You may have read and heard about the opportunities of FinTech in India. Even in the funding winter times, FinTech tops the chart in comparison with other sectors. The total fundraising is to the tune of $2Billion from Jan to June-2023. Source: ENTRACKR

WealthTech / InvestmentTech is one of the segments in the Fintech vertical, which the Venture Capital ecosystem (VCs) closely track and invest. The other verticals are LendingTech, Payments, NeoBanking, SaaS and InsureTech.

The objective of this blog post is two-fold

a) Analyse why wealth tech firms (including Robo-advisory) are not making money?

b) What sort of investment tech startups attracted VC money?

Table of Contents

ToggleAssumptions

Before we dive deeper into InvestmentTech/ WealthTech and Robo-Advisory, let me list the assumptions in my analysis.

1) I have excluded platforms with primary products like Credit / Lending, Alternatives like Gold, Real Estate and private markets.

2) Registrar and Transfer Agents (RTA) platforms.

4) wealth tech startups which are working in a stealth mode

5) I have included those InvestmentTech businesses headquartered only in India.

Landscape

I have been tracking the Wealthtech space since 2015, and since then, I have compiled info on these startups.

My list contains over 156 names, which include

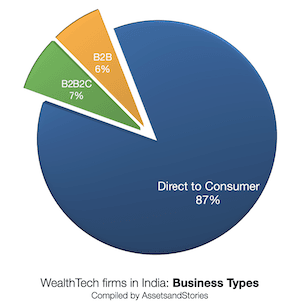

a) Robo-advisory / D2C: offering mutual funds and equity broking to investors directly

b) B2B2C: offering IFAs (RIAs and MFDs) tools to assist their practice.

c) B2B: serving institution clients like Banks, National Distributors and platforms.

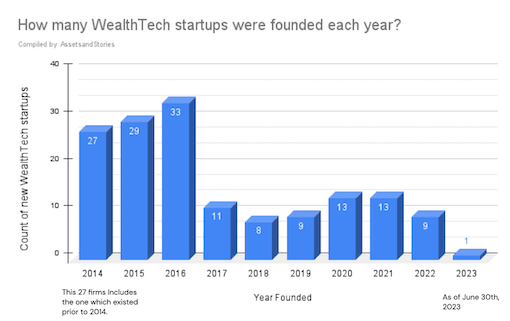

When were these WealthTech startups founded?

Most of these startups formed between 2015 and 2016. I even switched from Asset Management Sales to a Digital role during this period. Through this new role, I met over 50 startup founders from 2015 to 2018. I greatly respect these founders who believe in entrepreneurship and ventured into wealth tech. They shared with me a lot of nuances of the startup ecosystem.

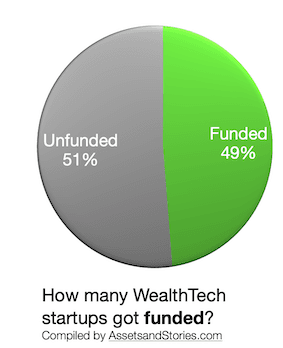

How many startups got funded?

Seventy-four wealth tech startups attracted funds from 317 Institutional investors. These investors include both Corporate/strategic investors and Venture Capital funds. I compiled this data from one of the leading market research platform.

The story/investment thesis from these 76 startup founders was strong, hence a long list of VCs.

How has the WealthTech story panned out?

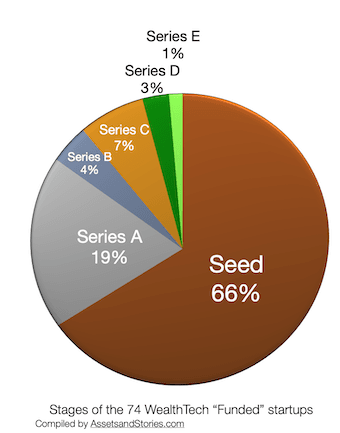

Funded Startups

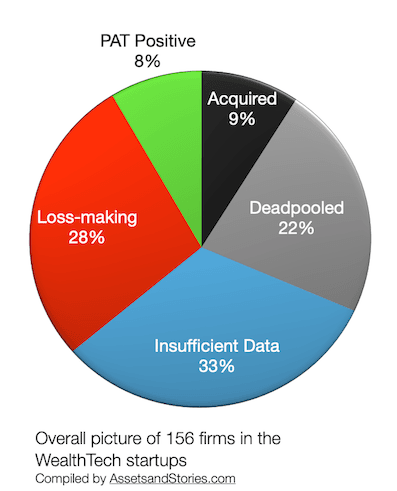

Of the 74 startups that VCs funded, 64% are still in the seed stage. In other words, the product/proposition of these startups are still in the Minimum Viable Product (MVP) stage. Only seven startups are (Profit After Tax) PAT-positive, and 2 PAT-positive have been acquired. Only one of the startups is in the Series E stage, generally defined as the risks of this stage are minimal as this startup has gained good market share.

Un-Funded startups

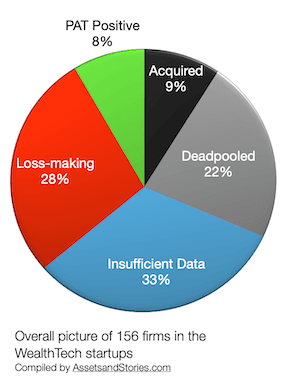

Out of 80 un-funded firms, five startups are PAT positive

Caveat: The financials for these firms are as of March 2021, and for a few of them are as of March 2022. March 2023 data was not available on the analyst-led platform which I referred to.

Out of twenty-one B2B and B2B2C firms, seven startups are PAT-positive.

WealthTech / InvestmentTech overall picture

Out of twenty-one B2B and B2B2C firms, seven startups are PAT-positive.

Friction points for WealthTech firms to break even.

Before we analyse the reasons for not being able to make money, you may wonder whether these businesses have a large market to reach. Since we are analysing past data, tracking how many new investors were onboarded from 2015 to 2022 is relevant.

As per the CII-CAMS report, 8.5 million millennial investors were onboarded in the mutual fund industry from April 2019 to March 2023. This set of new millennial customers amounts to 54% of new investors in the overall new investor growth. 8.5 million new customers is a reasonably good serviceable available market (SAM) to build an MVP (minimum viable product) for these 135 D2C startups. For twenty-one B2B and B2B2C firms, the total TAM (Total Addressable Market) of the existing mutual fund industry is available for service.

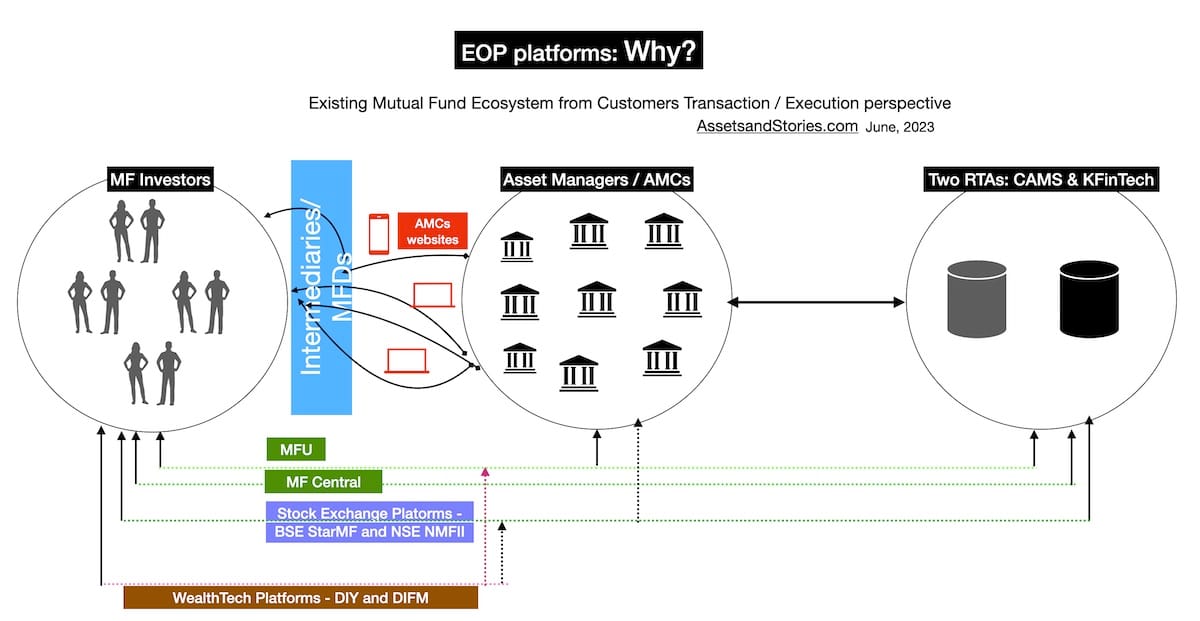

1. Ignored “Digital Plumbing.”

You may have read multiple stories on social media or heard from your friends about data in-accuracy in wealth-tech platforms. When the user highlights, these platforms fix the data inconsistency errors. However, this experience reduces the users’ confidence and trust. By design, the data exchange in the MF industry is very complex. Therefore, platforms should have invested more time in digital plumbing. Please look from a new user / new investor point of view – both Mutual Fund and the transaction execution platform are new to her. Why should she trust the platform for just giving access? Hence, invariably in the initial interactions, she doesn’t share her total wallet share. However, a certain percentage of her surplus is to try out new investment platforms. She becomes tentative if her smaller pie in the wallet shows an error. Continuing with the CII-CAMS report, over 35% came sourced by RIAs (SEBI Registered Investment Advisors), and 5% came “direct” from Asset Management companies. How many dropped off mid-way transacting and switched to other transaction methods? Most platforms focused on giving “access” to online investments rather than delivering “data accuracy”.

2. Regulatory Overhang

Adding to the plumbing is the problem of regulation. The rules of the game change the mid-way of game. The speed and innovation slow down to align with the new regulations. This friction hinders the acquisition and increases the time for new product releases. Both impact the profit and loss accounts. I have listed five friction points in this blog post for the InvestmentTech fraternity. However, I will give 50% weightage to this burden of the regulatory overhang alone.

You may have read and spoken about the MFD vs. SEBI RIA debate in many business papers. What intrigues me is why SEBI is ignoring the results of a similar IA regulation in the UK market. While SEBI launched “Direct” in 2013, SEBI drew inspiration from UK FCA in the 2011 concept paper; however, why ignore the FCA’s learning in 2022?

3. Path to Profitability

Continuing with my third reason after the complexity of data and regulation overhang, The third one is fundamental for business. If they choose the Investment Adviser (RIA) route, the platform user has to pay, and if they choose to be MFD, these platforms will be labelled as chemists and, therefore, can’t advise.

Of 132 D2C firms, only six have delivered profit after tax. One of these six has been acquired by another FinTech. D2C Robo-advisors are yet to discover an evident path to profitability.

The chances for B2B wealth tech firms to achieve profitability seem higher. However, getting a B2B business takes a few years. In other words, B2B, too, needs a long runway. Regarding B2B2C, I will be doing a detailed analysis. Hence I will park it for a future date.

4. Indian AMCs lack innovation.

Having spent 16 years in the AMC world, I undoubtedly make this statement. AMCs fiercely focus on one variable in the Profit and Loss account, namely “sales.” Why will they waste time when new initiatives like WealthTech won’t add up to sales for their financial year? Only when the new initiatives mature and start showing in sales / MS Excel will most AMCs reckon these wealth-tech platforms. How many Wealthtechs got swift support from AMCs? One of the fallouts of this callous attitude by AMCs is data inconsistency on WealthTech platforms. Please note there are only a few exceptions in the AMC industry. I have written a separate post on this topic.

5. Behavioural Finance

Assuming the wealth tech platforms solve the trust and path to profitability friction points, will this benefit the end user / retail investor or HNI? The answer is a complex one. You may have read that investment returns are not equal to investor returns. Unlike a consumer e-commerce platform, the user may choose an investment product at an entry point; however, her expectations may differ at an exit point. Platforms must develop tools to empower individuals/ users to make the right financial decisions. Building the behavioural finance layer is an additional cost for wealth tech startups; hence, they need to be able to afford one. Mature WealthTech platforms in the US and UK have built this layer in their platforms. I have seen just a couple of exceptions in the WealthTech Platforms in India.

Insights and the Wayforward

The Stereotypes

Of the 74 startup VCs funded, around 55% of these startup founders are from IIM, IIT or Ivy College.

A break in the clouds

- I was glad to discover that a few AMC group companies have also invested. It is a very encouraging trend. I have shared my thoughts on this in my earlier blog.

AMC’s engagement with Wealthtechs may encourage a successful hybrid robo-advisory model. - SEBI EOP regulation has given a path to generate revenue for direct-only execution-only platforms. Moreover, reading the narrative “balance” mentioned in the SEBI EOP’s circular is heartening, as investment behaviour isn’t just black and white.

- Account Aggregator will solve the “Digital Plumbing” friction point. However, only SEBI-registered RIA platforms can access this. Unfortunately, many stand-alone MFD platforms will not benefit.

- New startups comprehending the above friction points may discover a new business model.

I will continue to track and share about India and the global market.

Disclosure:

I am an adviser to two WealthTechs – Syntoniq and moolaah.

Disclaimer: I am not a SEBI registered Investment Advisor; some Asset Managers companies I mentioned in my blog may be listed on the stock market, and I am not recommending or discouraging these scrips.