this post, so my opinion may be flawed.

e) I may have inadvertently missed mentioning a few AMC names.

f) The above post is for academic pursuits and is not construed as business advice.

g) I will have investment exposure for all the names mentioned in this post.