Digital refers to the website, mobile apps and partner apps of Asset Management Companies.

Table of Contents

ToggleCII Mutual Fund Summit 2023

Last few days, there have been multiple conversations on the CII & CAMS report during the 17th Mutual Fund Summit. The theme was millennials’ participation in mutual funds and this segment’s opportunities. Everyone on Twitter applauded that this segment is not going “direct.”

Quoting the lines from this report. In sharp contrast to the intuitive conclusion that millennials are likely to go the Do-it-Yourself (Direct) way, 95% of millennials have chosen advisors or distributors to begin their MF.

A great T20 Cricket Match: Scorecard is available. However, the video footage and commentary are missing.

When I read the CII-CAMS report, this subject is highly engaging and relevant. Although, more data points are required to conclude the millennial segment.

Let me explain.

CAMS / RTA has compiled this report, and I understand that they have the investors’ transaction data repository and don’t have access to the investors’ experience data / UX.

Lets’s analyse the data points of the following question posed in this report.

Who’s sourcing these millennial investors, and from where?

The CII-CAMS report mentions that RIAs have sourced 35% of these new millennials.

Nevertheless, are these RIAs corporate or individuals?

India has nearly 1300 SEBI registered investment advisors (RIAs) as of March 2023. Out of 1300, 828 are individuals.

The report also mentions –The acceleration of RIAs to tap the millennial segment by providing slick, digital apps for seamless journeys has paid off.

These are corporate RIAs who own up digital platforms. Yet, we still need to find out how many RIA platforms contributed to bringing these millennial investors. Does a smooth and seamless journey mean these RIAs have solved the digital onboarding / frictionless KYC submission? There are good digital platforms that are MFDs too. Should one assume that MFD platforms didn’t contribute to getting the new segment to the industry?

Why ignore AMC’s captive digital platforms?

Having worked sixteen years in the asset management industry, I was always intrigued by why AMCs don’t give importance to their website or partner (MFD/IFA) Apps.

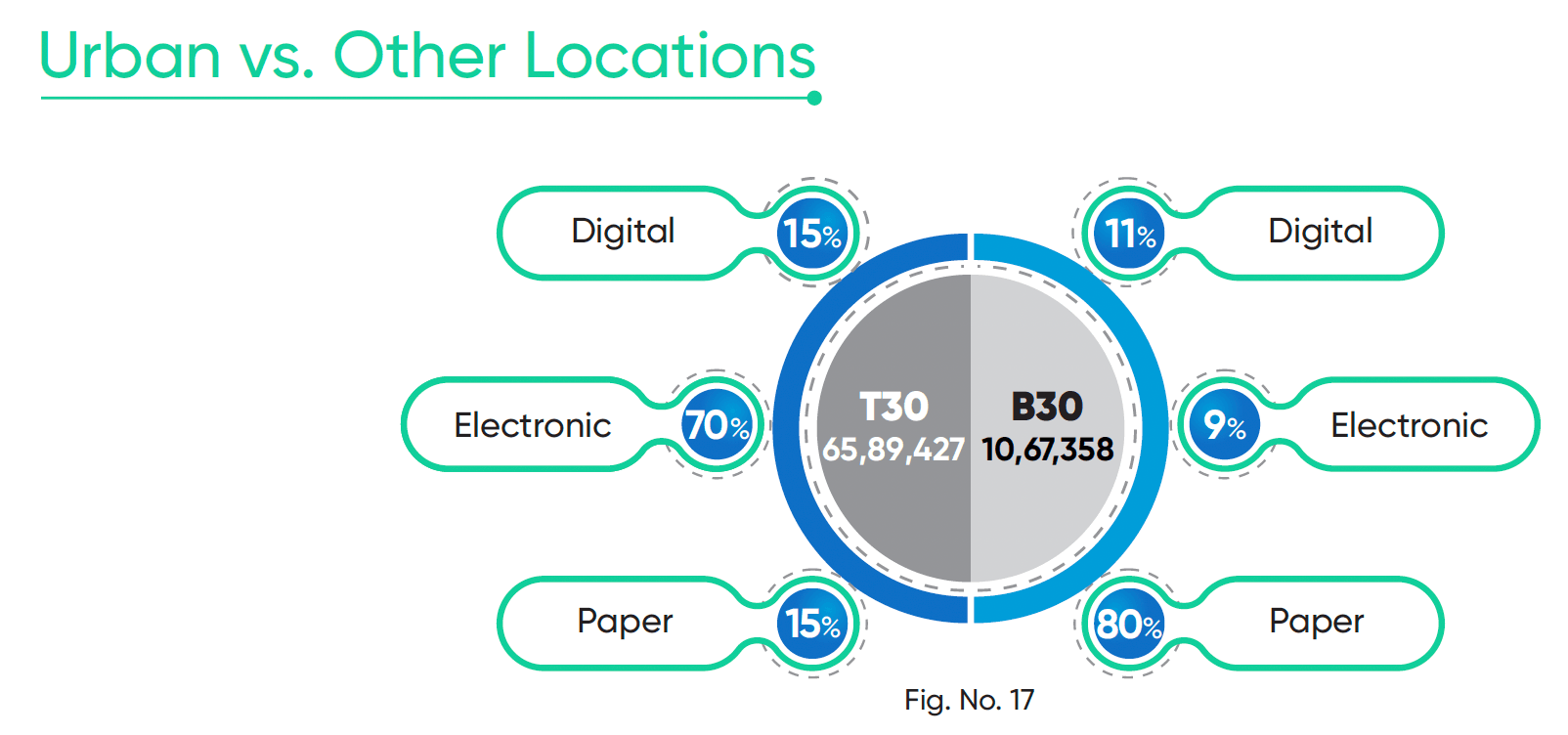

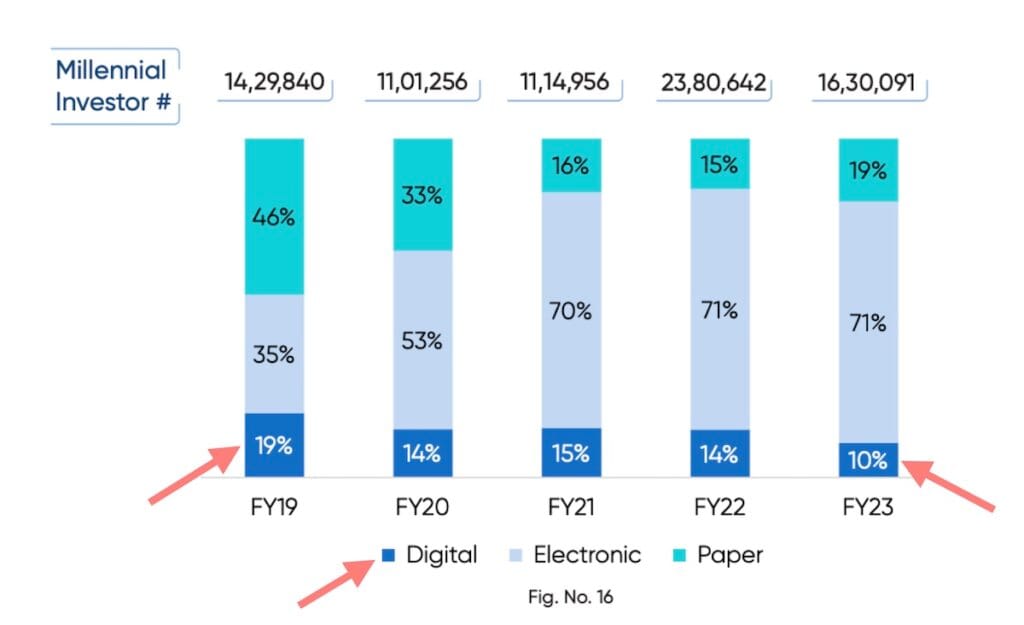

Let’s analyse this data point. The digital share segment in this graph is reducing?

Digital refers to the website, mobile apps and partner apps of Asset Management Companies. Why shouldn’t AMC improve the investor experience on this platform? Why is this metric not improving? If this is not important, then why have one? Why not re-direct this to elsewhere with a better experience?

Scorecard of AMC websites and mobile apps:

Disclaimer: I am not a SEBI registered Investment Advisor; these companies are listed on the stock market, and I am not recommending or discouraging these scrips.

I have chosen these companies as data is unavailable for non-listed asset management companies.

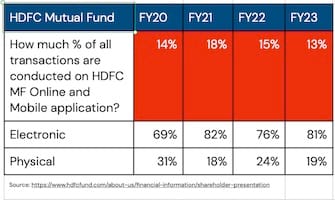

1) HDFC Asset Management Company Ltd

19% of their transactions are still offline / via paper mode. Is there no room to improve their website or mobile app?

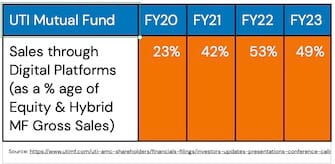

2) UTI Mutual Fund

Each Asset Manager has a different style of presenting their online transactions in their shareholder presentation.

Sales through Digital Platforms (as a % age of Equity & Hybrid MF Gross Sales)

Most of these transactions may happen through MFDs / IFAs / partner apps.

My take is that almost 50% of transactions are taking place on UTI AMC captive platforms. So it’s an encouraging data point.

3) Aditya Birla Capital

The annual report of this firm has yet to define the constituents of digital. It just mentions the “overall transactions”. These transactions could be captive and other platforms too. Therefore, one must delve more into the “overall and digital” definition.

4) Nippon Life India Asset Management Ltd

This asset manager has posted the total count of transactions. Since the other three had not included the transactions count, I preferred excluding this blog post.

Digital contribution to total NIMF Purchases & New SIP Registrations. The presentation clarifies that these transactions are through NIMF-owned Digital assets and digital integrations with distribution partners.

Nippon scores top among these four.

Insight

Referring to the CII-CAMS report, 25% of new millennials are still onboarding via paper mode. Is it because of the TINA (there is no alternative) factor?

I liked Mr Sreekanth Nadella, KFin Technologies and Mr Swarup Mohanty’s, Mirae Asset Investment Managers’ view on the MF Industry.

My take: AMC’s captive website and mobile app already have good traffic.

HDFC Mutual Fund: 24 users login in every minute on their captive portals.

Nippon Mutual Fund: 9 new digital purchases every minute.

Why can’t AMCs work on building digital platforms which have a seamless onboarding experience and track user experience metrics?