On 13th June 2023, SEBI released a circular for Execution Only Platforms (EOP) for facilitating transactions in direct plans of Mutual Funds schemes. I have been tracking the wealth tech platforms space since 2015, and I analyse both the trends in domestic and international markets in the Asset Management Industry. The objective of this blog is to share my perspective on the EOPs.

Table of Contents

ToggleCaveat

I am not a SEBI Registered Investment Adviser, and this website is to share my perspective on Asset Management Companies (AMCs) and WealthTechs. Hence, my opinion on AMCs shouldn’t be considered a stock recommendation or a caution.

Why EOPs?

It has been observed that various SEBI registered InvestmentAdvisors/StockBrokers provide execution services in direct plans of Mutual Fund schemes through their technology/digital platforms.

The above statement is from the SEBI circular.

However, let me take you through the journey which led to this circular.

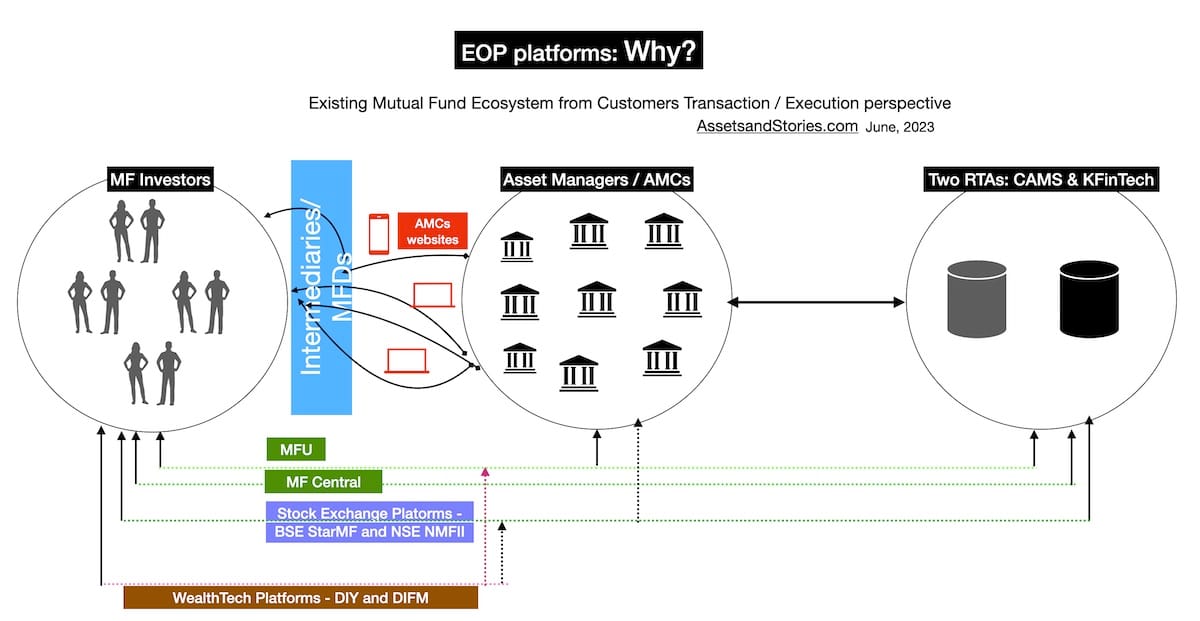

1. Most of the AMCs website offers an inferior customer experience. Data supports my statement. How will retail investors cope with this in-consistent experience? Hence Direct retail investors choose Directly-only websites like Groww, Kuvera, Paytm Money, Zerodha Coin and ET Money.

2. In Jan 2015, the Association of Mutual Funds of India (AMFI) launched MFU (Mutual Fund Utility), intending to create a transaction portal. Post 2020, many AMCs participated in this program. MFU saw challenges in integrating with RTAs (Registrar and Transfer Agents). The RTAs may have seen MFU as a threat. Why RTAs may have seen the MFU as a threat? The RTAs had their captive investor portals, viz., MyCAMS and KFintech. This great idea could have succeeded in fast execution and adoption. The AMCs / AMFI must be blamed for this industry-led platform’s slower adoption. Imagine if all AMCs supported this industry-led portal for B2B2C (MFDs) and D2C (Direct) in conjunction with the RTAs.

3. Stock exchange platforms for Mutual Funds transactions – BSE StarMF and NSE NMFII saw adoption increase post-2015. These platforms supported both Independent Financial Advisors and WealthTech platforms. Direct Plan was launched for SEBI Registered Investment Advisors (RIAs) by BSE StarMF in 2016, and later on, NSE NMFII followed suit. The Stock exchange platforms helped both RIAs and MFDs, in the Distributor Initiated Transaction model. In other words, the intermediary would fill in all the details on behalf of the investors, and the customer will complete the payment process. In other words, invest in the MF scheme. Direct Only Platforms, the new age ones, took this to the next step, facilitating the entire process for new retail investors. Smooth onboarding, few clicks of investments, sleek reporting. During the COVID period, the adoption of DIY platforms increased.

a) Combined Gross Equity Sales by both RIAs + Platforms grew faster by 191% in FY22 vs FY21 than the Industry growth of 84%. Source: IDFC AMC (now Bandhan)

b) The recent report by CAMS and CII quotes that RIAs have sourced about 35% of the new millennials. These DIY platforms offer Direct schemes.

MFC

In Sept 2021, I read the news about MFC (Mutual Fund Central). Like me, many industry stakeholders were intrigued about why one more new industry-led platform. It was obvious that the MFC initiative is led by RTAs and CAMS, and KFintech and the former MFU were driven by AMFI.

In summary, on the one hand, digital adoption among investors increased (demand). However, AMC websites, MFU and MFC are yet to offer a superior experience for Direct Investors. It’s apparent that SEBI had to formulate a framework and move quickly to Execution Only Platforms (EOPs)

How are EOPs envisaged?

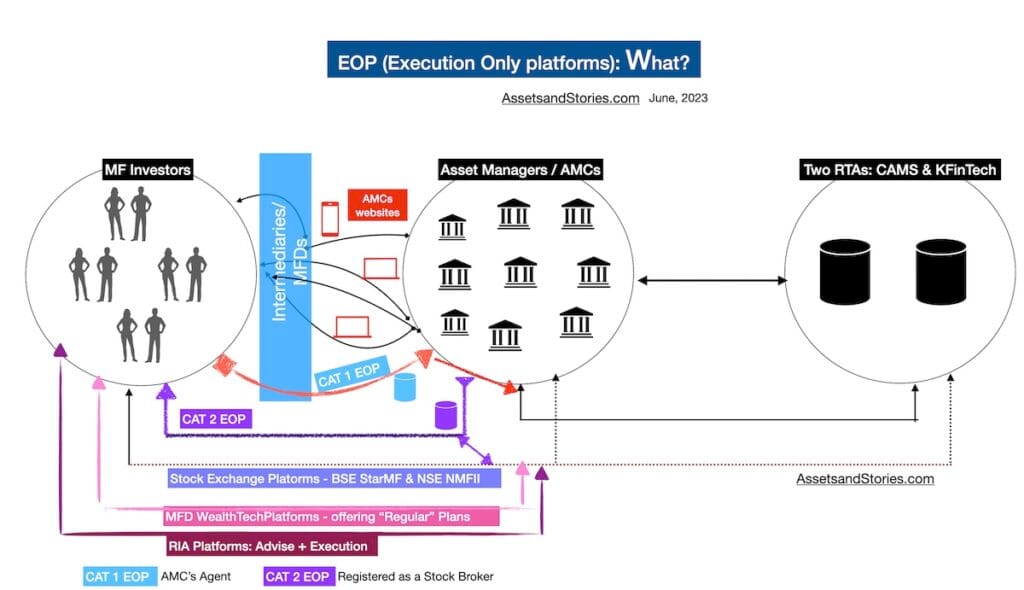

SEBI Categorised the Direct Platforms into two corporate entities.

1) An Agent to the Asset Management Company (AMC)

2) An Agent of an Investor registered as a stock broker.

Who are the paymasters for these new entities?

AMCs pay CAT 1 EOPs, and Investors pay CAT 2 EOPs.

The above framework is tricky, and I am drawing an analogy from Cricket sports. It is like a soft signal by an umpire and is controversial. Similarly, SEBI has mentioned that this framework balances investor convenience and investor protection.

Would CAT 1 EOP / an agent to the AMC own up to the fiduciary responsibility for their customers? Generally, MFDs (Mutual Fund Distributors) who offer “regular plans” are termed agents as they get paid commission/brokerage by the AMCs.

Switching back to my analogy of cricket, only after verifying using technology does the third umpire decide. In the EOPs case, Investors’ experience will determine if SEBI’s decision on categorising CAT 1 EOP as an Agent is apt.

What may EOPs look like?

To answer this question, we must dig deeper to understand the dynamics of MFDs, RIAs, MFU and MFC and their interplay with AMCs to serve the customers / retail investors / HNI investors. This list of questions will connect the dots as to how the landscape may appear.

1. Directing MFU and MFC to be part of EOP is a good move. Will all the AMCs continue to pay for both of these industry-led platforms? Consolidation is bound to happen. What would happen to MyCAMS and KFintech Portal?

2. “Direct-only” platforms with RIA licenses will continue business as usual.

3. However, Platforms not registered as SEBI RIA and promoting “Direct” plans will have to revisit their business plans. These platforms onboarded new users by offering Direct MF schemes and other equity products to generate revenue. It is an uncertain situation for these large platforms.

4. Stock Exchange Platforms, both BSE StarMF and NSE NMFII, will continue to support the “Direct only” RIA platforms and will facilitate CAT 2 EOPs. Stock exchanges are gaining more ground in the new EOP regime. Many MFDs and RIAs platforms currently ride on the stock exchanges; some may register as CAT 1 EOP and integrate with AMCs directly. Will Stock exchanges work with only CAT 2 EOPs, then?

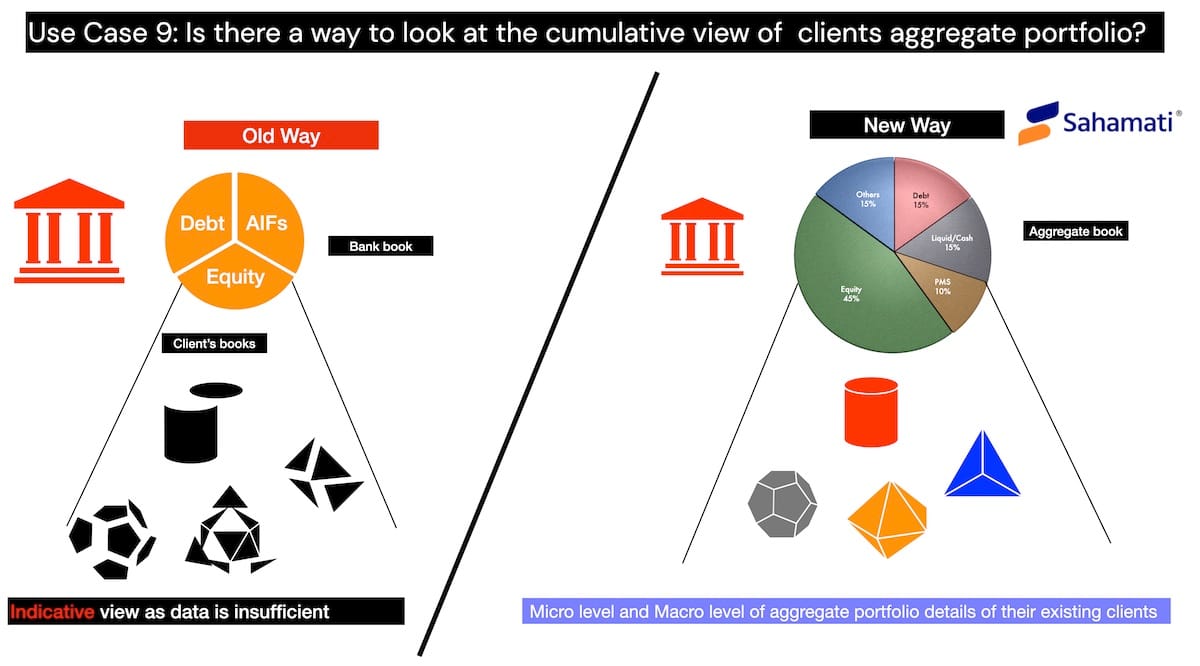

5.Circular mentions that transactions should be executed immediately. In other words, it is an API-based tech integration. Will CAT 1 EOP integrate their systems directly with AMCs or RTAs? Each route will open up new possibilities for the tech landscape. Could EOPs start storing data? Will the dependency on RTAs reduce? While RTAs data is sacrosanct, introducing a middleware to all AMCs will re-skill the AMC IT teams. Why are there only two RTAs in India? Isn’t it a duopoly? I will write a separate post later on this business opportunity.

6. CAT 1 EOPs can share the data analytics with AMCs. Could CAT 1 EOPs share the user analytics to select AMCs which can aid in the buying propensity of customers?

7. Can a group of MFDs form a company and launch a CAT 1 EOP? AMCs may support those MFDs groups with a good market share.

8. Can CAT 1 EOP have a sub-broker distribution structure? Can they share a certain percentage % of the share with their sub-agents?

9. Existing MFD wealth tech platforms, how will they compete with CAT 2 EOPs on the product positioning? Will MFD wealth-tech platforms switch to CAT 2 EOP model?

10.

You may have more questions on the economics of EOPs and how would the retail investor benefit et al. In the new EOP regime, the expense for AMC P&L will increase. Will the AMCs reduce the cost of their Operations or Sales?

CAT 1 EOPs (AMC Agents) will gain more traction – this is my view.

However, I am taking you on a tangent path. Since SEBI has allowed CAT 1 EOP as an Agent, Why can’t SEBI let AMCs strategically partner with CAT 1 EOPs (Agents) like the US and UK markets?

Insight:

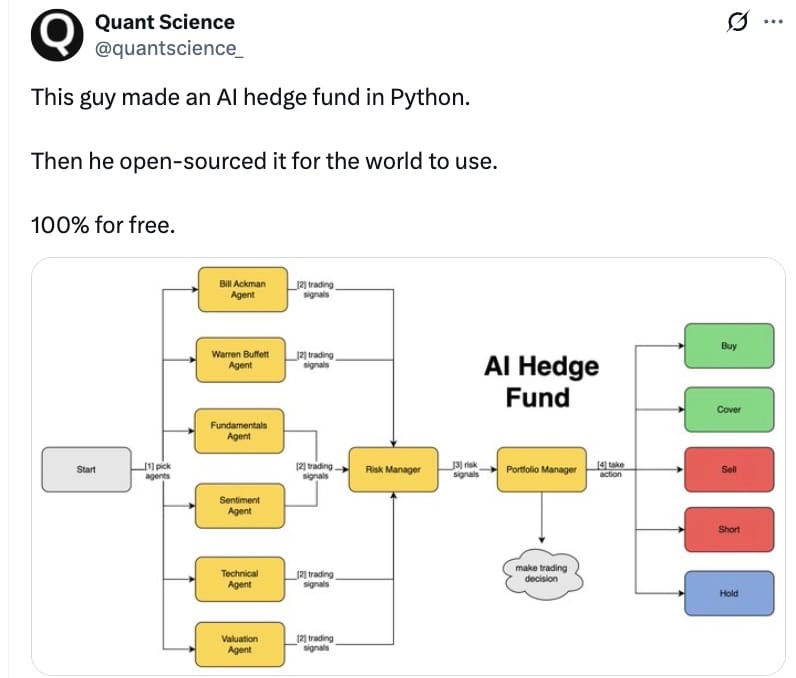

While the consumer tech world is actively working on interoperability, the EOP framework is just integration with relevant entities. In other words, the AMC Industry is a decade behind in tech and UX, and this space will evolve in the next few years. Like EOPs, retail investors will demand better customer experience, and AMCs will have to give importance to wealth tech.